Base NFTs surged in September led by DX Terminal, which recorded 1.27 million sales and 200,000+ traders, making Base a leading hub for experimental NFT projects as trading volume gains rivaled established collections.

-

DX Terminal topped sales with 1.27M transactions in September.

-

Base captured five of the top 10 collections by sales count.

-

DX Terminal posted a ~1,700% volume surge and 200k+ unique traders (DappRadar data).

Base NFTs surge: DX Terminal leads with 1.27M sales and heavy trader activity in September — read the analysis and key takeaways from COINOTAG.

Base’s NFT ecosystem accelerated in September, with DX Terminal recording 1.27 million sales — a more than 1,000% month-over-month increase — and helping Base place five collections in the top 10 by sales count.

Ethereum layer-2 network Base emerged as a notable center for experimental non-fungible token activity in September. According to DappRadar plain-text data, Base collections dominated sales-count rankings, reflecting rapid project-level engagement that challenged long-standing NFT hubs.

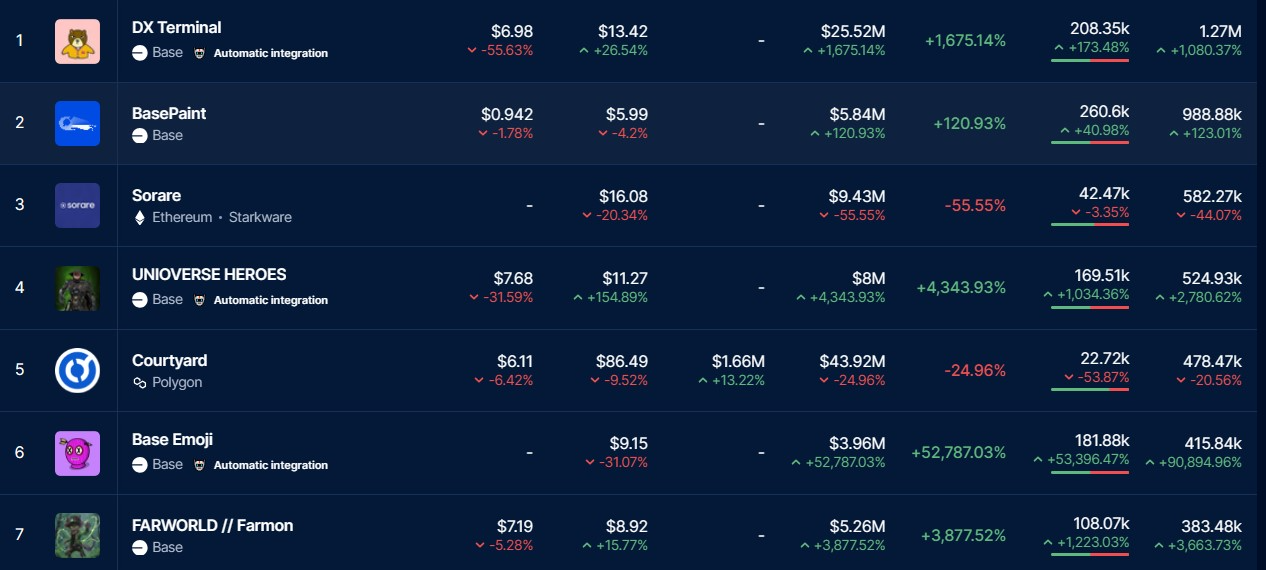

Although Base led by sales count, trading volume remained concentrated on Polygon and Ethereum collections. Polygon’s Courtyard led September volume with $43.9 million, followed by Ethereum’s Moonbirds at $34 million and CryptoPunks at $25.8 million. Base’s DX Terminal ranked fourth by volume with $25.5 million, a near 1,700% monthly surge.

The top seven NFT collections by sales count in September. Source: DappRadar

What caused Base NFTs to surge in September?

Base NFTs surged largely because of high-frequency, low-friction projects like DX Terminal that encouraged mass trading activity. Short-form mechanics and AI-driven gameplay boosted transaction counts, pushing Base to capture multiple top sales-count positions while broader markets focused on volume leaders.

How did DX Terminal drive Base’s NFT growth?

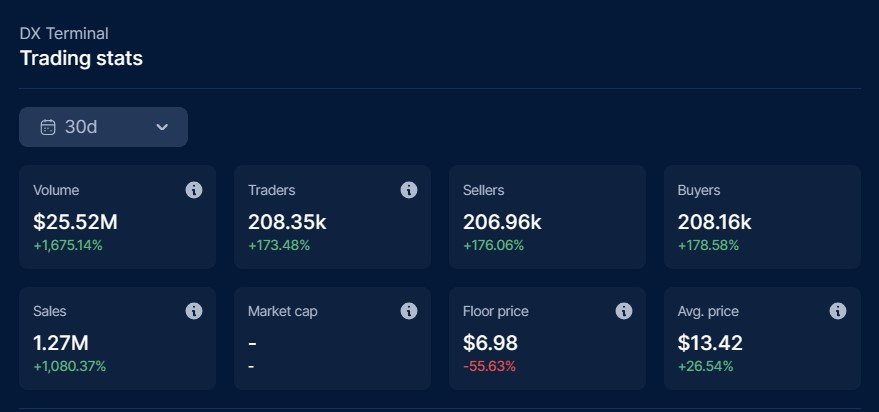

DX Terminal recorded 1.27 million sales in September, an increase exceeding 1,000% month-over-month. The project registered over 200,000 unique traders, driving page activity and on-chain transaction counts. Its AI-agent marketplace and retro-futuristic simulation encouraged rapid, repeatable trades rather than large-value, single transactions.

DX Terminal trading statistics. Source: DappRadar

DX Terminal functions as a gaming format where NFTs represent autonomous, AI-powered trader agents inside a simulated market. Each character has distinct traits and behaviors. Agents interact with player prompts, rival firms and non-playable characters to accumulate in-game status and wealth.

Unlike traditional play-to-earn designs, DX Terminal does not offer direct token rewards or real-world payouts. Its in-game token, WEBCOIN, is managed off-chain and carries no official external monetary value. The DX Terminal team has stated that any external tokens claiming affiliation are unofficial.

Why did trading volume remain higher on Polygon and Ethereum?

Established blue-chip collections continue to command larger trade sizes, which sustains higher dollar volumes on Polygon and Ethereum. Polygon’s Courtyard led volume in September with $43.9M, while Moonbirds and CryptoPunks contributed $34M and $25.8M respectively. Base’s rise affected counts more than aggregated dollar volume.

Even within top-volume collections, month-over-month declines were common. Many blue-chip projects saw 50–60% drops in trading volume, while Courtyard and Moonbirds registered smaller declines near 25% and 13.6% respectively. This underscores a split market dynamic: volume concentration vs. high-frequency sales counts.

Frequently Asked Questions

How many traders did DX Terminal attract in September?

DX Terminal attracted over 200,000 unique traders in September, contributing to its 1.27 million sales count and driving Base’s notable position among the month’s top-selling collections.

What is the role of AI in DX Terminal?

The project uses AI-powered NFT agents that autonomously trade and react to game inputs. These agents create high-frequency interactions that increase transaction counts without offering direct tokenized payouts.

Key Takeaways

- Sales domination: DX Terminal led September sales with 1.27M transactions, pushing Base into the top sales-count positions.

- Volume concentration: High dollar volumes remained on Polygon and Ethereum, led by Courtyard, Moonbirds and CryptoPunks.

- Market split: Base’s growth highlights a divergence between high-frequency, low-value sales counts and established, high-value collection volumes.

Conclusion

Base’s September performance shows how experimental projects like DX Terminal can rapidly scale transaction counts and attract mass participation. While trading volume stayed concentrated on Polygon and Ethereum, Base’s sales momentum signals evolving NFT engagement models. For continuing coverage and analysis, watch on-chain metrics and project announcements closely — COINOTAG will monitor updates.

Published: 2025-09-30 | Updated: 2025-09-30 | Author: COINOTAG

Notes: Data cited in this article is drawn from DappRadar plain-text reporting and project statements from DX Terminal. External site names are referenced as plain text only.