Date: Thu, Sept 18, 2025 | 08:40 AM GMT

The cryptocurrency market is showing strong resilience today as Ethereum (ETH) pushes to the $4,600 mark with a 2% intraday gain, following the latest Fed rate cut decision. Riding on this momentum, several altcoins are flashing bullish setups — including KAITO (KAITO).

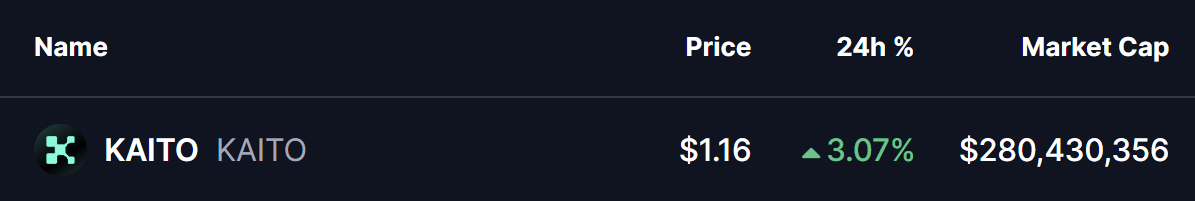

KAITO is trading in green with modest gains, but the chart reveals a much more important signal: the token has just confirmed a breakout from a bullish reversal setup and is now retesting that level — a move that could shape its next big direction.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Falling Wedge Breakout

For weeks, KAITO was stuck inside a falling wedge, a well-recognized bullish reversal pattern that often hints at an upcoming shift in momentum. The token found firm support around $0.2107 before staging a decisive rebound.

That rally propelled KAITO above the wedge’s descending resistance line, confirming a breakout near $1.16. From there, momentum carried the price to a local top of $1.55 before sellers booked profits.

KAITO (KAITO) Daily Chart/Coinsprobe (Source: Tradingview)

KAITO (KAITO) Daily Chart/Coinsprobe (Source: Tradingview)

As is common after strong breakouts, KAITO has since pulled back to retest the breakout zone. Currently trading near $1.16, the price is resting at a critical level where buyers may be preparing for another push.

What’s Next for KAITO?

The retest is unfolding in a constructive manner, but bulls will need to defend the breakout level to confirm further upside momentum. If buyers step in with conviction, the first step will be reclaiming the $1.55 local high. A clean move above that could open the door to a stronger rally.

Based on the wedge breakout projection, KAITO holds the potential to climb toward the $2.41 zone — representing nearly 106% upside from current levels.

On the flip side, if KAITO slips back under $1.02, it risks falling back into the wedge structure, raising the possibility of a fake breakout and delaying any bullish continuation.