HyperVault raises rug pull fears after $3.6m vanishes

Suspicious withdrawals from Hypervault have set off fears of a rug pull, with millions in crypto assets rapidly moved out of the platform.

- Hypervault sparks rug pull fears with $3.6 million drained and funneled through Tornado Cash.

- The protocol’s official X account vanished after the withdrawals, fueling fears that the team has abandoned the project.

- Rugpulls in 2025 remain costly, with cases like MetaYield Farm and Mantra causing multi-billion-dollar investor losses.

Hypervault Finance is facing rug pull allegations after about $3.6 million in crypto was drained from the project in a series of suspicious transactions. According to on-chain data , the funds were first bridged from Hyperliquid to Ethereum, then converted into ETH.

Roughly 752 ETH was later deposited into Tornado Cash, a mixing service commonly used to obscure transaction trails.

The unusual activity mirrors a pattern often linked to rug pulls in decentralized finance, with sudden, unexplained withdrawals routed through privacy tools. For users still holding funds tied to the project, the move has fueled fears of an exit scam.

What is Hypervault?

Hypervault Finance promoted itself as a decentralized vault protocol offering cross-chain liquidity and flexible yield opportunities. The project marketed itself as a safer way to manage assets across networks, targeting investors looking for passive income streams.

“Hypervault is the premier hub for yield on HyperEVM,” it claimed. Its connection to Hyperliquid , a rising player in the perpetuals exchange space, had given it added visibility in the market. However, those promotions may have been a facade, as the abrupt disappearance of funds is now calling that credibility into question.

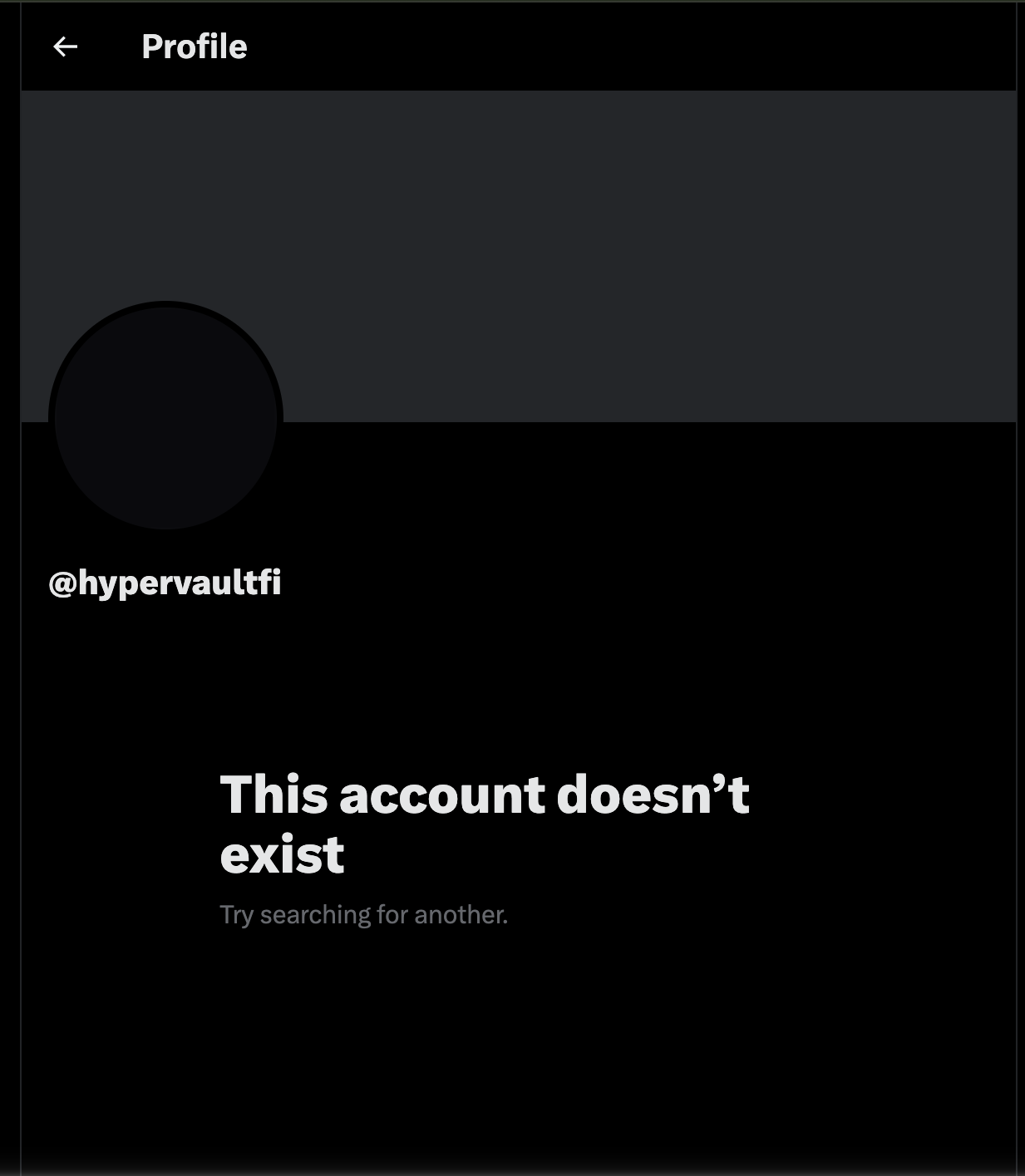

Adding another layer of suspicion, Hypervault’s official X account vanished alongside the funds, and no statement has been issued at the time of writing.

Screenshot of Hypervault’s profile amid rug pull concerns | Source: X

Screenshot of Hypervault’s profile amid rug pull concerns | Source: X

Rugpulls remain a risk in DeFi

Incidents like this highlight the persistent risks in decentralized finance. Rug pulls are a common exploit in the industry, where developers drain liquidity and abandon a project.

This trend has cost investors billions over the years. In some cases, even celebrity-backed or influencer-promoted projects have ended the same way, marketed as legitimate opportunities to attract retail investors, only for founders or promoters to quietly exit once liquidity peaks. These tactics often leave ordinary investors empty-handed, while those behind the schemes walk away with the proceeds.

So far this year, several cases have been recorded . The most significant to date came in February with MetaYield Farm, which drained $290 million from investors before vanishing.

Another such major incident was the fall of Mantra (OM), a DeFi protocol that collapsed in early 2025. In this event, insider wallets quickly moved $227 million in tokens, crashing OM’s price by over 90% and resulting in total investor losses of $5.5 billion. Founders denied wrongdoing, but wallet evidence and the rapid shutdown signaled classic rugpull patterns.

Until there is clarity from HyperVault’s team, the situation remains unresolved. The use of Tornado Cash, while not definitive proof, is a common tactic in cases where teams attempt to hide transactions after pulling funds, adding weight to speculation that the protocol’s operators may have walked away with users’ funds.

For now, the unusual activity suggests that Hypervault may be the latest rug pull in the DeFi sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?