MNT Hits All-Time High as Trump-Linked Stablecoin Boosts Mantle Liquidity

MNT surges to new highs as the $3 billion USD1 stablecoin deployment fuels Mantle Network liquidity and demand. Technicals and on-chain metrics suggest the rally has strong fundamentals.

MNT, the native token that powers the modular Layer-2 (L2) network Mantle, has emerged as today’s top-performing altcoin. Its value has soared over 7% today, even as the new trading week kicks off on a lackluster note across the broader crypto market.

Fueled by the recent deployment of World Liberty Financial’s USD1 stablecoin on the Mantle network, the rally has pushed MNT to a new all-time high. Now, the altcoin is ready to extend its gains.

Trump-Linked Stablecoin Sparks Mantle Liquidity Boom

Last week, Donald Trump-backed World Liberty Financial announced the deployment of the protocol’s $3 billion USD1 stablecoin on the Mantle network.

This integration has increased Mantle’s stablecoin market capitalization by 1% over the past week, deepening on-chain liquidity. According to data from DefiLlama, this stands at $738 million at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Mantle Network Stablecoin Market Cap. Source:

Stablecoins provide blockchain networks with a stable medium of exchange for transactions. Therefore, when their supply grows, it signals increasing confidence from users. This, in turn, drives up the price of the network’s native token, as higher liquidity allows users to transact more frequently and use the token to facilitate those transactions.

Mantle Network Stablecoin Market Cap. Source:

Stablecoins provide blockchain networks with a stable medium of exchange for transactions. Therefore, when their supply grows, it signals increasing confidence from users. This, in turn, drives up the price of the network’s native token, as higher liquidity allows users to transact more frequently and use the token to facilitate those transactions.

As on-chain activity deepens, demand for MNT will likely strengthen, supporting the potential for a continued price rally in the short term.

Furthermore, the positive readings from MNT’s price daily active address (DAA) divergence confirm the uptick in the altcoin’s demand, adding to this bullish outlook. This metric, which compares an asset’s price movements with the changes in its number of daily active addresses, is at 94.47%.

MNT Price DAA Divergence. Source:

MNT Price DAA Divergence. Source:

A price rally accompanied by a positive DAA divergence is a bullish signal, suggesting growing interest and potential for further price appreciation.

The trend suggests that MNT’s currency rally is not speculative noise but backed by genuine user demand and network activity.

MNT Trades in Bullish Formation

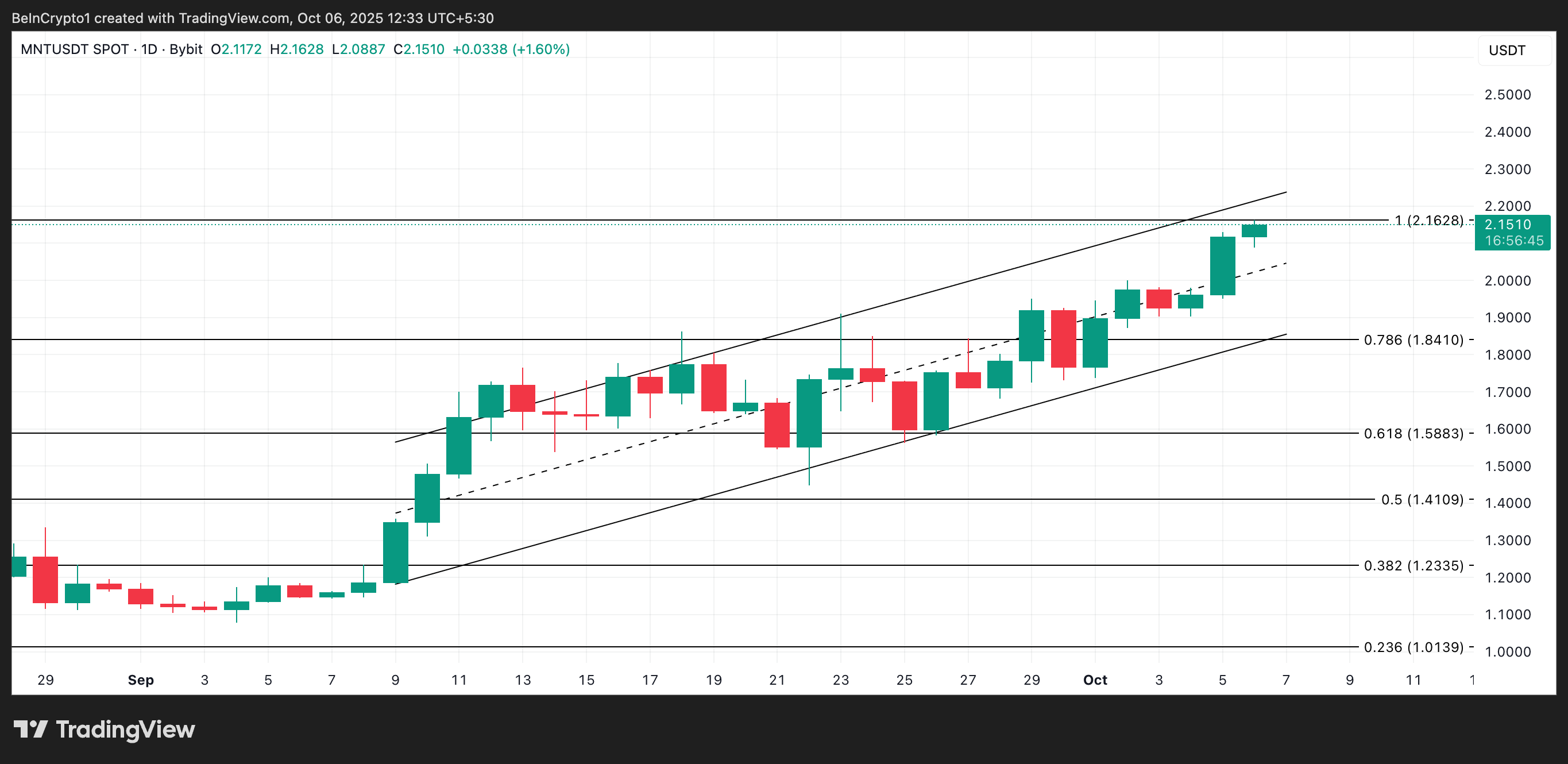

On the daily chart, MNT has traded within an ascending parallel channel since September 6, highlighting the steady rise in buy-side pressure in the market.

This pattern is formed when an asset’s price moves consistently between two upward-sloping trendlines — one acting as support and the other as resistance.

The formation of this channel indicates that MNT has been climbing in a well-defined uptrend, with each pullback attracting renewed demand over the past few sessions. If demand remains, the token could break above this pattern and stretch to fresh highs in the coming sessions.

MNT Price Analysis. Source:

MNT Price Analysis. Source:

However, MNT’s price could slip under $2 to reach $1.84 if profit-taking commences.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin breaks above $125,000 as shutdown fears brings Crypto safe-haven demand

Grayscale Launches US Crypto ETPs With Ethereum and Solana

Quick Take Summary is AI generated, newsroom reviewed. Grayscale launched the first US spot crypto ETPs with staking for Ethereum (ETH) and Solana (SOL). The products combine regulated crypto exposure with staking rewards, appealing to both retail and institutional investors. The products combine regulated crypto exposure with staking rewards, appealing to both retail and institutional investors1qqReferences 🚨BREAKING: Grayscale just launched the first-ever US spot crypto ETPs with staking for $ETH and $S

Bitcoin Tops $3.55B Inflows as Crypto Funds See $5.95B Week

Quick Take Summary is AI generated, newsroom reviewed. Digital asset investment products recorded a historical high of $5.95 billion in a single week. Bitcoin dominated the rally with a record $3.55 billion inflow, pushing its assets under management to $195 billion. Ethereum, Solana, and XRP also saw strong demand, with the US leading regional inflows at $5 billion. The surge reflects renewed institutional and retail confidence, diversifying capital into top-tier crypto assets.References According to Coin

CME Group announces 24/7 crypto derivatives trading starting in 2026