NFT sales double to $256m, Hypurrr tops the list

NFT sales volume more than doubled, surging by 103.11% to reach $256.9 million. This is a notable turnaround from last week’s $84.6 million in sales volume.

CryptoSlam data shows:

- The number of NFT buyers jumped by 18.25% to 694,348

- Sellers increased by 17.77% to 584,235.

- NFT transactions dipped by 8.67% to 1,874,619.

Bitcoin’s ( BTC ) rally to the $122,000 level has energized the entire crypto market. Ethereum ( ETH ) has followed suit, climbing to $4,500.

The global crypto market cap now stands at $4.2 trillion, up from last week’s $3.78 trillion. This bullish momentum has spilled over into the NFT sector, which has posted impressive gains.

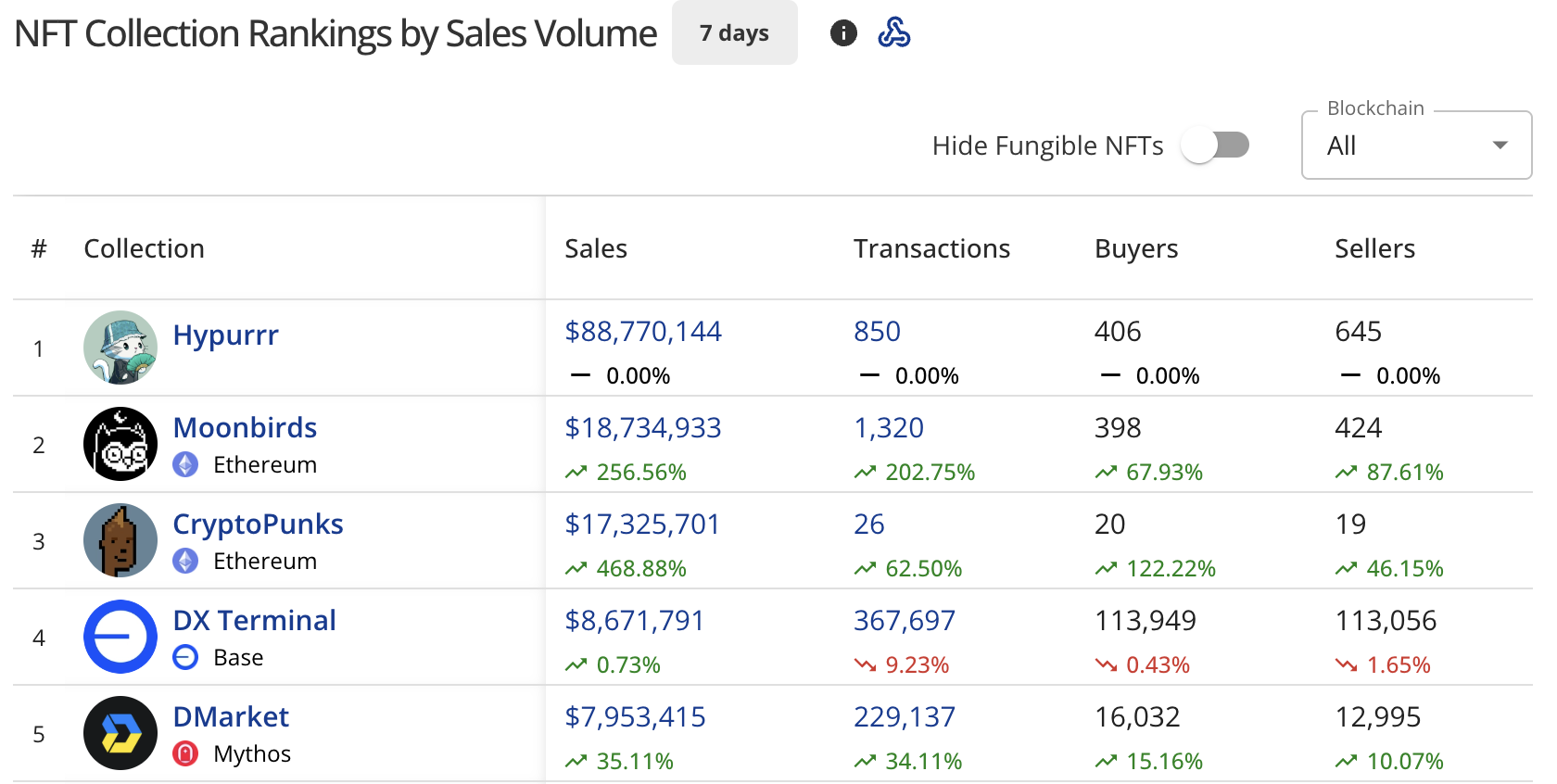

Hypurrr dominates NFT collections

The Hypurrr collection has emerged as the top performer this week, generating $88.77 million in sales across 850 transactions.

The collection attracted 406 buyers and 645 sellers. Hypurrr also dominated the top individual NFT sales, occupying four of the top five spots.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Moonbirds secured second place with $18.72 million in sales, posting a 254.57% increase. The Ethereum-based collection saw 1,319 transactions, with 398 buyers and 424 sellers participating.

CryptoPunks claimed third position at $17.33 million, recording a 468.88% surge. The collection had 26 transactions, with 20 buyers and 19 sellers.

DX Terminal on the Base blockchain came in fourth with $8.67 million in sales, up 0.73%. The collection processed 367,697 transactions and attracted 113,948 buyers.

DMarket rounded out the top five with $7.95 million in sales on the Mythos blockchain, up 34.95% from the previous week.

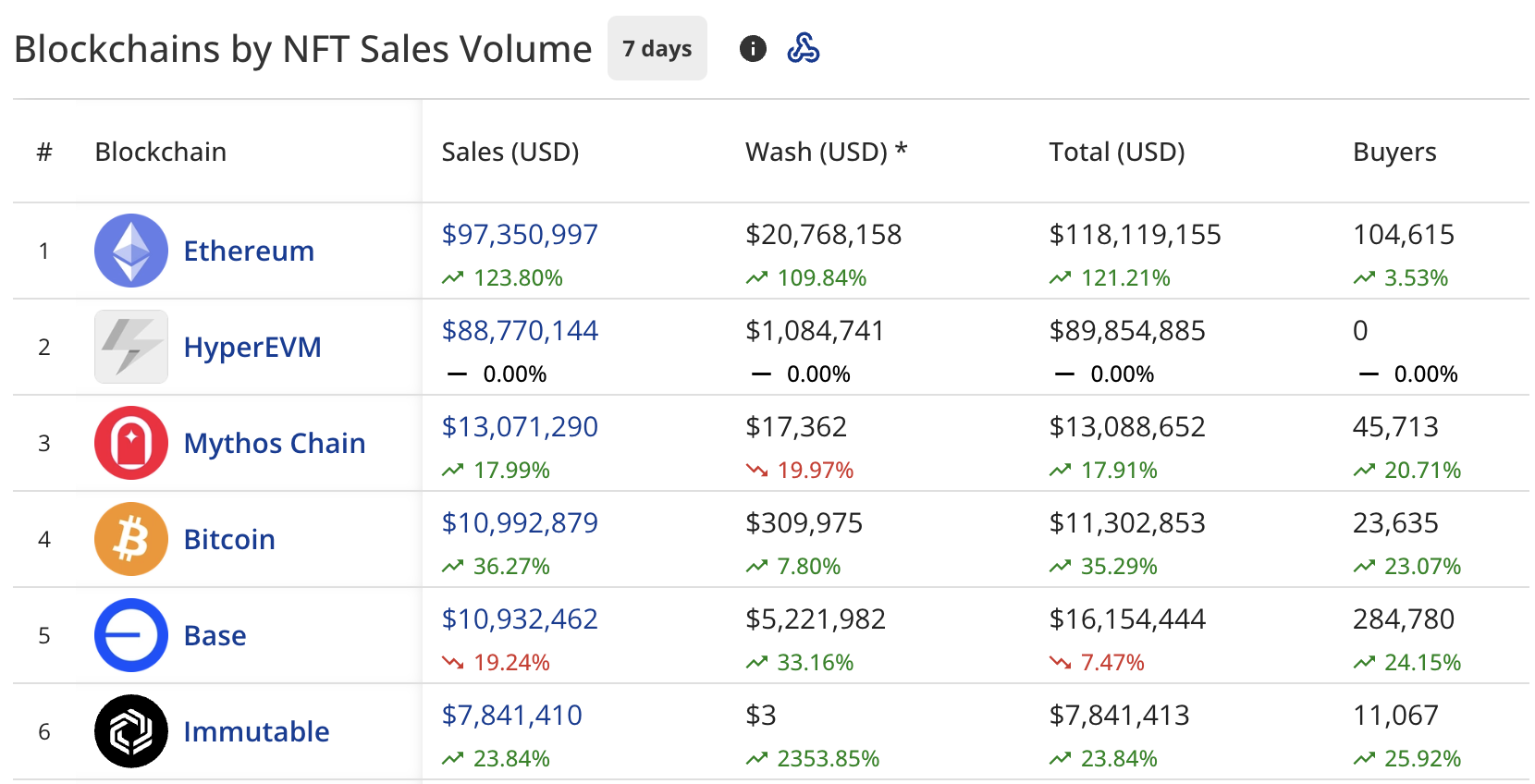

Ethereum leads blockchain rankings

Ethereum maintained its position as the leading blockchain for NFT sales, recording $97.4 million in volume, up 124.35% from last week’s $28.3 million.

The network processed wash trading worth $20.84 million, bringing its total to $118.24 million. The platform saw 104,625 buyers, up 3.55%.

HyperEVM took second place with $88.77 million in sales, driven entirely by the Hypurrr collection’s performance. Interestingly, the blockchain recorded zero buyers in the tracked period.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Mythos Chain ranked third with $13.07 million, up 17.69% from last week’s $10.9 million. The blockchain attracted 45,713 buyers, up 20.71%.

Bitcoin placed fourth at $10.97 million, which is a 36.20% increase from last week’s $14.12 million. The network saw 23,635 buyers, up 23.07%.

Base dropped to fifth position with $10.92 million, down 19.71% from the previous week. The blockchain had 284,780 buyers, up 24.15%.

Solana ( SOL ) landed in seventh place with $7.74 million, up 56.23% from last week’s $16.1 million. The blockchain recorded 56,811 buyers, up 18.33%.

Top individual sales

CryptoPunks #1563 led individual sales at $12.05 million (2745 ETH), sold two days ago.

Four Hypurrr NFTs followed:

- Hypurrr #3926 sold for $7.86 million

- Hypurrr #175 sold for $7.82 million

- Hypurrr #1131 sold for $7.63 million

- Hypurrr #3460 sold for $6.46 million

All four Hypurrr sales occurred five days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Latest ZK-Focused Statement and What It Means for Layer 2 Scaling

- Vitalik Buterin's ZKsync endorsement triggered a 143% $ZK token surge, redefining Ethereum's Layer 2 scalability with ZK technologies as the cornerstone. - ZKsync's Atlas upgrade achieved 43,000 TPS with sub-second finality, while Kohaku/Lighter frameworks reduced proof costs by 50x, accelerating industry-wide ZK adoption. - Institutional adoption (Deutsche Bank, Sony) and $28B+ TVL growth highlight ZK's market potential, with ZKP market projected to reach $7.59B by 2033 at 22.1% CAGR. - Zcash (ZEC) and

The Influence of ZKsync’s Vitalik-Endorsed Scaling Technology on Ethereum’s Prospective Supremacy

- Vitalik Buterin's 2025 endorsement of ZKsync positions zero-knowledge proofs as Ethereum's scalability solution, enhancing transaction throughput to 15,000 TPS with near-zero fees. - Institutional partnerships, including Deutsche Bank's DAMA 2 and Sony's supply chain solutions, demonstrate ZKsync's enterprise-grade scalability and RWA integration. - ZKsync's 43,000 TPS (post-Atlas) and $15B institutional capital outpace Arbitrum's 45% TVL, signaling a shift toward privacy-centric, enterprise-focused bloc

The Influence of Institutional Strategists on the Evolution of Long-Term Investment Patterns

- Thomas Sowell's analysis of market signals and decentralized systems shapes institutional investors' strategies to avoid policy-distorted markets. - His critiques of rent control and centralized interventions inform avoidance of regulated real estate and subsidy-dependent sectors like renewables. - The Hoover Institution amplifies Sowellian principles through data-driven policy advocacy, aligning with conservative investment frameworks prioritizing market-tested solutions. - While direct case studies are

ASTER Trades at $0.9562 After Trend Line Break Signals Stronger Momentum