Tokenized Gold Market Nears $3B as Bullion Blasts to Fresh Record Highs

Gold’s historic rally accelerated on Monday, with spot prices punching through $3,800 per ounce to set fresh all-time record, extending a torrid year in which bullion is up roughly almost 47% year-to-date.

That surge is echoing on across crypto rails, with gold-backed tokens climbing to an all-time high market capitalization of $2.88 billion, CoinGecko data shows. Tokenized versions of the metal are backed by physical reserves but settle on blockchain rails, offering round-the-clock trading and near-instant transfers.

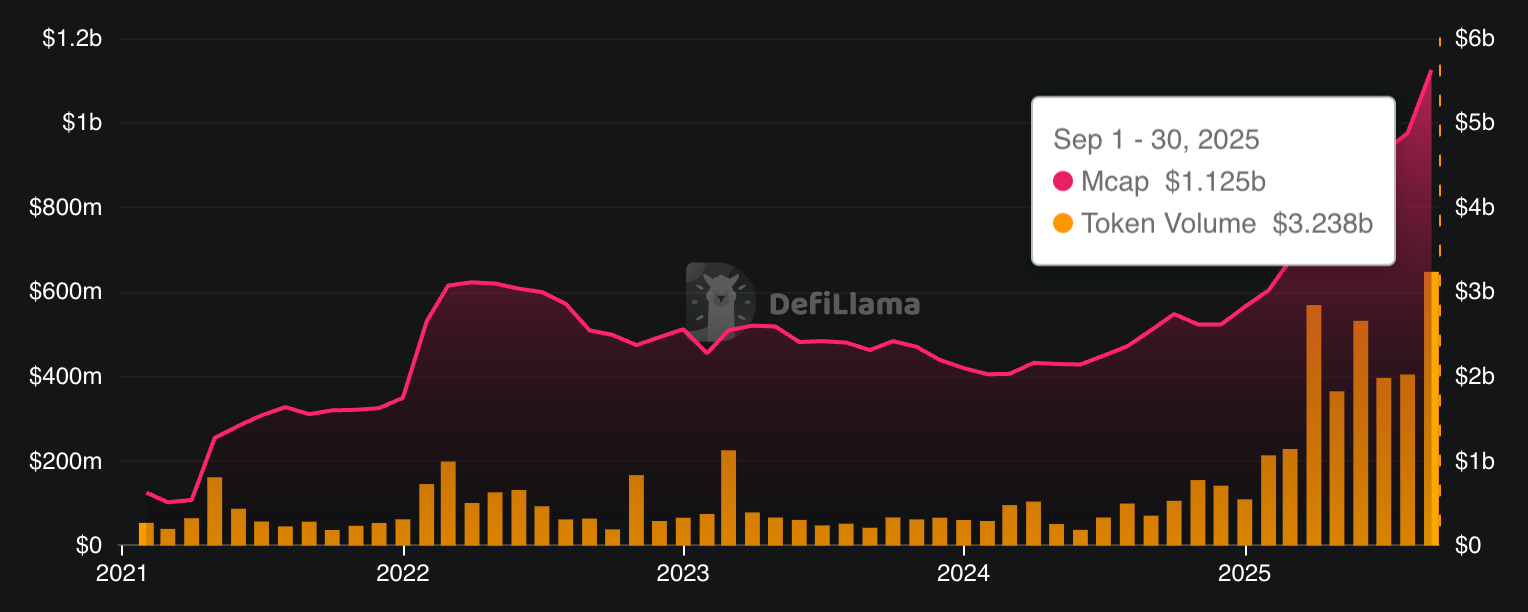

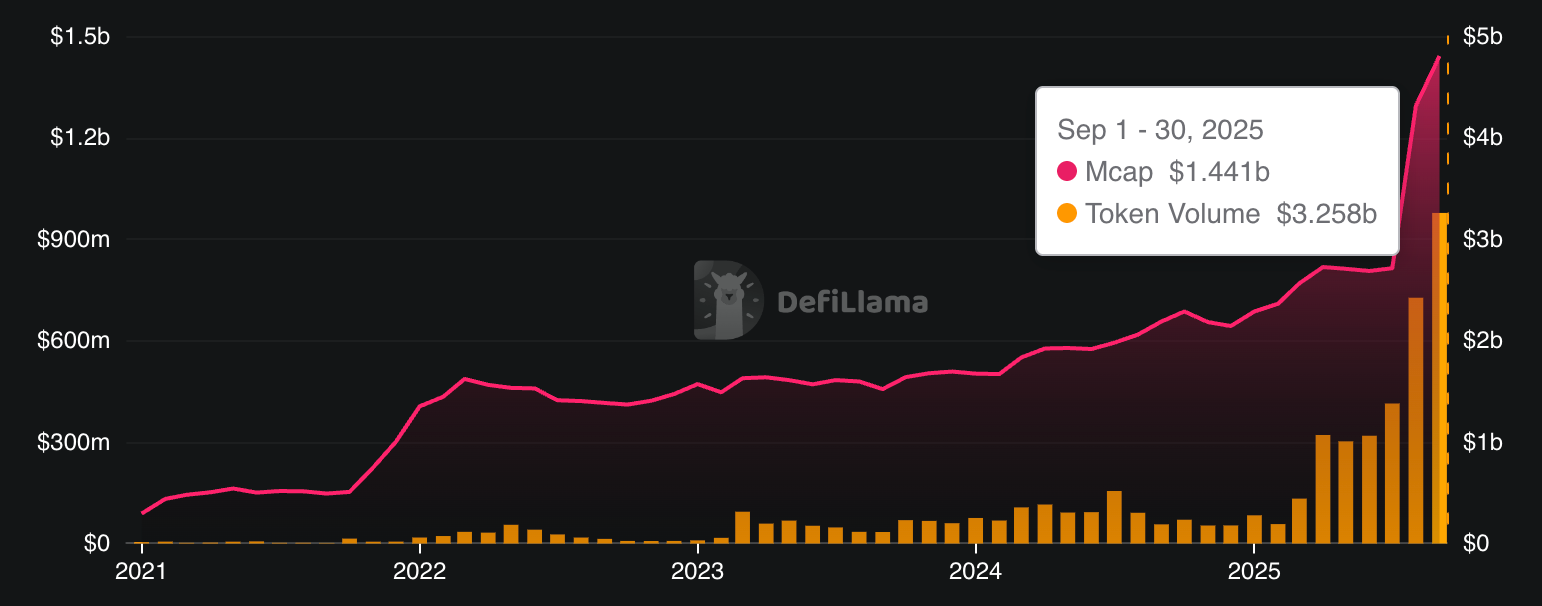

XAUT$3,832.05 and Paxos' PAXG$3,843.58, both tokens issued by firms predominantly known for their stablecoins, are dominating the category. XAUT’s capitalization stood near $1.43 billion and PAXG’s at roughly $1.12 billion, both at their respective all-time highs.

Liquidity has swelled alongside the rally, too. PAXG attracted more than $40 million in net inflows during September and set a fresh trading volume record surpassing $3.2 billion in monthly turnover.

XAUT also posted a record $3.25 billion in monthly volume, per DeFiLlama. Meanwhile, the token's market cap growth came solely from the underlying metal's appreciation, as no new token minting happened this month after August's $437 million jump.

The tokenized gold market could continue gaining as macro conditions remain supportive for the yellow metal. Investors expectations mount for more Federal Reserve rate cuts and a softer U.S. dollar, while anxiety builds over a possible government shutdown in the U.S. Meanwhile, BTC$114,362.81, often dubbed as "digital gold," is lagging behind gold with a 22% year-to-date return.

Read more: Bitcoin to Join Gold on Central Bank Reserve Balance Sheets by 2030: Deutsche Bank

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving 2025: Effects on the Market, Investor Reactions, and Tactical Investment Prospects

- Zcash's 2025 halving reduces block rewards by 50%, tightening supply and reinforcing its deflationary model. - The event coincided with a 1,172% price surge, driven by institutional investments and growing shielded transaction adoption. - Institutional demand, including Grayscale and Cypherpunk's ZEC acquisitions, highlights Zcash's strategic value in privacy-focused crypto markets. - Regulatory risks under MiCA and short-term volatility remain concerns, but long-term projections suggest potential for $1

New Prospects in EdTech and Career Training: Fast-Expanding Academic Pathways Tailored to Meet Industry Demands

- Global higher education is reshaping curricula to align with AI, security, and green energy industry demands, creating high-growth career pathways. - AI programs see 45% annual enrollment growth (2020-2025), with graduates earning 56% higher wages than non-AI peers in fields like cybersecurity and data science. - Security programs address 750,000 U.S. cybersecurity job gaps through AI-driven threat detection, while wind energy training responds to 64% global wind power growth in 2025. - Institutions like

Will Fed Leadership Change Disrupt Ethereum’s 2026 Rally?

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report