XRP is trading near $3.00 after a double-bottom breakout but rejection at $3.10 created short-term pressure; holding $3.00 is critical for further gains while failure risks a pullback toward $2.90–$2.80. Institutional ETF flows are supporting the outlook.

-

XRP near $3.00: $3.00 is the pivot; $3.10 acted as resistance.

-

ETF progress and institutional demand—XRPR ETF holds $77.6M—are lifting sentiment.

-

Technicals: price above the 1W 50 EMA ($2.77) with weekly gains of 7.6%.

XRP price near $3.00 after $3.10 rejection; watch the $3.00 pivot for confirmation. Read the latest technicals, ETF updates, and market targets.

How is XRP trading after the $3.10 rejection?

XRP price is trading near $3.00 after a double-bottom breakout that met resistance at $3.10. The $3.00 level now acts as a short-term pivot: a sustained hold supports targets at $3.30–$3.50, while a break risks movement toward $2.90–$2.80.

Why did XRP reject at $3.10 and what does technical analysis show?

Price action shows a clear double-bottom that pushed XRP above $3.00, then encountered selling pressure near $3.10. Short-term indicators remain constructive: the 1W 50 EMA sits at $2.77, and weekly RSI near 54 is neutral, allowing upside if volume rises.

$XRP formed a double bottom before climbing higher, but is now facing rejection near $3.10.

The market is attempting a pullback around the $3.00 zone, and price action here will decide whether bulls regain control or sellers push it lower. pic.twitter.com/9W0xKEXayC

— BitGuru 🔶 (@bitgu_ru) October 3, 2025

Analysts at BitGuru noted that “price action around the $3.00 zone will decide whether bulls regain control or sellers push it lower.” Despite the pullback, higher lows indicate steady accumulation and room for continuation if buying volume increases.

Source: Coingecko

Source: Coingecko

Market data from Coingecko shows XRP trading at $3.00 after weekly gains of 7.6%, with a 24-hour range of $2.99–$3.09. Market cap is near $179 billion and 24‑hour volume is approximately $5.43 billion, underscoring sustained liquidity and interest.

What ETF developments are influencing XRP sentiment?

Recent ETF progress has improved macro sentiment for XRP and altcoins broadly. Multiple spot XRP ETF filings are under review, and the newly launched XRPR ETF holds $77.6 million in assets, signaling early institutional participation. These flows are a primary tailwind for price discovery.

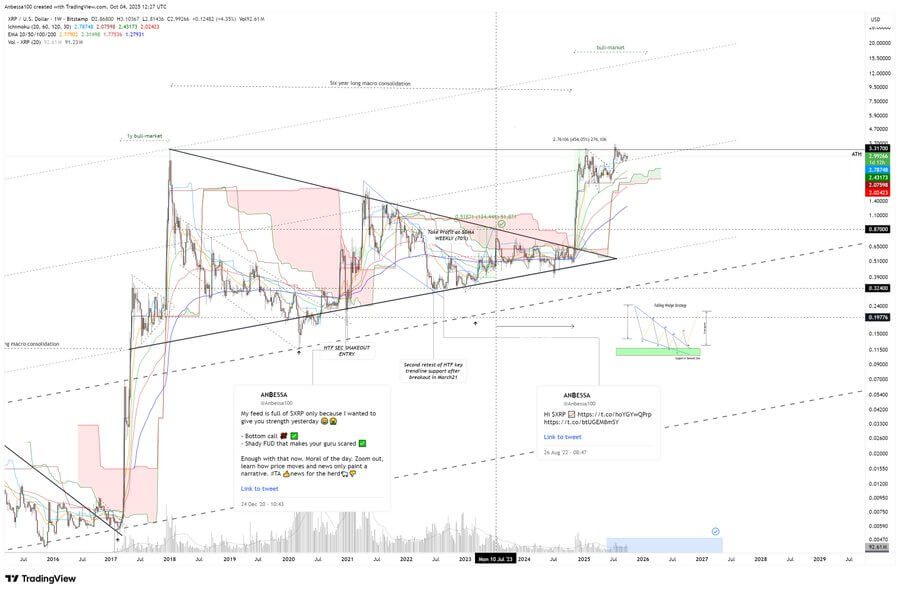

Source: Annbessa (X)

Source: Annbessa (X)

On-chain observers note XRP remains above the one-week 50 EMA at $2.77 after a prolonged consolidation that preceded the 2024 breakout. With Bitcoin trading above $123,000, altcoin rotation has favored XRP’s short-term momentum.

Frequently Asked Questions

What are the immediate support and resistance levels for XRP?

Immediate resistance sits at $3.10; support levels to watch are $3.00 (pivot), $2.90, and $2.80. Maintaining $3.00 is critical for a push toward $3.30–$3.50.

How much institutional interest is there in XRP ETFs?

Early ETF adoption is measurable: the XRPR ETF holds $77.6 million in assets, suggesting growing institutional allocation to XRP via spot ETF exposure.

Key Takeaways

- Pivot level: $3.00 is decisive for next directional move.

- ETF tailwinds: XRPR ETF assets ($77.6M) show institutional demand forming.

- Technical bias: Weekly structure remains bullish above 1W 50 EMA ($2.77); watch volume for confirmation.

Conclusion

XRP price sits at a short-term crossroads: the $3.00 pivot and $3.10 resistance will shape whether the market resumes an upward trajectory toward $3.30–$3.50 or consolidates near lower supports. Continued ETF inflows and improving technicals support a constructive outlook; traders should monitor volume and weekly EMA for confirmation.