Bitcoin Rally Flashes Red Flags: New Highs, But Fewer Hands Are Holding the Rally

Bitcoin’s surge to new highs masks weakening fundamentals as user activity drops and open interest spikes. Analysts warn that limited participation could trigger a sharp correction if sentiment shifts.

Bitcoin’s recent climb to new all-time highs might not be as strong as it looks. A new report has revealed that while BTC’s price has surged, the number of active addresses on its network has dropped. This signals a negative divergence between the coin’s market price and on-chain activity.

The weak participation puts a potential decline back to the $120,000 price region on the table.

Bitcoin Runs, But Network Activity Signals Trouble Ahead

In a new report, pseudonymous CryptoQuant analyst CryptoOnchain notes that BTC’s rally to a new all-time high of $125,708 appears to be driven less by broad market enthusiasm and more by speculative trading activity.

The analyst examined user activity on the Bitcoin network and found a “negative divergence between the price and the number of active network addresses.”

According to the report, while the king coin’s price has climbed, the daily count of its active wallet addresses (14-day moving average) “is approaching its lowest level since April 2020.”

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

BTC Network Address. Source:

CryptoQuant

BTC Network Address. Source:

CryptoQuant

Commenting on what this means for the coin, the analyst writes:

“Traditionally, a sustainable price increase should be accompanied by a rise in network activity, as it indicates the influx of new users and organic demand. A decline in this metric while the price is rising could suggest that the recent rally is driven more by derivatives trading, financial leverage, and the activity of a small group of large players, rather than widespread public participation.”

This means that while BTC prices are breaking new highs, fewer unique users are actually transacting on-chain, a sign of an unstable bull run. The current trend increases the risk of a sharp pullback if market sentiment shifts.

High Leverage in Bitcoin Futures Sparks Concerns

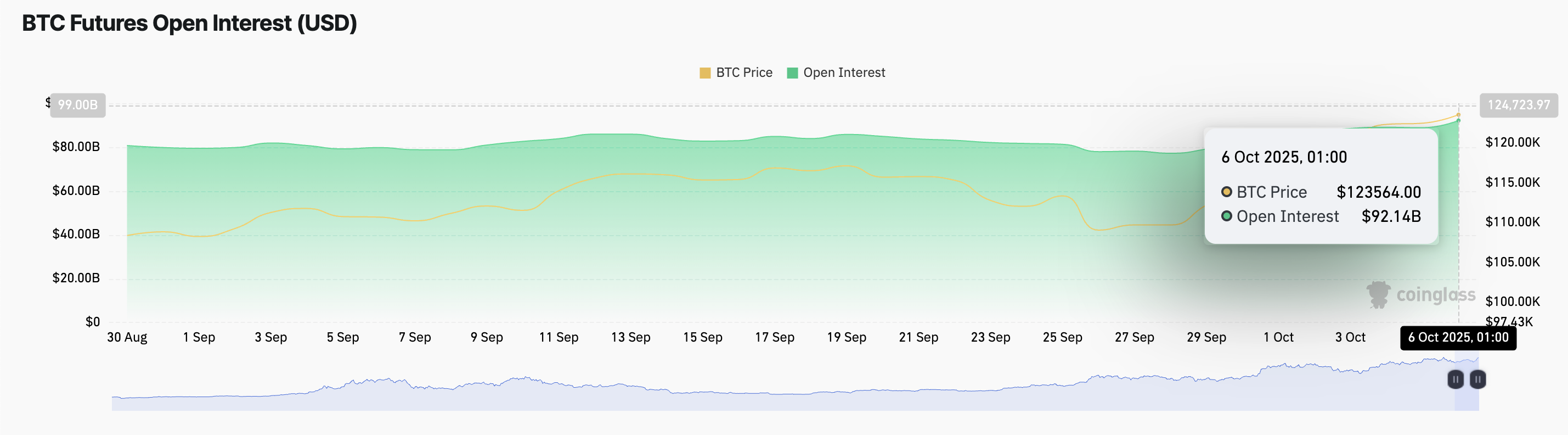

The uptick in BTC’s futures open interest also confirms this bearish outlook. According to Coinglass, this currently sits at a year-to-date high of $92.14 billion, climbing 10% since October 1.

BTC Futures Open Interest. Source:

Coinglass

BTC Futures Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding futures or options contracts that have not yet been settled or closed.

Historically, a rapid increase in futures open interest during a price rally has been linked to overheated markets. When too many traders enter with high leverage, even minor liquidations can trigger steep corrections, putting BTC at risk of a pullback.

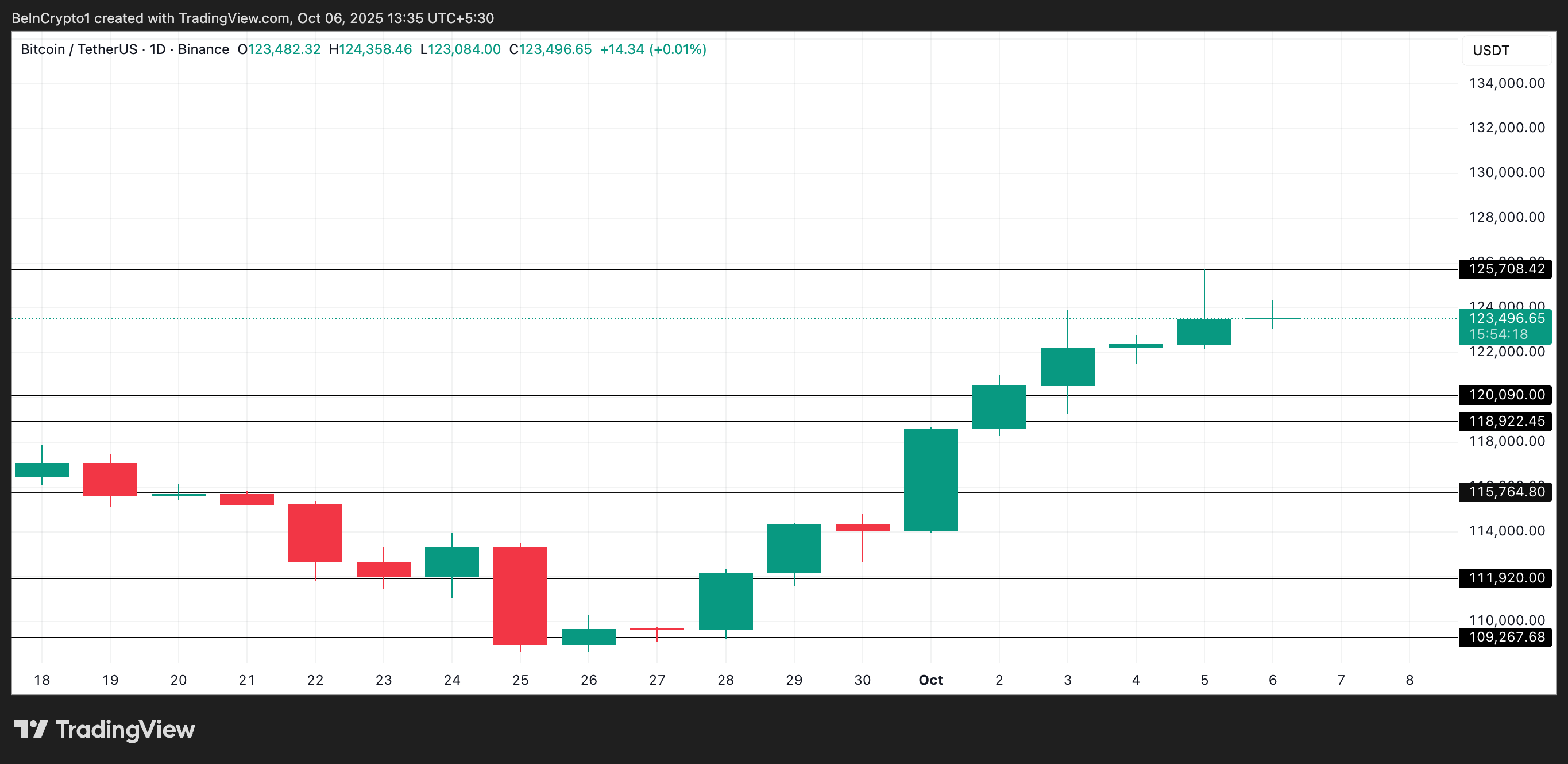

Strong Rally, But Will $120,000 Hold?

According to CryptoOnchain, this current trend is a “warning.”

“If network activity fails to grow in tandem with the price, it is likely that the price lacks strong fundamental support to maintain its current levels, and the risk of a local price correction increases,” the analyst added.

In this scenario, the coin could revisit $120,090 if the underlying demand continues to fall.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, an uptick in user participation on the Bitcoin network would invalidate this bearish projection. If new buyers enter the market, they could push BTC to revisit its all-time high and attempt a break above it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin breaks above $125,000 as shutdown fears brings Crypto safe-haven demand

Grayscale Launches US Crypto ETPs With Ethereum and Solana

Quick Take Summary is AI generated, newsroom reviewed. Grayscale launched the first US spot crypto ETPs with staking for Ethereum (ETH) and Solana (SOL). The products combine regulated crypto exposure with staking rewards, appealing to both retail and institutional investors. The products combine regulated crypto exposure with staking rewards, appealing to both retail and institutional investors1qqReferences 🚨BREAKING: Grayscale just launched the first-ever US spot crypto ETPs with staking for $ETH and $S

Bitcoin Tops $3.55B Inflows as Crypto Funds See $5.95B Week

Quick Take Summary is AI generated, newsroom reviewed. Digital asset investment products recorded a historical high of $5.95 billion in a single week. Bitcoin dominated the rally with a record $3.55 billion inflow, pushing its assets under management to $195 billion. Ethereum, Solana, and XRP also saw strong demand, with the US leading regional inflows at $5 billion. The surge reflects renewed institutional and retail confidence, diversifying capital into top-tier crypto assets.References According to Coin

CME Group announces 24/7 crypto derivatives trading starting in 2026