Google’s Secret Weapon for AI? A Bitcoin Mining Company

Google secured a 5.4% stake in Cipher Mining through a $3B deal supporting AI-ready data centers in Texas. The move highlights the AI-crypto convergence, expanding Google’s presence in energy-intensive infrastructure and reshaping miners’ strategic growth.

Google has acquired a 5.4% stake in Bitcoin mining company Cipher Mining. The move underscores the growing intersection of cryptocurrency and artificial intelligence infrastructure.

The acquisition, announced Thursday, accompanies a $3 billion multi-year agreement for Fluidstack, an AI cloud platform that builds and operates HPC clusters for major companies, to lease computing capacity from Cipher’s Texas site.

Google Backs Major Texas Data Center Expansion

The deal highlights growing convergence between AI platforms and crypto mining. Cipher Mining will deliver 168 megawatts of computing power to Fluidstack, supported by up to 244 MW of gross capacity, at its Barber Lake site in Colorado City, Texas. The site can expand to 500 MW and spans 587 acres, offering space for long-term growth.

Under the terms, Google will guarantee $1.4 billion of Fluidstack’s lease obligations to Cipher. In exchange, it will receive warrants for roughly 24 million shares of Cipher common stock. This makes Google a significant minority investor while supporting financing for one of the largest AI-ready mining facilities in the U.S.

Cipher CEO Tyler Page described the partnership as a milestone for the company’s high-performance computing ambitions. “This collaboration allows us to scale our infrastructure while serving frontier AI workloads efficiently,” he said.

This move mirrors Google’s earlier investment in TeraWulf in August, when it secured an 8% stake in exchange for guaranteeing $1.8 billion of Fluidstack lease obligations for TeraWulf’s 200 MW AI hosting capacity. That deal helped TeraWulf shift from purely Bitcoin mining to high-performance computing, setting a precedent for Google’s dual focus on crypto and AI data centers.

Miners Accelerate Shift Toward AI Infra

Analysts suggest this investment could speed up AI and crypto mining blending. With Google’s backing, Cipher gains capital and credibility, which may encourage other miners to expand into AI hosting. The deal may also intensify competition in Texas, an attractive state for its low energy costs and deregulated grid.

The agreement includes two five-year extension options, potentially lifting total contracted revenue to $7 billion. As the AI industry grows rapidly, this move signals a new era of hybrid projects that merge financial, computational, and energy-intensive sectors.

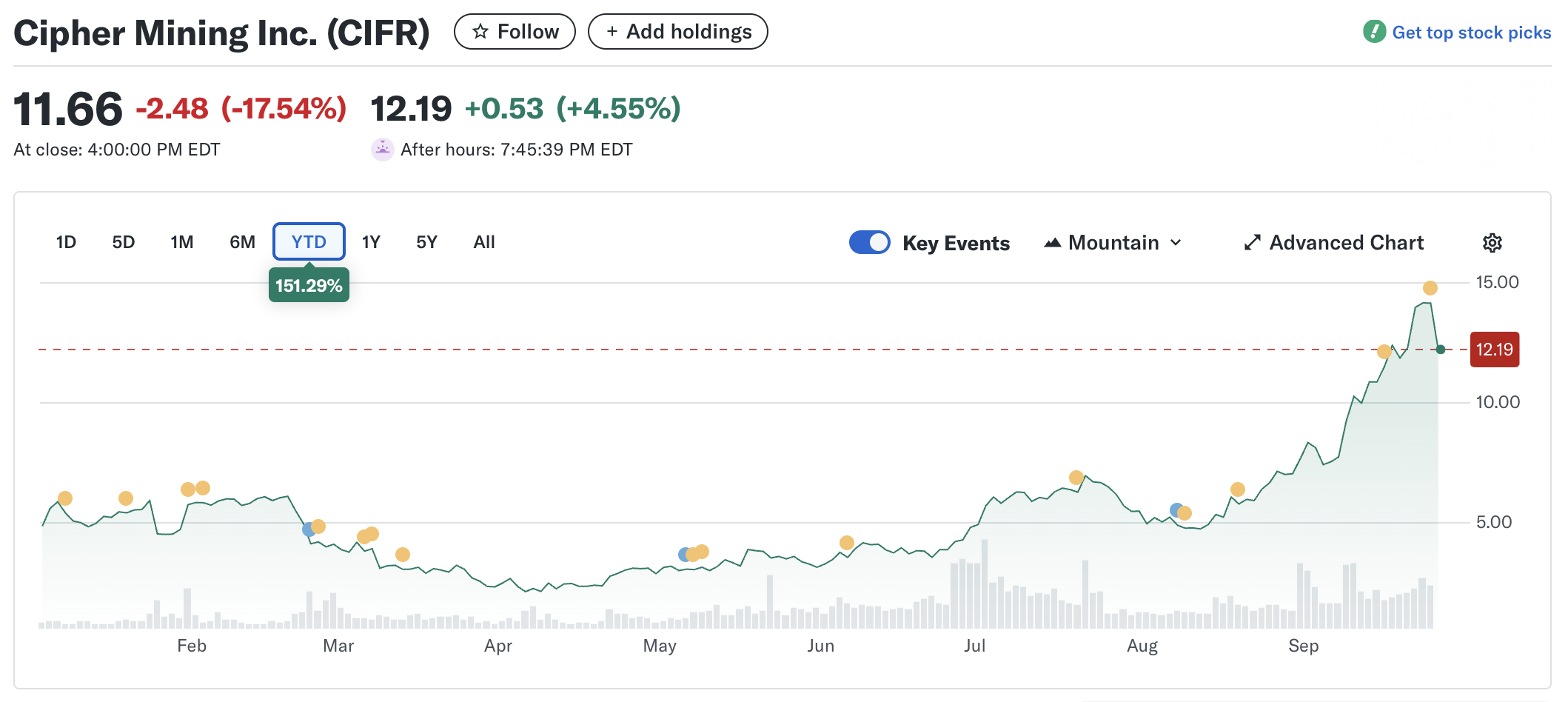

Cipher Mining stock performance YTD / Source: Yahoo Finance

Cipher Mining stock performance YTD / Source: Yahoo Finance

A mid-September analysis by The Miner Mag showed that Bitcoin mining stocks extended their recovery and outperformed Bitcoin. The trend was partly explained by investors rewarding companies that pivot toward GPU and AI services.

Cipher Mining (CIFR) shares surged from $14 to $17 on the day. They later retreated to close at $11.66. Year-to-date, the stock has climbed about 151.3%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bankless | Hyperliquid's Battle for Supremacy in 2025: Can It Hold On in 2026?

How does x402 V2 make autonomous payments by AI agents possible?

![[Bitpush Daily News Selection] JPMorgan issues Galaxy short-term bonds on the Solana network; New York court sentences Terraform Labs founder Do Kwon to 15 years in prison; US Financial Stability Oversight Council (FSOC) annual report removes digital asset risk warning; OpenAI launches a more advanced model, GPT-5.2, to compete with Google](https://img.bgstatic.com/multiLang/image/social/35029d7d430a8303837232285bb190721765555021864.jpg)