3 Altcoins That Could Hit All-Time Highs In The Fourth Week Of September

SAROS, MNT, and HYPE are nearing critical levels that could spark new all-time highs in the final week of September. Holding key supports and breaking resistance zones will be decisive for their rallies.

The crypto market continues to remain unpredictable with some altcoins forming new ATHs while others decline. Among these is Saros (SAROS) which has remained afloat this week, near its ATH.

BeInCrypto has analysed two other altcoins that could likely form a new all-time high this week as the market improves.

Saros (SAROS)

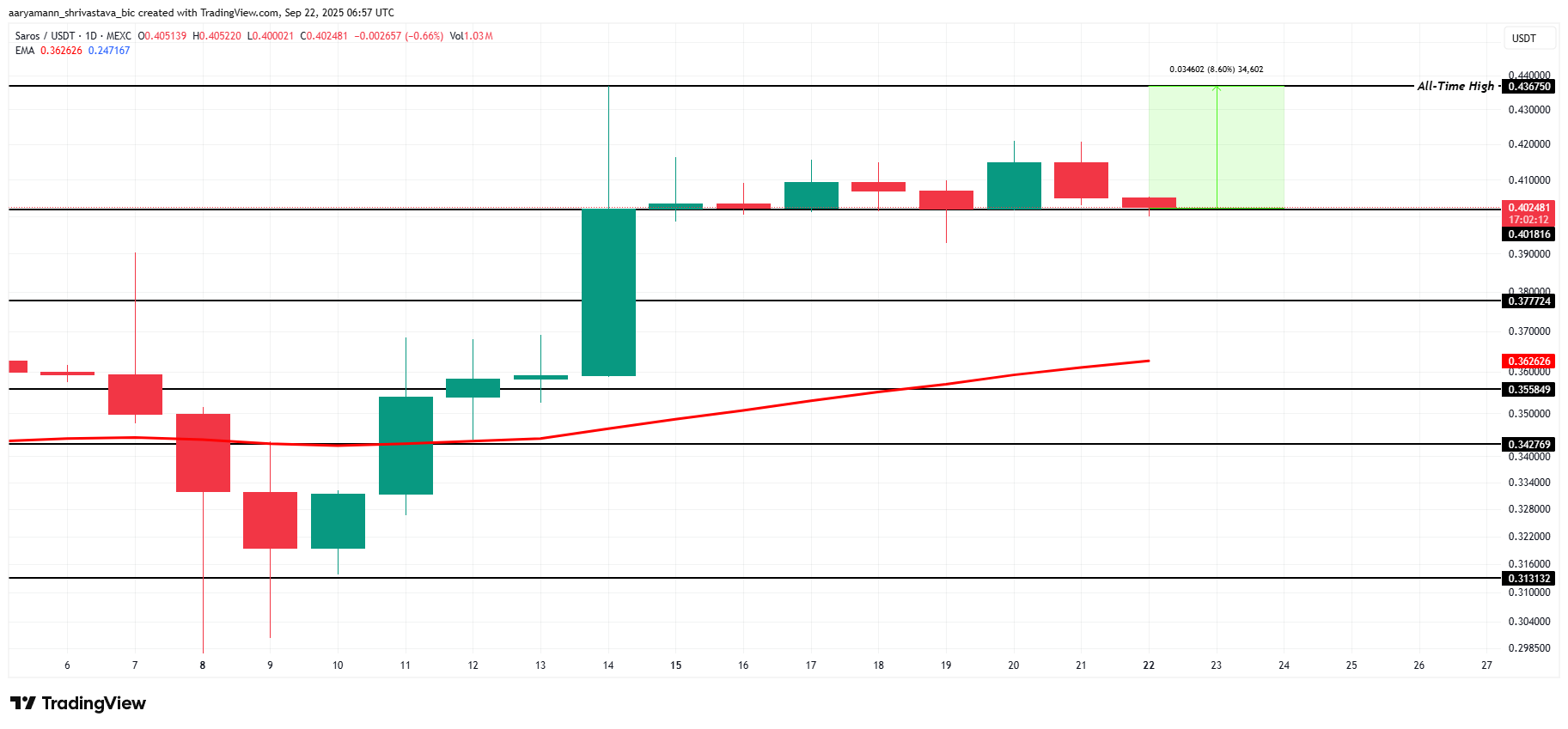

SAROS price is trading at $0.402, holding firmly above the $0.401 support level. This support has remained intact for over a week, indicating strong investor confidence. The stability provides a foundation for SAROS to attempt recovery.

The altcoin is only 8.6% away from its all-time high of $0.436. With the 50-day EMA positioned well below current levels, acting as support, SAROS has technical strength. A bounce off $0.401 could allow the token to retest the ATH this week, boosting investor sentiment further.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

SAROS Price Analysis. Source:

TradingView

SAROS Price Analysis. Source:

TradingView

However, risks remain if bullish momentum weakens. SAROS price could slip under $0.401 support and extend losses to $0.377. Such a drop would invalidate the bullish thesis, signaling a potential bearish reversal.

Mantle (MNT)

MNT price is trading at $1.59, about 16.3% away from its all-time high of $1.86. The altcoin faces resistance at $1.63, which must be breached to clear the path toward recovery. Holding above current levels will be crucial to maintain investor confidence.

The Ichimoku Cloud indicator suggests bullish momentum is building for MNT. If the altcoin successfully flips $1.63 into support, it could rally toward $1.86. A breakout above this level would retest the ATH and also open the door for new record highs.

MNT Price Analysis. Source:

TradingView

MNT Price Analysis. Source:

TradingView

However, risks remain if selling pressure increases. MNT price could slip through its immediate support at $1.47, extending losses to $1.34. Such a decline would invalidate the bullish thesis and reinforce bearish sentiment.

Hyperliquid (HYPE)

HYPE price is currently at $49, making it the farthest from its all-time high on this list. The altcoin would need a 21% rally to reach the ATH of $59 and push further into uncharted territory, potentially forming a new high if momentum builds.

The Ichimoku Cloud indicator suggests bullish momentum remains intact despite recent declines. If HYPE manages to breach $53 and flip it into support, the token could rally toward $56. Clearing this resistance zone would pave the way for a potential retest of the $59 all-time high.

HYPE Price Analysis. Source:

TradingView

HYPE Price Analysis. Source:

TradingView

However, risks remain if bearish sentiment grows or investors decide to sell. HYPE could break below $48, exposing the price to further decline to $46. Such a drop would completely invalidate the bullish thesis and limit the chances of recovery in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.