ASTER Price Falls 10% in 8 Hours As Outflows Begin Their Domination

ASTER fell 10% in 8 hours as selling pressure builds and momentum turns bearish. Holding $1.87 support or reclaiming $2.24 will decide its next move.

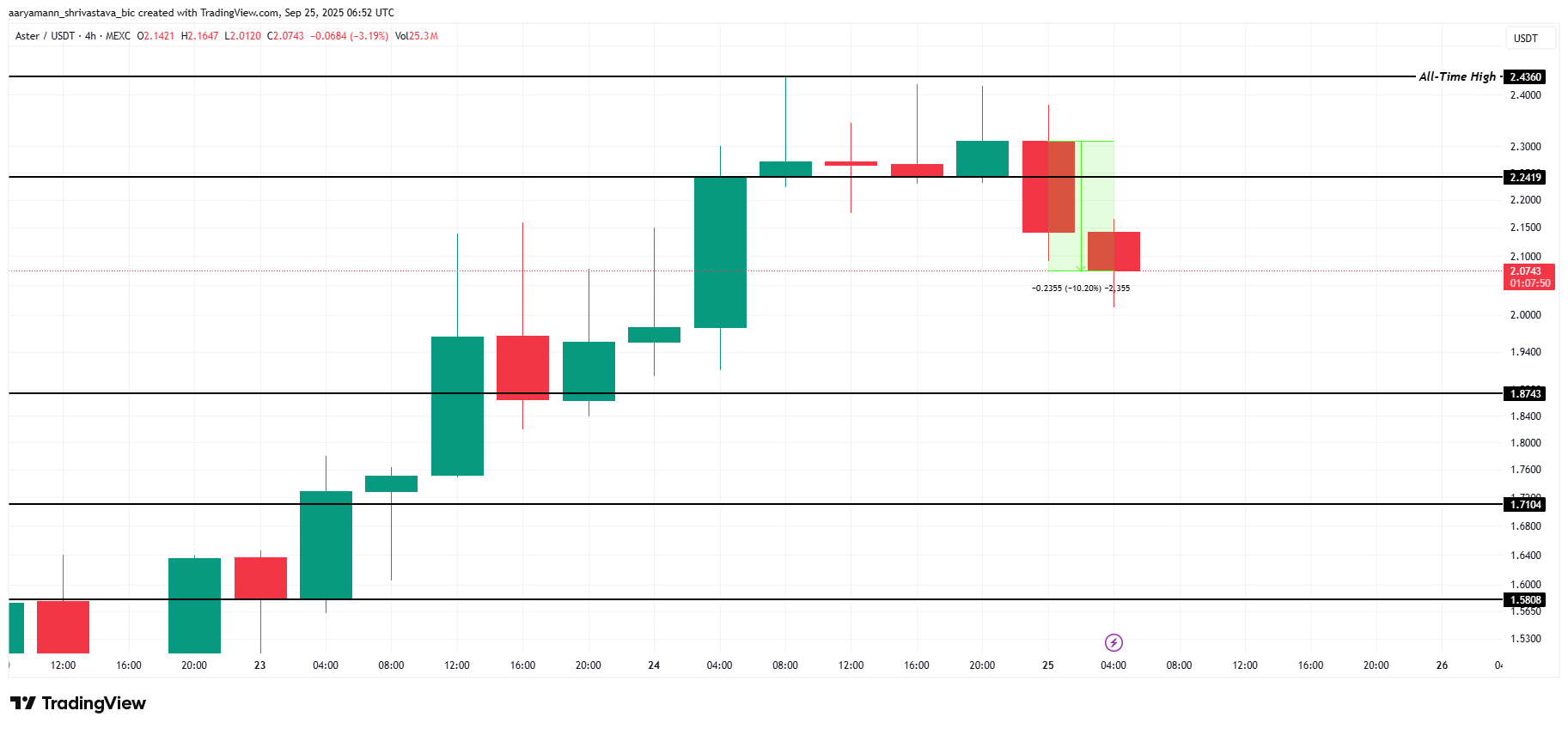

ASTER recently recorded a new all-time high (ATH) of $2.43, but the rally was short-lived.

Within the last eight hours, the altcoin has dropped by 10%, sliding toward the $2.00 mark. The shift in investors’ stance and growing market weakness raises the risk of further losses.

Aster Is Losing Support

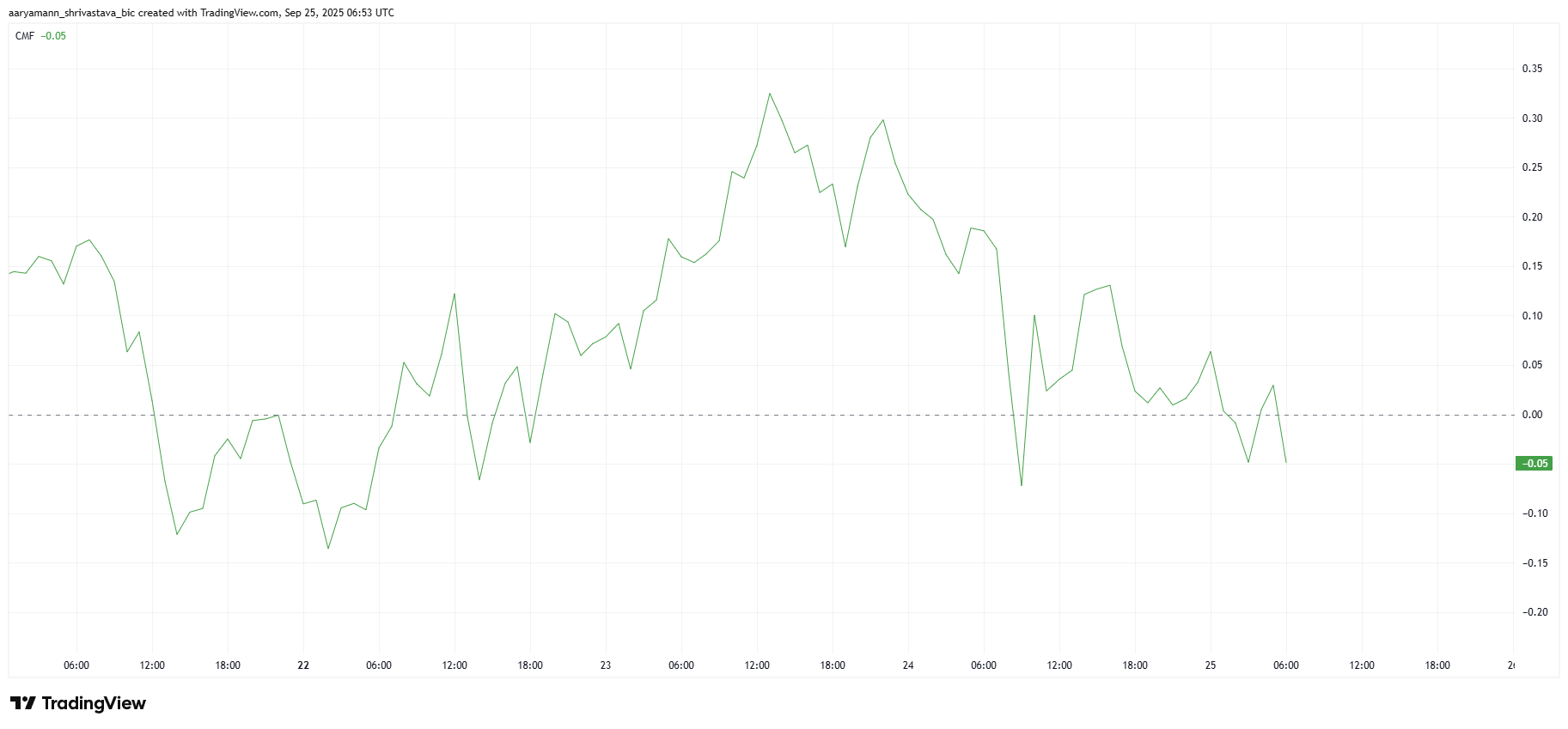

The Chaikin Money Flow (CMF) indicator highlights a decline in ASTER’s momentum. Currently slipping below the zero line, the CMF suggests outflows are beginning to dominate inflows. This change signals that selling pressure is outweighing buying activity, a bearish sign for the token’s near-term outlook.

Negative netflows highlight a point of saturation among investors who had been strongly bullish on ASTER during its climb to record highs. As enthusiasm cools, profit-taking is accelerating, leaving the altcoin vulnerable to deeper corrections.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

ASTER CMF. Source:

ASTER CMF. Source: TradingView

ASTER CMF. Source:

ASTER CMF. Source: TradingView

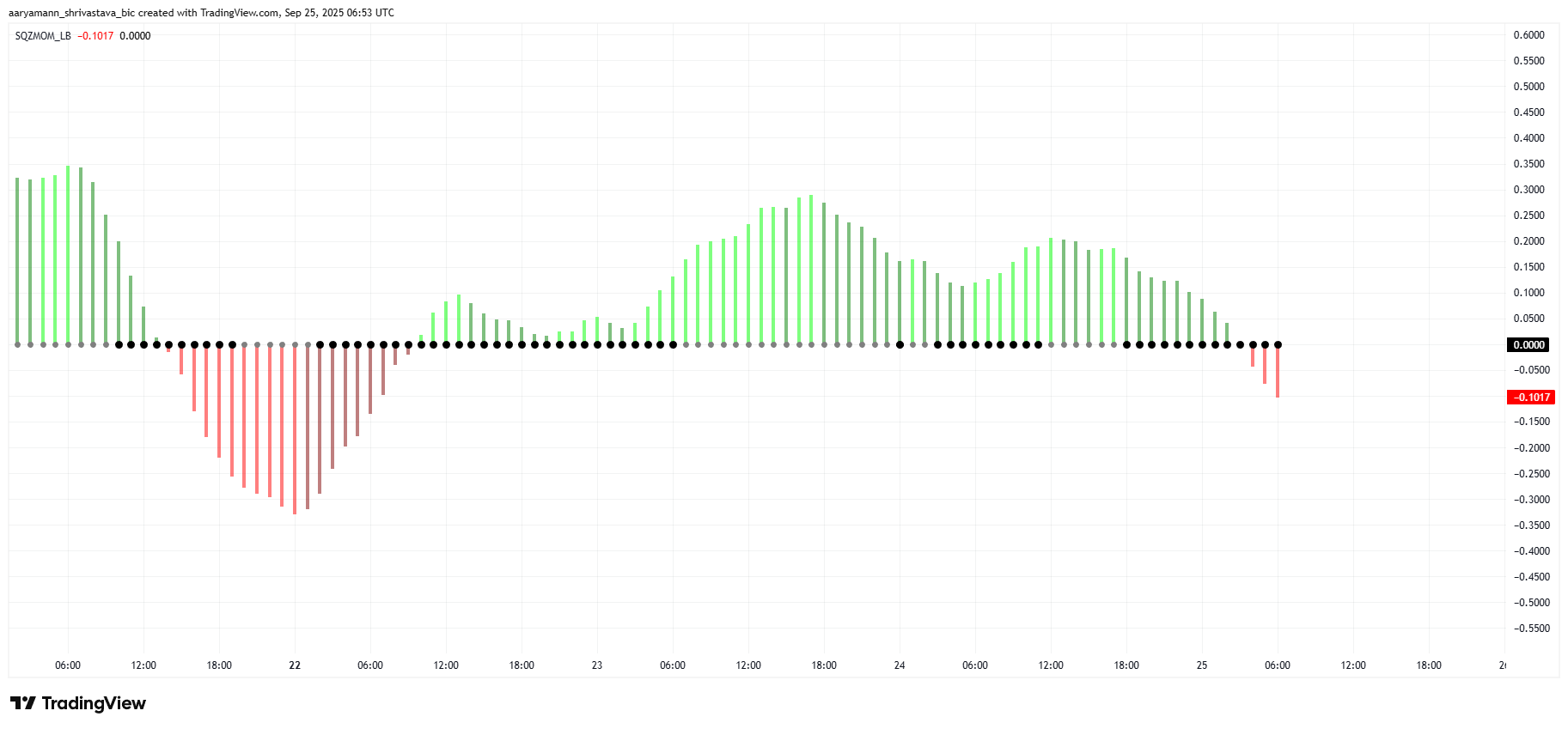

From a macro perspective, the Squeeze Momentum Indicator reveals a bearish trend building beneath the surface. The indicator shows that momentum has shifted into negative territory. As the squeeze develops, a potential release could drive heightened volatility that would weigh further on the altcoin’s performance.

If bearish momentum dominates when the squeeze breaks, ASTER could see accelerated losses. Volatility explosions often favor the prevailing trend, and with indicators flashing red, the bias appears skewed toward the downside. This setup leaves ASTER exposed to sharp corrections in the short term.

ASTER Squeeze Momentum Indicator. Source:

ASTER Squeeze Momentum Indicator. Source: TradingView

ASTER Squeeze Momentum Indicator. Source:

ASTER Squeeze Momentum Indicator. Source: TradingView

ASTER Price May Face A Drop

ASTER is trading at $2.07 at the time of writing, with its latest decline confirming the pressure it faces. The $2.24 level has now become strong resistance, blocking any immediate attempts at recovery.

The next critical support for ASTER lies at $1.87, and considering the prevailing momentum, the token is likely to test this level. A further drop could trigger panic selling, amplifying the decline as traders rush to secure gains or cut losses.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source: TradingView

ASTER Price Analysis. Source:

ASTER Price Analysis. Source: TradingView

However, if broader market cues turn favorable and ASTER reclaims $2.24 as support, the bearish outlook could be invalidated. This recovery would bring the token closer to its ATH of $2.43, offering bulls a chance to retest higher levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.