Solana is emerging as Wall Street’s preferred blockchain for stablecoins and tokenization because its high throughput, sub-millisecond finality and faster settlement make it more attractive for institutional trading and ETF operations compared with alternatives.

-

Speed and finality: Sub-millisecond settlement makes Solana appealing to institutional traders.

-

Stablecoin supply on Solana is growing but remains far smaller than Ethereum’s on-chain stablecoin value.

-

Bitwise has launched a physical Solana ETP and awaits SEC decision on a spot Solana ETF (decision due Oct. 16, 2025).

Meta description: Solana Wall Street: Solana’s speed and finality make it a top choice for stablecoins and tokenization—read Bitwise’s take and ETF update. Learn more.

Bitwise’s Matt Hougan said Solana’s speed and finality make it Wall Street’s top choice for stablecoins and tokenization despite Ethereum’s dominance.

Summary: Chief Investment Officer Matt Hougan of Bitwise told Solana Labs that institutional investors favor blockchains with rapid finality and high throughput. Hougan said Solana’s settlement speed improvements and low-latency confirmations make it particularly suited for stablecoin issuance and real-world-asset tokenization.

Speaking on Oct. 2 with Solana Labs’ Akshay Rajan, Hougan emphasized that Wall Street audiences find Bitcoin’s role in institutional portfolios “hard to get their heads around,” while stablecoins and tokenized assets present clear, actionable opportunities.

Source: Matt Hougan

What is the institutional case for Solana?

The institutional case for Solana centers on ultra-low latency, predictable finality and throughput that support high-frequency settlement needs. Financial firms prioritize networks where settlement times and unstaking windows align with fund liquidity and ETF redemption mechanics.

How does Solana’s settlement speed compare?

Solana’s settlement latency has improved from around 400 microseconds to about 150 microseconds according to industry reporting. Those microsecond-level gains reduce execution uncertainty and are attractive to asset managers designing tokenized securities or stablecoin rails.

Why are stablecoins and tokenization important to institutions?

Stablecoins enable near-instant transfers and programmable money rails, while tokenization converts stocks, bonds and real estate into tradable digital assets. Institutions see both as tools to streamline settlement, increase market access and reduce processing friction.

How big is Solana’s stablecoin market?

Solana’s on-chain stablecoin supply is reported at $13.9 billion, representing roughly 4.7% market share in stablecoin tokenization. By contrast, Ethereum holds approximately $172.5 billion on-chain in stablecoins, roughly 59% market share; layer-2 networks raise Ethereum’s share further when included.

What do industry leaders say?

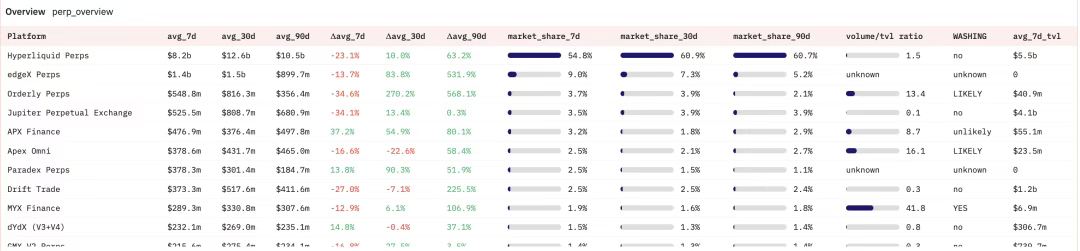

Industry figures note that total value locked (TVL) is only one metric. Some strategists recommend the EVM ecosystem for issuing new stablecoins due to tooling and interoperability, while others stress Solana’s performance and evolving custody solutions as differentiators for institutional use cases.

What is Bitwise’s current exposure to Solana?

Bitwise offers the Bitwise Physical Solana ETP, a fully backed product that provides institutional-grade custody for SOL exposure. The ETP has attracted modest assets relative to BTC and ETH products, with roughly $30 million in assets under management at the most recent reporting.

When will regulators decide on a spot Solana ETF?

The SEC’s decision on Bitwise’s spot Solana ETF is scheduled for Oct. 16, 2025. Approval would create a new regulated vehicle for institutional and retail investors to access SOL under a familiar fund wrapper.

Frequently Asked Questions

Can Solana replace Ethereum for stablecoins?

Solana offers performance advantages that appeal to certain institutional workflows, but Ethereum currently leads in on-chain stablecoin volume and developer tooling. Adoption will depend on liquidity, regulatory clarity and custody infrastructure.

Is Solana suitable for tokenizing real-world assets?

Yes — tokenization use cases require speed, throughput and secure custody. Solana’s performance profile aligns with these needs, while issuers must also consider legal frameworks and interoperability.

Key Takeaways

- Performance matters: Solana’s low-latency finality aligns with institutional trading requirements.

- Market share gap: Ethereum currently dominates stablecoin on-chain value, though Solana’s share is rising.

- ETF watch: Bitwise’s spot Solana ETF decision (Oct. 16, 2025) could materially affect institutional access to SOL.

Conclusion

Solana’s technical strengths—speed, throughput and rapid finality—are driving renewed institutional interest in stablecoins and tokenized assets. Bitwise’s public endorsements and product launches underscore that trend, while Ethereum remains the dominant settlement layer today. Market participants will watch custody infrastructure, liquidity and the pending SEC decision to gauge whether Solana can capture meaningful institutional share.