HBAR Price May Fail Breakout As Bitcoin Correlation Falls To 2-Month Low

Hedera’s HBAR is losing steam as its correlation with Bitcoin hits a two-month low. A drop below $0.219 could extend its bearish phase.

Hedera’s native token, HBAR, is struggling to maintain momentum after a recent rebound failed to generate meaningful gains.

Despite briefly attempting to break out of its downward pattern, weakening market conditions and its fading correlation with Bitcoin have raised concerns that the recovery may not hold.

Hedera Is Pulling Away From Bitcoin

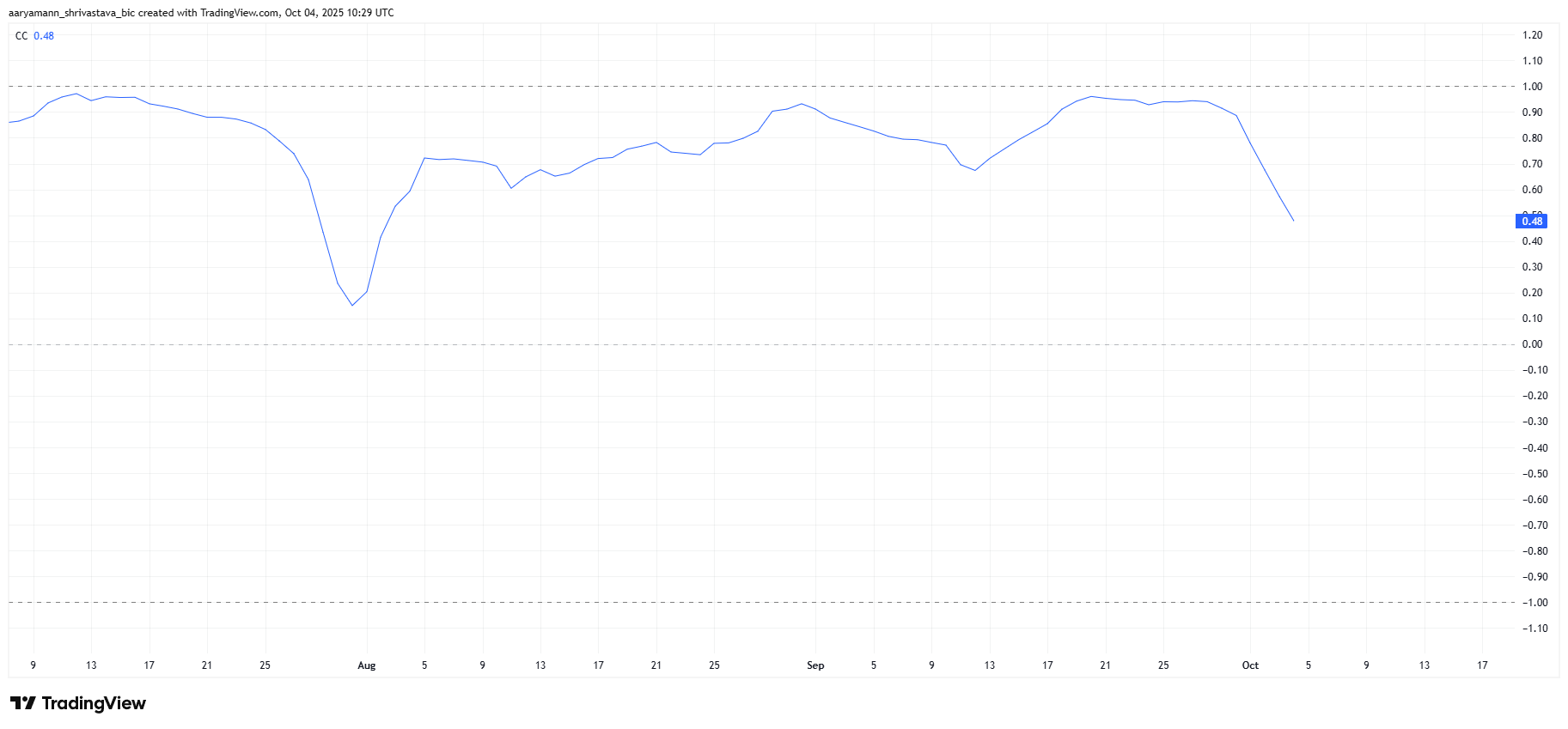

HBAR’s correlation with Bitcoin has slipped to 0.48, its lowest point in two months. This weakening connection signals that the altcoin is beginning to move independently from Bitcoin’s price action.

While independence can occasionally spark unique rallies, it often leaves smaller assets more vulnerable during volatile periods.

This divergence could hurt HBAR’s near-term outlook, especially as Bitcoin trades near $122,000 and inches closer to its all-time high.

Historically, altcoins have benefited from Bitcoin-led rallies, but a decoupling at this critical stage could mean HBAR misses out on the broader market upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Correlation To Bitcoin. Source:

TradingView

HBAR Correlation To Bitcoin. Source:

TradingView

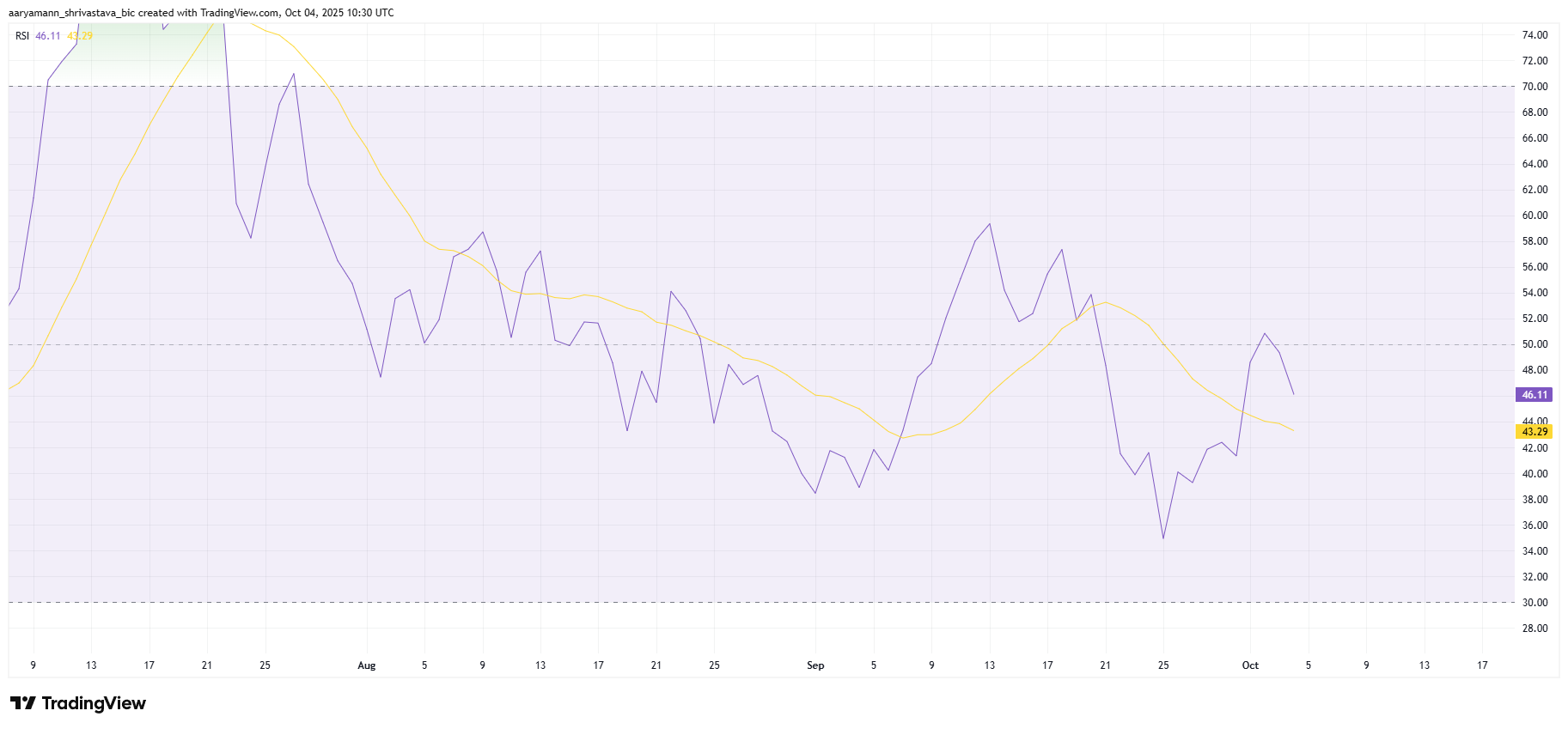

On the technical front, the Relative Strength Index (RSI) is struggling to stay above the neutral 50.0 mark.

A sustained rise past this level would indicate building bullish strength, but HBAR has so far failed to establish it as support. This shows lingering uncertainty among traders.

If the RSI drops further, it would push HBAR into bearish territory and limit any potential recovery attempts. The lack of strong buying momentum suggests that investors are hesitant to re-enter the market.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

HBAR Price May Pull Back

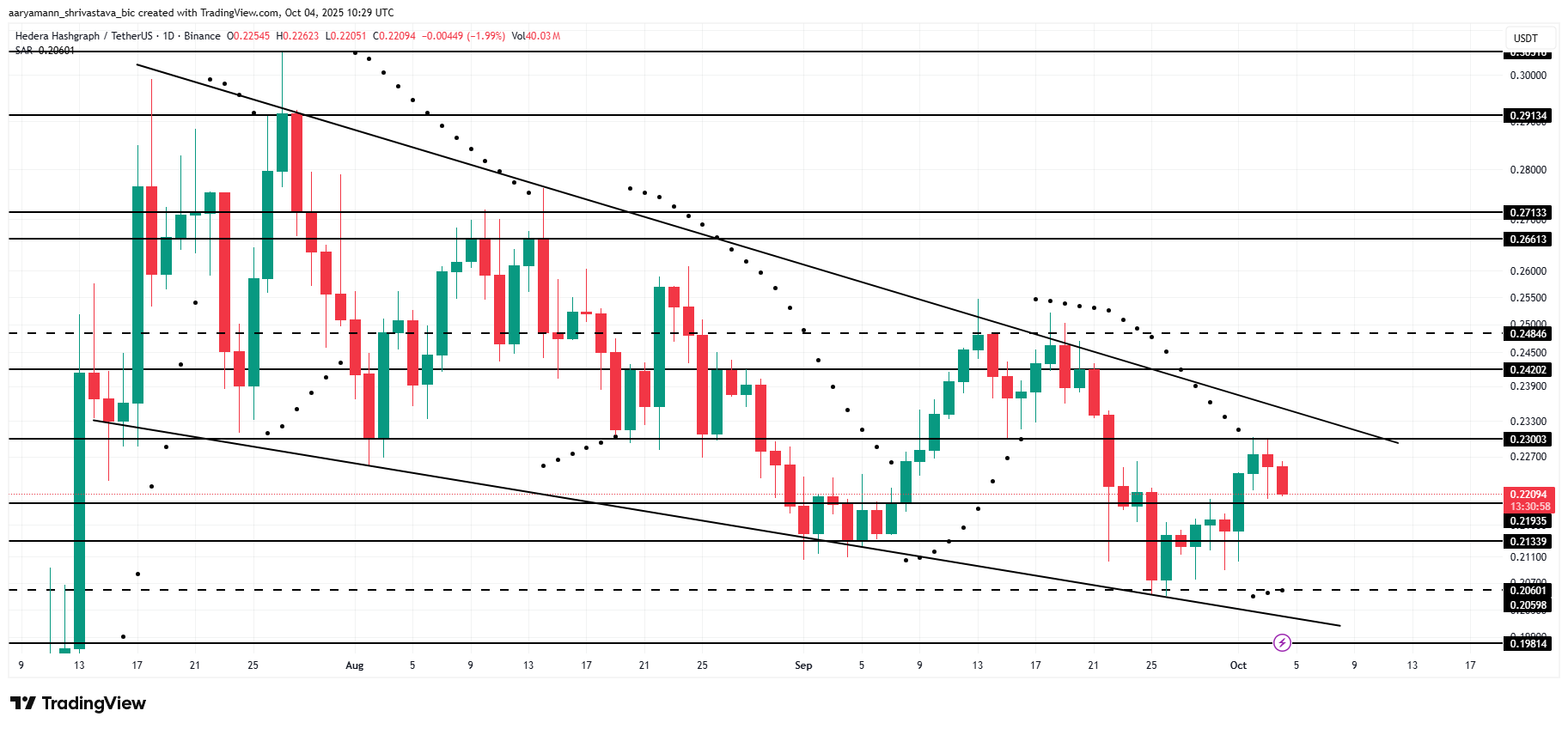

HBAR is trading at $0.220 at the time of writing, hovering just above the $0.219 support. The token recently attempted to break out of a descending wedge pattern.

However, it has struggled to sustain its upward momentum, leaving the breakout uncertain.

If bearish pressure intensifies, the failed breakout could lead HBAR to drop toward $0.206, testing the lower trend line as support. Such a decline would confirm a continuation of the current downtrend and extend the consolidation phase for the altcoin.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if bullish sentiment returns, HBAR could bounce off the $0.219 level and rally toward $0.230.

A move past this resistance would confirm a successful breakout, potentially pushing the price further to $0.242 and invalidating the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!