$127 Million Lost in September as Crypto Hacks Target RWAs and DeFi Projects

Losses from crypto attacks fell in September, but more incidents show cryptojacking risks remain strong—especially for vulnerable RWA projects.

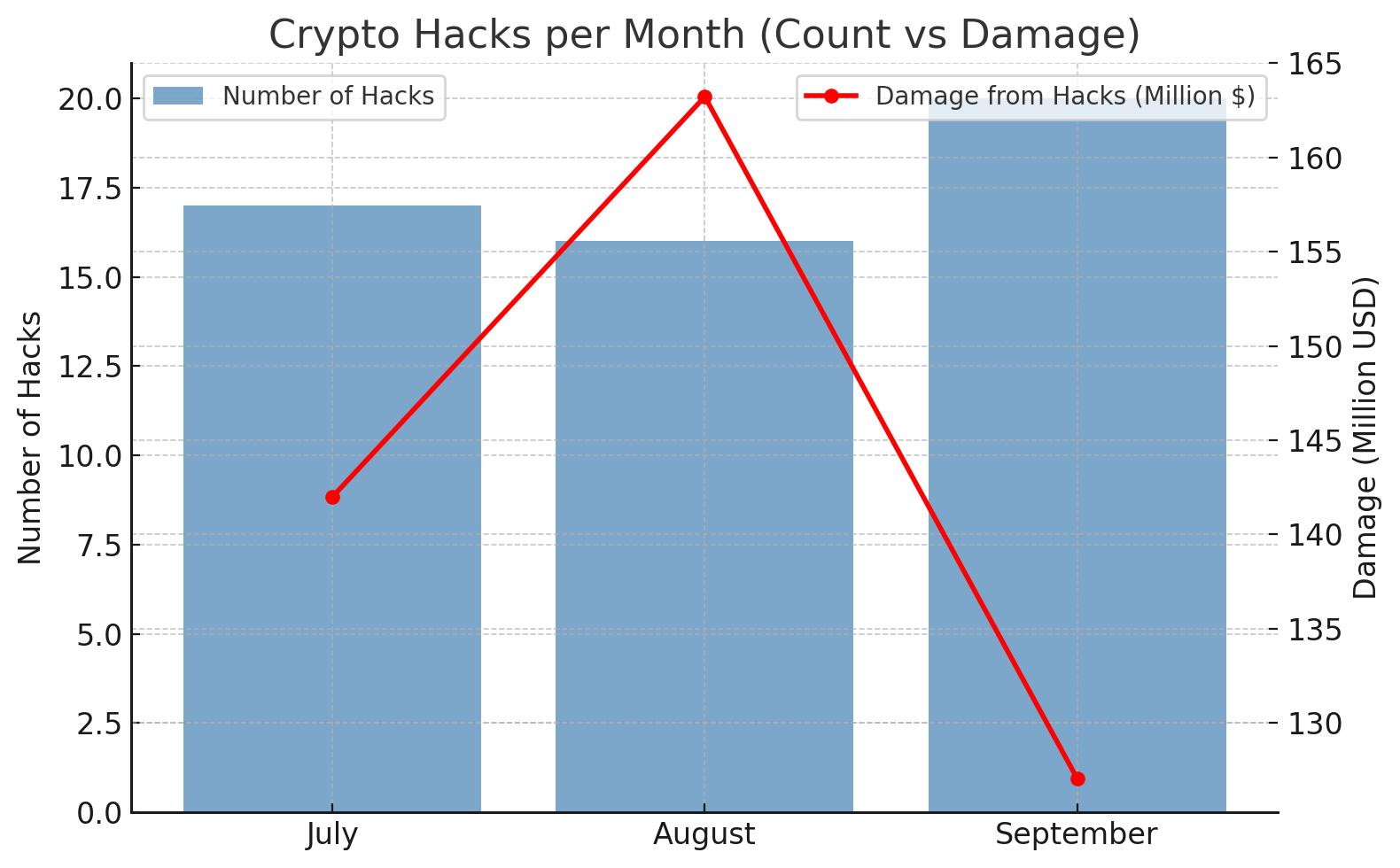

September recorded total damages of $127.06 million from 20 crypto-related attacks, according to PeckShield.

While this marks a 22% decrease compared to August’s $163 million, the number of incidents actually rose. This shows that cryptojacking in September highlights risks that continue to lurk across the crypto ecosystem.

Cryptojacking in September – Cooling Down, But Risks Remain

According to PeckShield, September 2025 saw around 20 large-scale attacks in the crypto industry, causing estimated losses of $127.06 million. Key incidents in cryptojacking in September included UXLINK ($44.14 million), SwissBorg ($41.5 million), Venus ($13.5 million, later recovered), Yala ($7.64 million), and GriffAI ($3 million).

Although the total value of damages decreased, the number of hacks is on the rise, as attackers continue to evolve their methods, leaving no link in the ecosystem fully secure.

Looking back at August, it was a turbulent month with 16 major security incidents wiping out more than $163 million, up 15% from July. Q3 2025 saw over $432 million lost from 53 hacks, confirming that cryptojacking in September is part of an ongoing threat.

Number of cryptojacking in Q3 2025. Source: BeInCrypto

Number of cryptojacking in Q3 2025. Source: BeInCrypto

Growing Pressure on RWA Projects

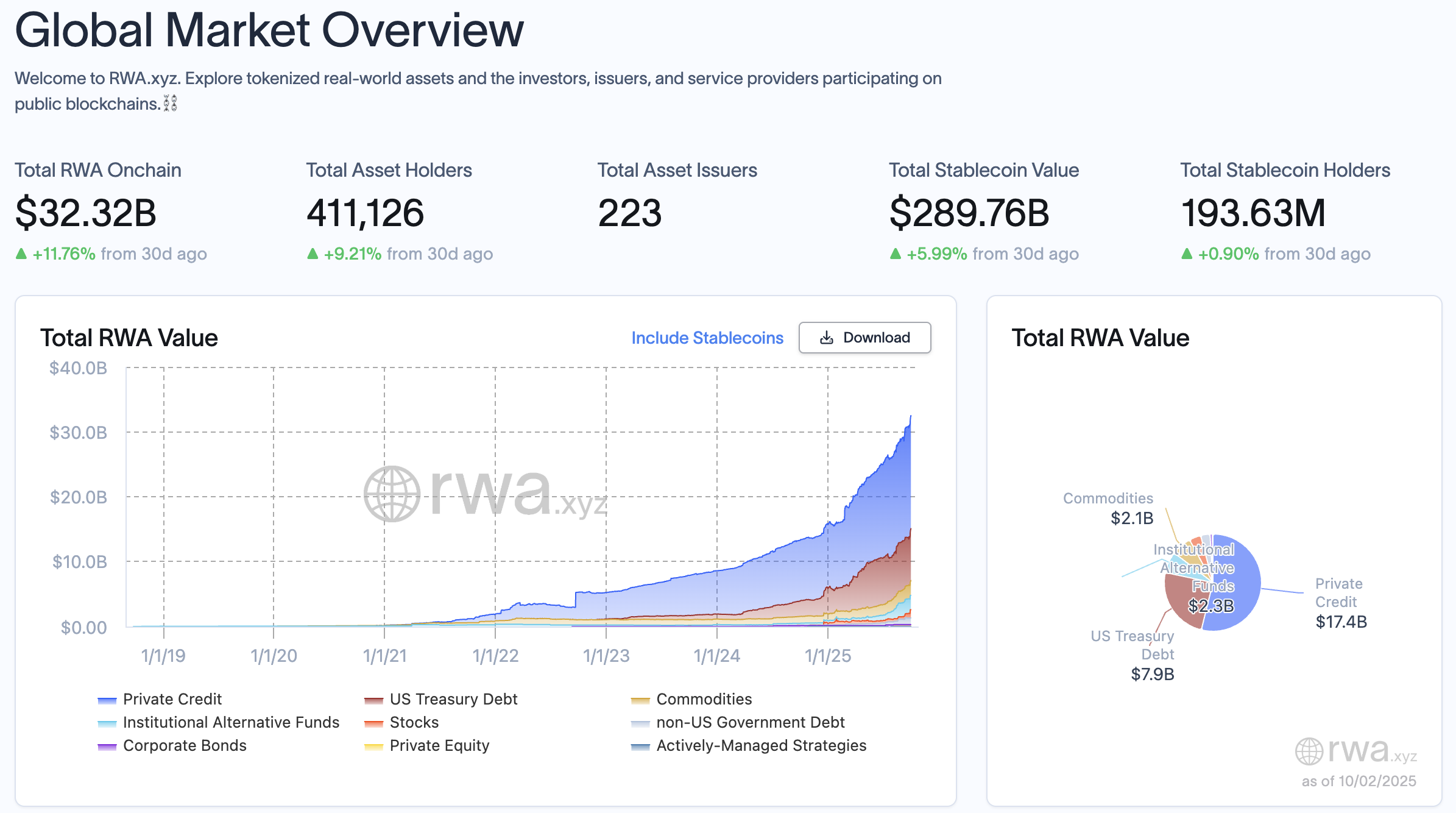

As BeInCrypto reported, a growing trend of attacks targeting RWA projects has been recorded, resulting in around $14.6 million in damages in just the first half of 2025. Since these projects must bridge on-chain infrastructure with off-chain assets, they open up new vulnerabilities for hackers.

RWA segment picture. Source:

RWA segment picture.

RWA segment picture. Source:

RWA segment picture.

The RWA segment has been booming, with on-chain value reaching $32.32 billion, an 11.76% increase over the past 30 days.

While RWA projects promote “security and transparency” to attract traditional investors, the complexity of integrating blockchain and real-world assets has, in fact, created more entry points for attackers.

If this trend continues, confidence in the RWA segment—considered one of the main growth drivers of the crypto market—could be shaken. Therefore, reinforcing independent security audits, multi-layer protections such as multisig and timelocks, and continuous on-chain monitoring will safeguard institutional investor trust against future cryptojacking September-style incidents.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

Fed rate cut may pump stocks but Bitcoin options call sub-$100K in January

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.