- China’s central bank injects ¥530 billion this week.

- Liquidity boosts may support global risk assets like Bitcoin.

- Analysts eye $150K BTC as capital flows increase.

China Pumps ¥530B Into Markets—Is Bitcoin the Next Beneficiary?

This week, the People’s Bank of China (PBOC) made headlines by injecting a massive ¥530 billion (about $73B USD) into the financial system through short-term lending operations. The move is part of a broader strategy to boost liquidity and stimulate the Chinese economy.

But this isn’t just domestic news—it’s sparking speculation in the global crypto space. With liquidity rising in one of the world’s largest economies, many are asking: Could Bitcoin benefit from China’s liquidity injection?

Liquidity Boost = Risk-On Sentiment?

Increased liquidity often leads to more risk-taking behavior among investors. While China still officially restricts direct crypto trading, global markets are highly interconnected. When a major economy adds liquidity, capital often spills over into risk assets—including cryptocurrencies like Bitcoin.

Analysts argue that this kind of stimulus adds fuel to the fire for Bitcoin price predictions, especially as traders look for inflation-resistant and high-growth alternatives to fiat currencies.

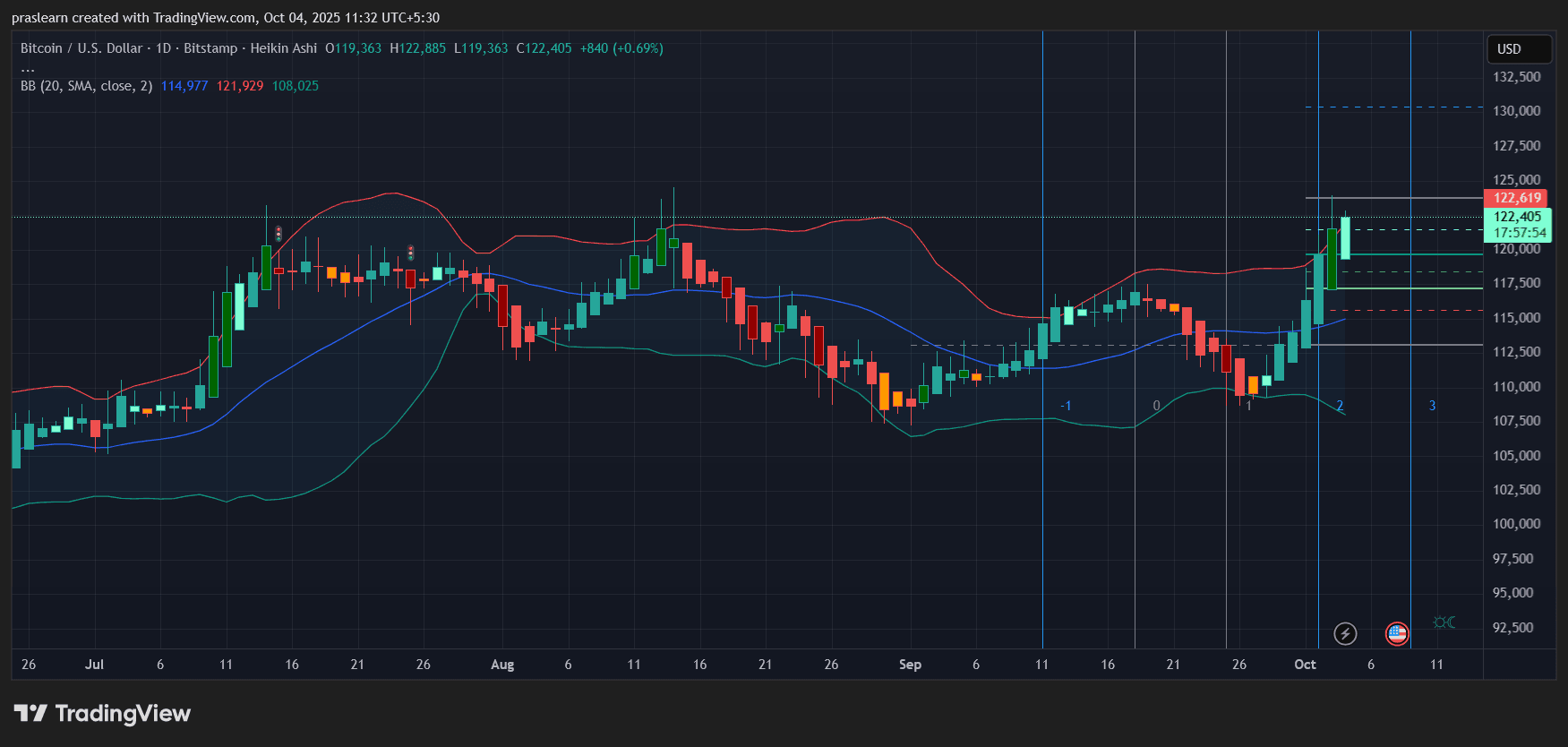

As global interest rates remain high in Western economies, fresh liquidity from China could indirectly support bullish sentiment in digital assets. And with BTC already showing signs of strength, some are calling for a run to $150,000 in the coming months.

Could Bitcoin Really Hit $150K?

While speculative, the idea of Bitcoin reaching $150,000 is not far-fetched to many market participants. Institutional adoption is growing, spot ETFs are thriving, and macroeconomic conditions—like liquidity injections from major central banks—could be the final catalyst.

Whether or not China’s liquidity directly impacts Bitcoin’s price, it clearly plays into the broader global risk asset narrative that continues to drive attention (and money) into crypto.