MicroStrategy Expands Bitcoin Holdings With $22M Purchase Despite Price Dip

Contents

Toggle- Quick breakdown

- MicroStrategy buys the dip amid market weakness

- Total holdings now exceed 640,000 BTC

- Saylor remains confident in year-end rally

Quick breakdown

- MicroStrategy bought 196 BTC for $22.1M as Bitcoin fell below $110,000.

- The company now holds 640,031 BTC, purchased for $47.35B in total.

- Michael Saylor expects Bitcoin to rally toward year-end despite headwinds.

MicroStrategy buys the dip amid market weakness

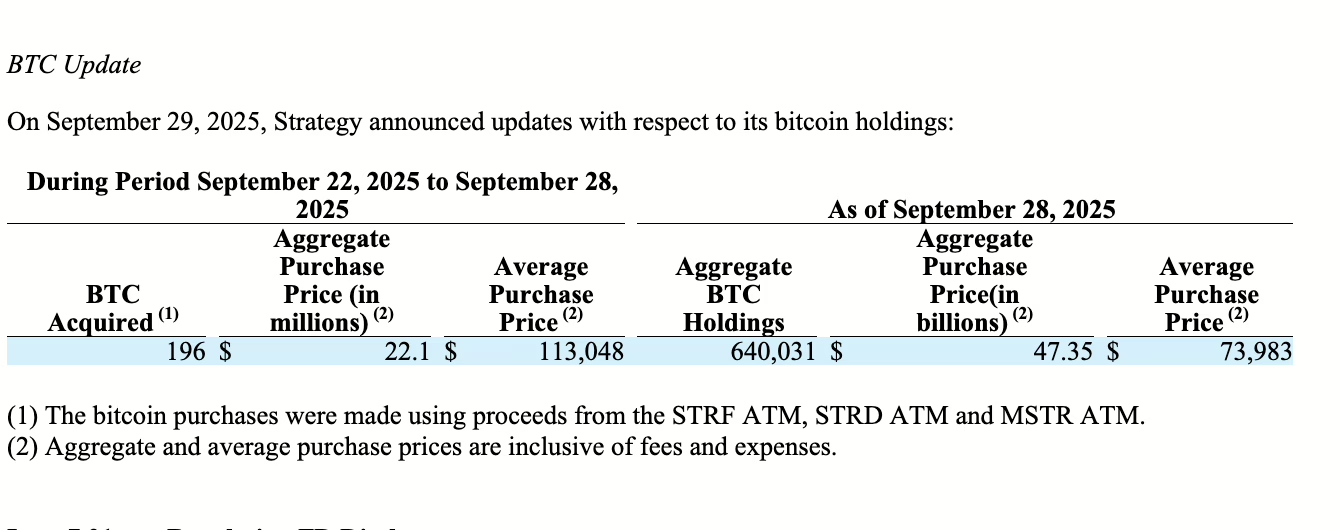

MicroStrategy, the world’s largest corporate holder of Bitcoin, has strengthened its position by acquiring an additional 196 BTC last week. The $22.1 million purchase came as Bitcoin briefly slipped below the $110,000 mark, according to a U.S. Securities and Exchange Commission (SEC) filing on Monday.

Source:

SEC

Source:

SEC

The latest acquisition was made at an average price of $113,048 per Bitcoin, with the cryptocurrency beginning the week near $112,000 before tumbling on Thursday, data from CoinGecko shows.

Total holdings now exceed 640,000 BTC

Following the purchase, MicroStrategy now controls 640,031 BTC valued at roughly $47.35 billion, bought at an average price of $73,983 per coin. While this latest buy underscores the company’s continued accumulation strategy, it represents one of its smallest weekly Bitcoin acquisitions in recent months, reflecting a gradual slowdown in purchase volumes.

Saylor remains confident in year-end rally

Despite reduced buying, co-founder Michael Saylor maintains a bullish outlook. Speaking last week, he predicted Bitcoin could rebound strongly toward the end of the year as institutional adoption grows and macroeconomic pressures ease.

“I think that as we work through the resistance of late and some macro headwinds, we’ll actually see Bitcoin start to move up smartly again toward the end of the year,”

Saylor said. Saylor added that

“companies that are capitalizing on Bitcoin are buying even more than the natural supply being created by the miners,”

which is “putting upward pressure on the price.”

Meanwhile, Saylor urged U.S. regulators in August to establish a formal taxonomy for digital assets , warning that ongoing regulatory ambiguity threatens to stall innovation and hinder the nation’s competitiveness in the global crypto market.

Speaking during Strategy’s second-quarter earnings call on Thursday, Saylor emphasized the urgent need to define key terms such as “digital security,” “digital commodity,” and “tokenized asset.”

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP spot ETFs experience 19-day inflow streak

The Rise of a Governed Clean Energy Marketplace: REsurety's CleanTrade and the Next Chapter in Sustainable Finance

- CFTC's 2025 approval of REsurety's CleanTrade platform establishes the first regulated market for financially-settled clean energy contracts. - The platform addresses market fragmentation by standardizing VPPAs and RECs, enabling institutional-grade trading with real-time pricing and risk analytics. - Rapid adoption ($16B notional value in two months) demonstrates demand for scalable, transparent green finance solutions that reduce counterparty risks. - By converting complex VPPAs into tradable assets, C

Solana’s Uptake Among Institutions and Recent Market Fluctuations: Reasons to Trust in Its Long-Term Potential

- Solana secures institutional validation via JPMorgan's $50M Solana-based commercial paper and Bhutan's gold-backed TER token, signaling cross-sector adoption. - Technical upgrades like Firedancer and consensus algorithm enhancements boost scalability, outpacing Ethereum while maintaining cost efficiency and sustainability. - Q2 2025 revenue ($271M) and $7.14B trading volume post-Bhutan deal highlight Solana's market dominance despite $130–$145 short-term volatility amid macroeconomic uncertainty. - JPMor

BrightView’s Approach to Growth in the Changing Landscaping Industry: Harnessing Infrastructure and Sustainable Practices

- BrightView leverages infrastructure and sustainability to lead the evolving landscaping sector. - Its 2025 initiatives include smart irrigation (30% water savings) and 17% electric fleet expansion, aligning with UN SDGs and SASB standards. - IoT/AI tools boost efficiency, while 2025 EBITDA rose 8.5% to $352. 3M , supporting $300M fleet upgrades and $150M share buybacks. - Client diversification (83% retention) and niche markets (e.g., solar-powered senior living) strengthen market reach and client loyalt