Date: Tue, Sept 23, 2025 | 06:50 AM GMT

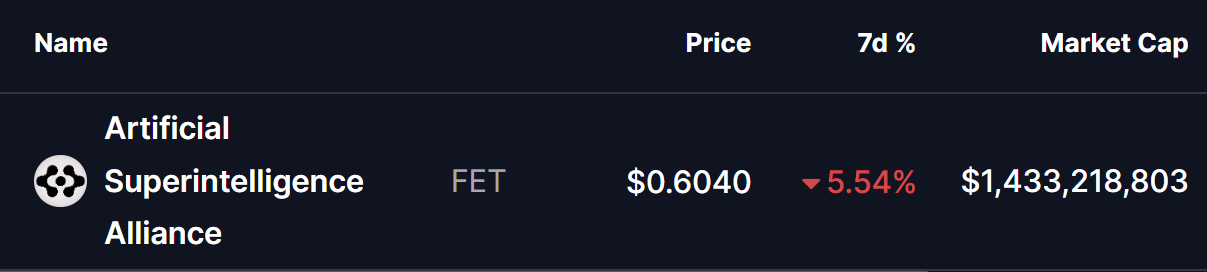

The cryptocurrency market is facing notable selling pressure, with Ethereum (ETH) sliding to the $4,200 level after a 6% weekly drop. Major altcoins are also under stress, including AI-focused token Artificial Superintelligence Alliance (FET), which has declined nearly 5% this week.

More importantly, FET is now retesting a pivotal breakout zone, a level that could dictate its next move.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting the Falling Wedge Breakout

For several weeks, FET had been locked inside a falling wedge pattern — a widely recognized bullish reversal setup that often hints at a trend shift. The token found firm support around $0.5780 before staging a rebound that pushed it above the wedge’s descending resistance line, confirming a breakout near $0.64.

That breakout fueled momentum toward a local high of $0.6980, which aligned closely with the 200-day moving average ($0.6803). However, sellers took profits at this resistance, dragging the price back down.

FET Daily Chart/Coinsprobe (Source: Tradingview)

FET Daily Chart/Coinsprobe (Source: Tradingview)

Now, as is typical after strong breakouts, FET has pulled back to retest the wedge’s upper boundary. Currently trading around $0.6032, the price is resting at this critical level — where bulls will try to reassert control.

What’s Next for FET?

The retest is unfolding in a constructive manner, but for the bullish momentum to remain intact, buyers must defend this breakout zone. If they succeed, the first hurdle will be reclaiming the 200-day MA ($0.6803). Clearing that resistance could unlock a stronger move upward.

Based on the wedge’s technical projection, FET has the potential to climb toward $0.9231, representing nearly 52% upside from current levels.

On the flip side, if FET slips back under $0.56, it would signal a failed breakout — a bearish scenario that could trap bulls and delay any meaningful recovery.