Why are all exchanges frantically embracing Perp DEX?

Binance founder CZ once said, "Everyone wants to build a Perp DEX," which perfectly captures the hottest trend in the current crypto market. This statement precisely identifies the essence of the ongoing interplay, competition, and integration between centralized (CEX) and decentralized (DEX) forces in the market.

Background of the Strong Rise of DEX: The Decline of CEX's "Three Powers"

Centralized exchanges are facing the decline of their three core powers: pricing power, listing fee power, and liquidity dominance. The rise of perpetual contract decentralized exchanges (Perp DEX) is the key driving force behind this situation.

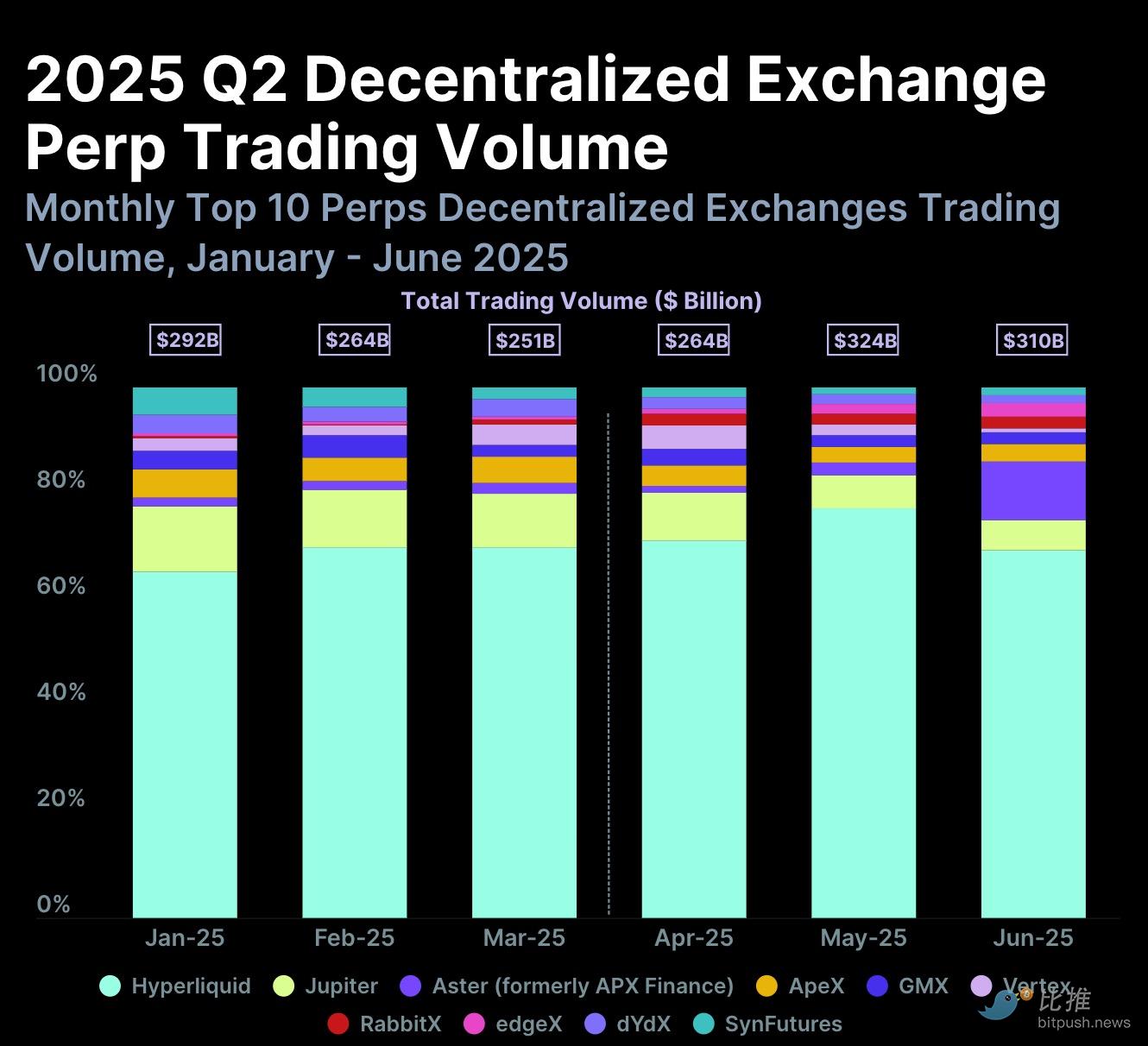

According to Q2 2025 data, the trend of traffic migration in the crypto market has become very clear:

-

Trading Volume Rebound: Perp DEX trading volume reached a new high of $898 billion in Q2 2025, accounting for a significant share of overall DeFi growth. Meanwhile, the total trading volume of centralized exchanges (CEX) saw a nearly 28% decline.

-

Market Share Compression: The DEX-to-CEX trading volume ratio has soared to 40% or even higher, indicating that decentralized platforms are rapidly eating into the market share of centralized giants.

Below are the leading projects as of mid-September 2025, based on real-time trading volume and market dominance:

| Rank | Project Name | Core Features and Advantages |

| 1 | Hyperliquid | Daily trading volume exceeds $15 billion, industry leader. Runs on its own Layer 1 chain, offering zero gas fees and sub-second execution. |

| 2 | Lighter | Daily trading volume of $5 billion. ZK-powered platform, emphasizing zero fees and low-latency order books on Ethereum and Arbitrum. |

| 3 | Aster | Daily trading volume of $4.5 billion, supported by Binance CZ. Supports multi-chain operations, leverage up to 1001x, and offers RWA stock Perp trading. |

| 4 | edgeX | Daily trading volume of $3.4 billion. Focuses on MEV-free execution and innovative integration of Perp and spot markets. |

| 5 | Paradex | Daily trading volume of $1.1 billion. Backed by Paradigm, offers zero fees and CEX-level liquidity, making it a hotspot for potential airdrops. |

CEX's Strategic Counterattack

In this context, CEXs need a "traffic anchor" to re-lock users and trading volume. Perp DEX, with its inherent advantages, has become the strategic choice for CEXs:

Capturing Non-KYC Traffic and Long-tail Assets: The strict compliance (KYC/AML) requirements of CEXs are a shackle to their expansion. Perp DEXs naturally attract users seeking privacy and anonymous trading, and can quickly capture market hotspots and various "long-tail assets" through permissionless listing mechanisms, including meme coins that have not undergone extensive due diligence.

Countering Native DEX Competition: Native Perp DEXs such as Hyperliquid are rising rapidly, with their trading volume and market share continuously eroding the derivatives market of CEXs. CEXs must participate through self-building, investment, or integration to retain lost users and traffic within their own ecosystems.

Main Trends of Perp DEX in 2025

-

RWA Integration: The integration of real-world assets (RWAs) is bridging crypto and traditional finance, such as stock Perps (like Tesla and NVIDIA) on Aster.

-

AI and Modularity: Projects like Jaine are leveraging AI-driven trading, while modular chains like Celestia provide greater scalability for Perp DEXs.

-

Narrative-driven: The "narrative-first" approach, exemplified by SunPerp, emphasizes community and attention, standing out in competition with established players like GMX.

-

The shift towards zero-fee models and points farming has greatly lowered the trading threshold for users. Platforms such as Lighter and Paradex are leading this trend, attracting a large number of "airdrop hunters" and professional traders through incentive mechanisms, further driving liquidity concentration.

Potential Emerging Projects (Pre-TGE Stage)

In addition to pioneers like Aster, the community is enthusiastic about pre-TGE projects, which are often sought after for their airdrop potential, points, and innovative narratives:

-

Ethereal: Linked to the Ethena ecosystem, offers high-performance trading supported by USDe, with hype centered on its strong narrative and massive airdrop potential.

-

Hibachi: Backed by Dragonfly, incentivizes trading volume and PnL through Masterchef competitions, seen as an easy points farming opportunity.

-

Pacifica: Built on Solana, developed by former Binance and Coinbase teams, praised for its user-oriented value accrual model.

-

Extended: Built by a former Revolut team, already live but in the pre-token stage, making it a mid-term points farming target.

Conclusion

Perpetual contract DEXs are not just a sub-sector of DeFi; they are the fastest-growing and most innovative segment, poised to redefine on-chain trading with unprecedented trading volumes and technological innovation. From Hyperliquid's dominance to CEXs' strategic counterattacks, 2025 is undoubtedly the year of the Perp Wars. While some believe the DEX market will ultimately become a "winner-takes-all" landscape like social media, the proactive "experimentation" of CEXs and the emergence of hybrid models are proving another fact: the crypto financial market needs diversity, not a single overlord.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.