Bitcoin’s market has entered a turbulent phase, with long-term holders realizing significant gains while analysts signal the possibility of renewed upward momentum.

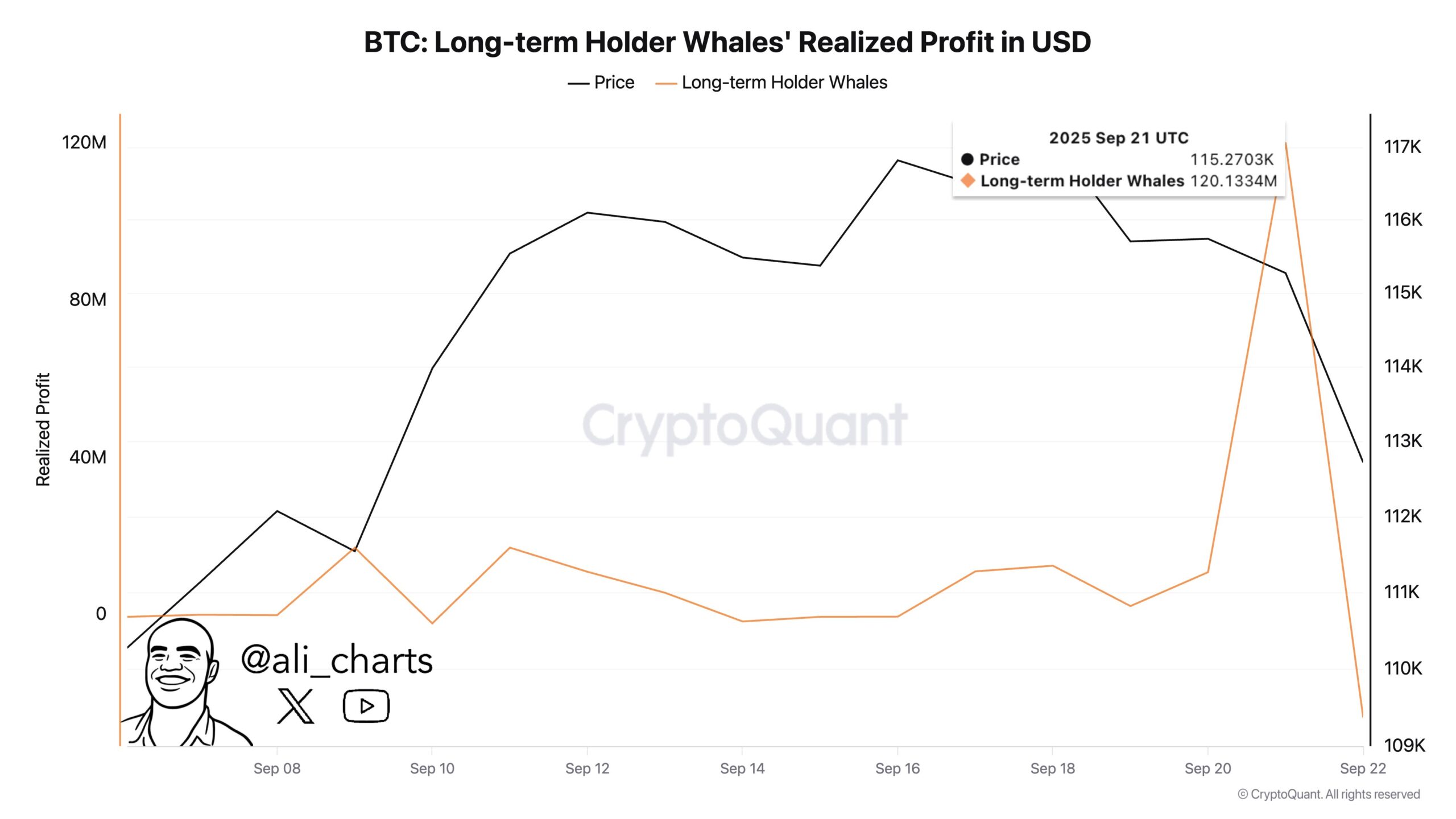

Data from CryptoQuant shows that long-term Bitcoin whales have recently locked in around $120 million in realized profits. This wave of selling coincided with a pullback in BTC prices, which briefly dipped below $112,000 before bouncing back above $113,000. The move suggests that some large investors are taking advantage of earlier gains while preparing for the next market phase.

Despite the sell-off, sentiment among market watchers is not entirely bearish. Michaël van de Poppe, a well-known analyst, noted that while corrections may still occur, the odds now favor a rebound for both Bitcoin and Ethereum.

He pointed out that the ETH/BTC pair remains structurally strong, and if the 20-week moving average begins to climb, it could provide the foundation for the next leg higher.

Technical indicators add further context. Bitcoin’s RSI currently sits in the mid-range near 55, reflecting neither extreme overbought nor oversold conditions. After months of consolidation and several liquidity sweeps that cleared overleveraged positions, traders are eyeing the $110,000–$115,000 range as a critical support zone.

If Bitcoin manages to hold these levels, analysts believe it could build momentum heading into October, historically one of its strongest months. Conversely, a break below $110,000 would raise the risk of further downside, but for now, the market appears to be balancing between profit-taking by whales and renewed optimism for another rally.