Bitcoin has quietly reached $125,000.

Original | Odaily

Author | Dingdang

Original Title: $125,000 per coin! Bitcoin Wants to Break Every Ceiling

Bitcoin has once again reached a historic peak.

The BTC price has broken through $125,000, setting a new all-time high. According to OKX market data, the current price is reported at $125,277. With this breakthrough, Bitcoin’s market capitalization has surpassed Amazon, reaching $2.49 trillions, ranking 7th among global assets by market cap.

Among the “Big Four,” BNB also hit a new all-time high, peaking at $1,192 before retreating to $1,179. ETH rebounded to $4,553, and SOL recovered to $232.

In derivatives, data shows that in the past 24 hours, a total of 112,700 people were liquidated globally, with total liquidations amounting to $256 million. Long positions accounted for $117 million, while short positions accounted for $139 million, indicating that both sides suffered losses and the new high caught many off guard. Of this, BTC liquidations alone reached $72.47 million, accounting for 28%. The largest single liquidation occurred on Bybit – BTCUSDT, valued at $3.1153 million.

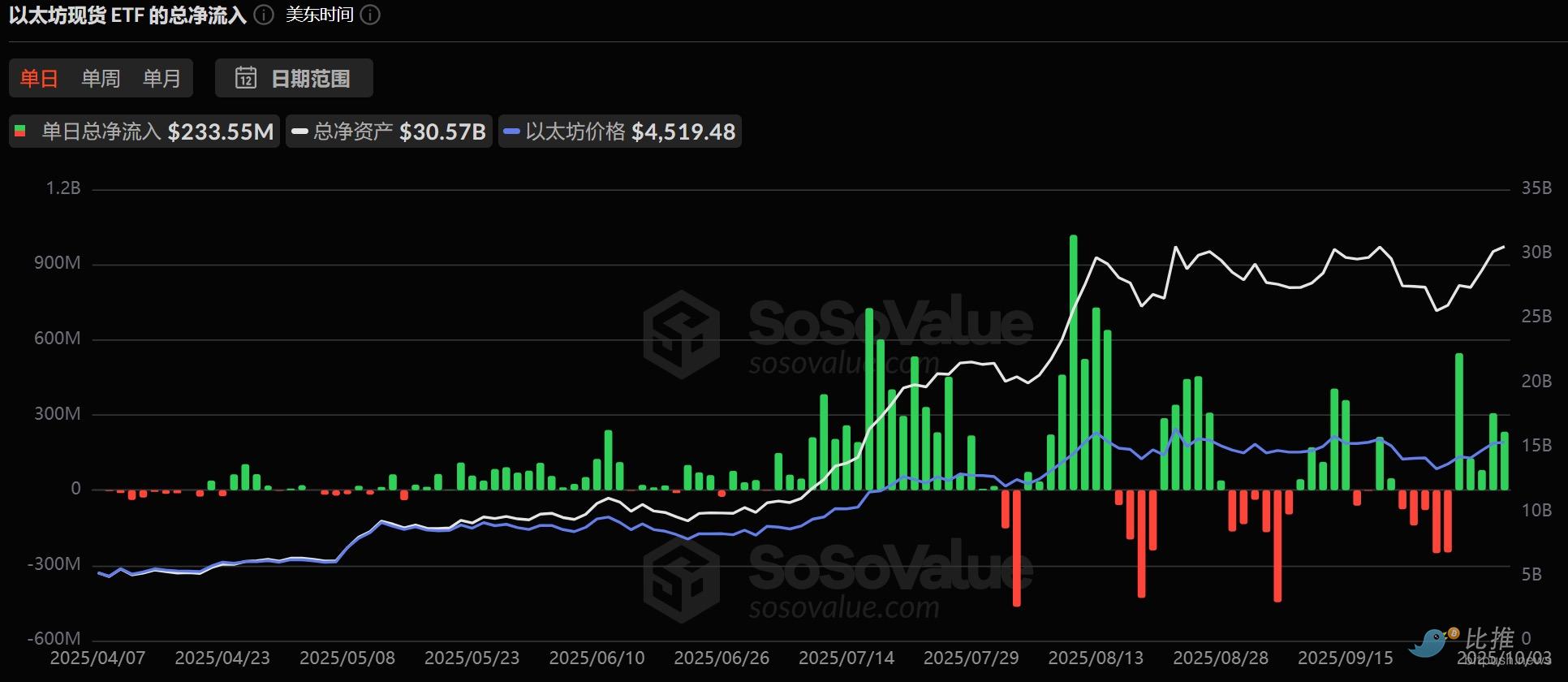

In terms of capital flows, data shows that BTC spot ETFs have seen net inflows for a consecutive week, with the scale of inflows continuing to expand. On October 3, the single-day net inflow reached $985 million, becoming a major driver for BTC’s new highs. ETH spot ETFs have also recorded net inflows for a week, but the momentum is slowing down.

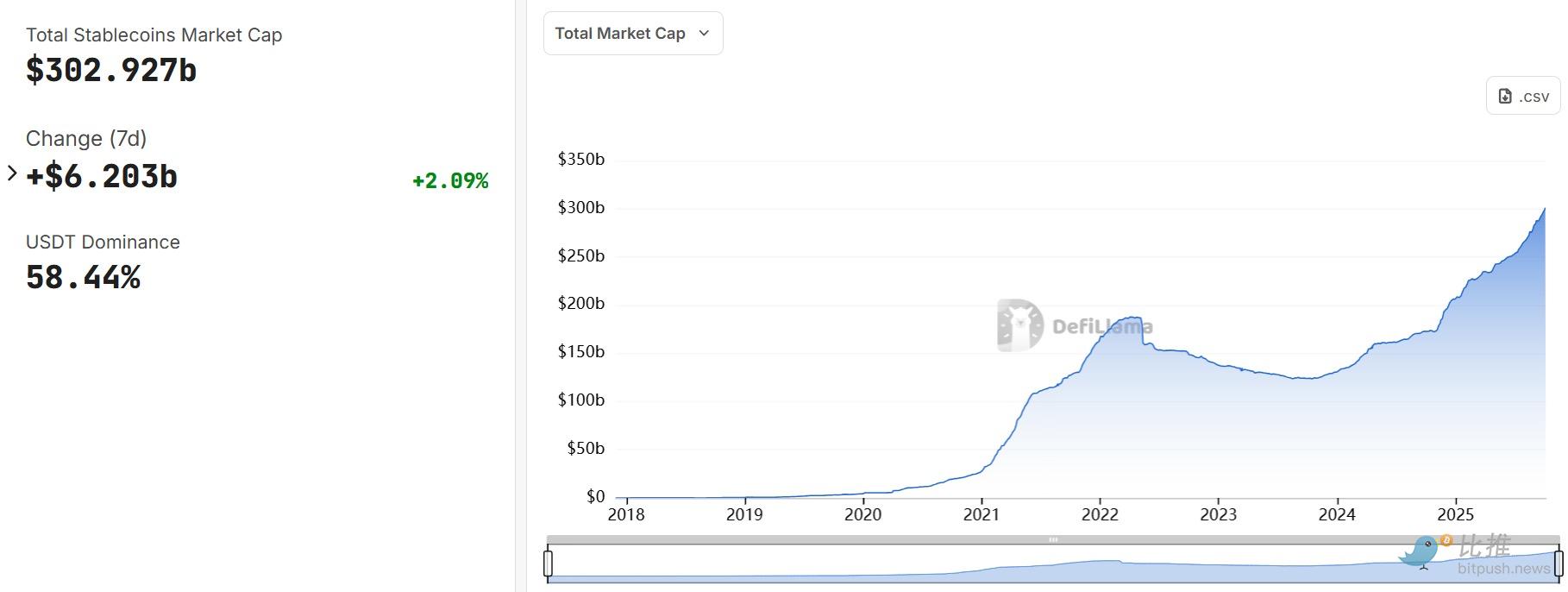

According to data, the total market capitalization of stablecoins has surpassed $300 billions, setting a new record high.

Macro: U.S. Government Shutdown

On October 1, the U.S. federal government officially entered a shutdown as Congress failed to pass the 2026 fiscal year funding bill, causing federal spending authority to expire at midnight. However, this is not the first time the federal government has experienced a shutdown.

President Trump stated that a shutdown “may be inevitable,” which will affect millions of federal employees and multiple government services. However, historical performance shows that the impact on the crypto market is usually only a short-term disturbance and does not reverse long-term trends.

Below is historical data for reference:

U.S. Treasury options pricing indicates that the government shutdown starting October 1 will last at least 10 days, with a maximum duration of up to 29 days. Due to the shutdown, the U.S. September non-farm payroll report was not released as scheduled.

In an interview, U.S. President Trump said he is considering distributing part of the tariff revenue directly to the public in the form of “dividends,” with a maximum amount of $2,000 per person. Some believe this move is similar to the pandemic stimulus checks of 2020-2021 and could bring new liquidity to the crypto market, potentially reviving the altcoin market.

Market Views

Jia Yueting: Loosening CAMT Rules Is a Huge Positive for Companies with Treasuries

Faraday Future founder Jia Yueting has recently commented frequently on crypto hot topics, stating: “The crypto market’s surge was triggered by the U.S. Treasury’s plan to loosen CAMT (Corporate Alternative Minimum Tax) rules, no longer taxing unrealized Bitcoin gains held by companies like MicroStrategy at 15%. Previously, accounting standards based on market value meant unrealized profits were also taxed, leading to protests from MSTR, COIN, and others, who argued it was unfair and detrimental to global competitiveness. For companies with treasuries, this is a huge positive. Long-term holding of crypto assets as a store of value and a hedge against fiat depreciation is now receiving regulatory acquiescence and support. This will fundamentally change the asset allocation logic of large institutions.”

Caixin: This U.S. Government Shutdown May Have a Greater Impact Than Before, BTC and ETH Surge Shows Market Anxiety

Caixin’s analysis points out that since 1981, there have been 14 U.S. federal government shutdowns, most lasting one to two days. However, due to Trump’s reciprocal tariffs and disputes with Federal Reserve Chairman Powell, this shutdown may have a greater impact than previous ones. When the shutdown was confirmed in the early hours of October 1, spot gold and December futures prices both hit record highs of $3,862 and $3,903 per ounce, respectively; Bitcoin and Ethereum also surged, indicating market anxiety and a strong desire for safe havens.

Standard Chartered: Bitcoin May Hit a New All-Time High Next Week, and Could Rise to $135,000

Geoff Kendrick, Head of Global Digital Asset Research at Standard Chartered, stated in his latest report that Bitcoin may hit a new all-time high next week and could further rise to $135,000. Yesterday, Bitcoin broke through $121,000, continuing the fourth quarter “Uptober” rally. Kendrick noted that Bitcoin’s performance has broken the old pattern of “price declines 18 months after halving.” It was expected to enter a weak period after the April 2024 halving, but the actual performance has been much stronger.

JPMorgan: Based on Gold’s Record Gains, Bitcoin Could Rise to $165,000

JPMorgan analysts predict that by the end of 2025, Bitcoin’s price could reach $165,000, citing that Bitcoin is undervalued compared to gold and that ETF inflows continue to increase.

Conclusion

Bitcoin’s return to $120,000 is not just a numerical milestone, but also a revival of confidence.

Legendary trader Eugene said that Bitcoin’s new highs will break all limits. Whether you are bullish or not, if you want to continue the “easy money mode,” this is the scenario you want to see.

However, it should be noted that a reversal in sentiment does not mean risk has disappeared. Caution and rationality are still needed in capital operations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gold and Bitcoin both hit record highs as the U.S. government shutdown fuels "dollar depreciation trades"

Stimulated by the potential U.S. government shutdown, market concerns over U.S. fiscal issues and the depreciation of the dollar have intensified, driving gold and bitcoin prices to repeatedly reach new highs. Gold has surpassed $3,900 per ounce, and bitcoin has exceeded $125,000. The U.S. Dollar Index has fallen by about 10% so far this year. Analysts believe that, driven by structural factors such as persistent inflation and high deficits, this trend still has room for further growth.

Astronomer’s $125K Bitcoin Take Profit Could Signal Renewed Momentum and Potential Move Toward $150K

Solana (SOL) Spikes Higher – Bulls Tighten Grip As Market Heats Up Again