USD1 stablecoin is set to make debut on Aptos network

USD1 will be launched on the Aptos blockchain following a partnership with World Liberty Financial. The USD1 stablecoin is expected to go live on October 6.

- USD1 will be launched on the Aptos network on Oct. 6, marking its first integration into a Move-based blockchain.

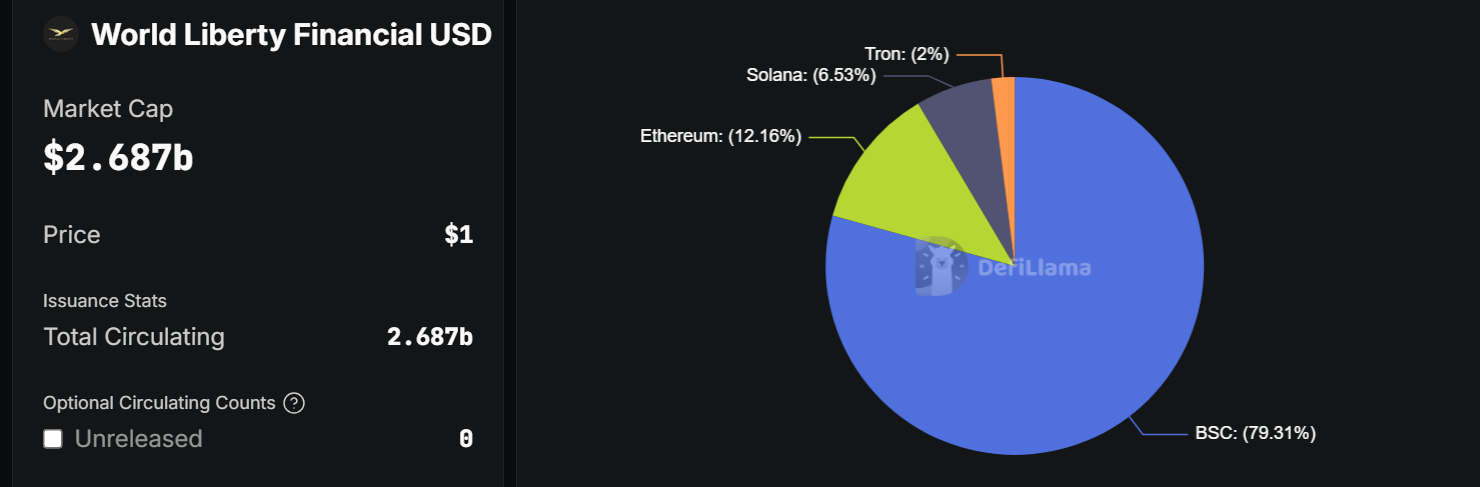

- Since its launch in March 2025, USD1 has grown to a market cap of around $2.68B, with most of its supply on BNB Chain.

On Oct. 1, Donald Trump Jr. and World Liberty Financial CEO Zach Witkoff announced that the USD1 stablecoin will be launching on the Aptos network on October 6. The launch will mark the first time that WLFI’s stablecoin will be hosted on a Move-based blockchain.

“The list grows of those choosing the fastest, cheapest, & most efficient rails in the world,” wrote Aptos ( APT ) in its latest post

Based on information from the official post, multiple wallets and exchanges will provide support for the launch on the Aptos ecosystem, including Petra Wallet, Bitget Wallet, OKX, Gate group and many more.

The stablecoin will be available for trading once it completes integration into Aptos on October 6. The integration will include Aptos DeFi protocols on-chain, such as Echelon Market, Hyperion, Thala Labs, Panora Exchange and Tapp Exchange.

The Aptos network becomes the latest crypto project to support WLFI’s stablecoin integration; other projects in the past have included Justin Sun’s Tron ( TRX ), Ethereum ( ETH ), Solana ( SOL ), Plume Network as well as BNB Chain ( BNB ).

USD1’s web3 expansion

Ever since it was launched in March 2025, World Liberty Financial’s stablecoin USD1 has accumulated a market cap of $2.68 billion based on data fron DeFi Llama. The largest share of the stablecoin is deployed on the Binance Smart Chain, approximately 79.3% of the total circulating supply.

Meanwhile, Tron accounts for 2% of the total supply, meanwhile at least 12.16% of the stablecoins have been deployed on Ethereum. Lastly, Solana has hosted 6.53% of the WLFI stablecoin supply on-chain.

Entering as a new contender, Aptos already hosts a number of stablecoins on-chain. Aptos runs Tether, USD Coin, USDE and PYUSD and has a monthly volume of $60 billion. According to data from RWA.xyz, Aptos has a stablecoin market share of just 0.35% of the total stablecoin market.

USD1 is mostly deployed on Binance Smart Chain | Source: DeFi Llama

USD1 is mostly deployed on Binance Smart Chain | Source: DeFi Llama

Most recently, World Liberty Financial announced that it would launch a debit card. The card will reportedly allow users to link USD1 and WLFI wallet to Apple Pay, allowing for seamless crypto-to-fiat integration. In addition, the debit card will also be made compatible with the platform’s upcoming app.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster DEX's On-Chain Momentum: Signaling the Future of DeFi

- Aster DEX reported $27.7B daily volume and $1.399B TVL in Q3 2025, outpacing DeFi benchmarks with 2M users. - Institutional whale activity, including CZ's $2M ASTER purchase, drove $5.7B inflows and 800% volume spikes. - Hybrid AMM-CEX model and ZKP privacy tech enabled 40.2% TVL growth, 77% private transactions, and 19.3% perpetual DEX market share. - ASTER's margin trading upgrades and Stage 4 airdrops fueled 30% price surges, while Aster Chain's 2026 launch will integrate privacy-preserving ZKPs. - On

Astar (ASTR) Price Rally: Protocol Enhancements and Ecosystem Growth Drive Long-Term Value

- Astar (ASTR) surged 150% due to protocol upgrades and ecosystem expansion, positioning it as a sustainable value creation case study in blockchain. - Tokenomics 3.0 (fixed 10.5B supply) and Burndrop mechanism created deflationary incentives, supported by Galaxy Digital's $3. 3M OTC investment and Astar's $29.15M buyback. - Cross-chain interoperability with Polkadot/Plaza and Sony's Soneium, plus partnerships with Toyota and Japan Airlines, expanded real-world utility in logistics, identity, and loyalty p

Astar 2.0 Debut and Tokenomics Revamp: Driving DeFi Innovation and Attracting Institutional Participation

- Astar Network's Astar 2.0 introduces Tokenomics 3.0 with fixed 10.5B ASTR supply and 5% annual burn rate to stabilize value for institutional investors. - The update features Burndrop mechanism, asynchronous cross-chain security, and ESG-aligned protocols to address regulatory risks and attract traditional capital. - Plaza platform enables seamless asset transfers across Ethereum , BSC, and Polkadot , while zkEVM scalability targets 300,000 TPS by 2026 for enterprise-grade DeFi solutions. - Governance sh

PNC Bank launches Bitcoin trading for high-net-worth clients