Bitcoin Production in September Softens Amid Rising Difficulty — MARA Maintains Lead

September’s surge in Bitcoin mining difficulty squeezed profits across the sector, yet Marathon Digital (MARA) maintained its production lead. With efficiency now defining success, smaller miners face a challenging path amid rising costs and shrinking rewards.

Competition in the Bitcoin mining sector intensified in September 2025 as mining difficulty reached new all-time highs, while production across most major miners declined.

Large-scale companies with strong balance sheets and accumulation strategies continued to thrive in this environment, whereas smaller miners faced growing pressure from operational costs and technical volatility.

Bitcoin Production Declines as Difficulty Rises

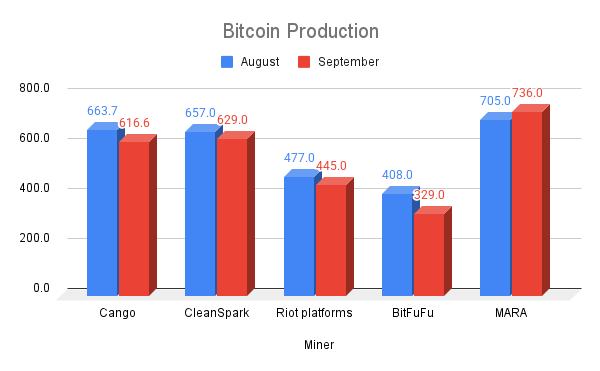

According to publicly released reports, Cango mined around 616 BTC in September, down from 663 BTC in August.

CleanSpark produced 629 BTC, a slight dip from the previous month. Riot Platforms generated 445 BTC, compared to 477 BTC in August. BitFuFu’s output dropped sharply to 329 BTC, while Marathon Digital Holdings (MARA) maintained its lead with 736 BTC mined, further expanding its Bitcoin reserves.

Bitcoin production by major mining companies. Source: BeInCrypto

Bitcoin production by major mining companies. Source: BeInCrypto

The data suggests that while larger miners managed to keep their production relatively stable, smaller operators began to feel the strain from rising difficulty and energy costs.

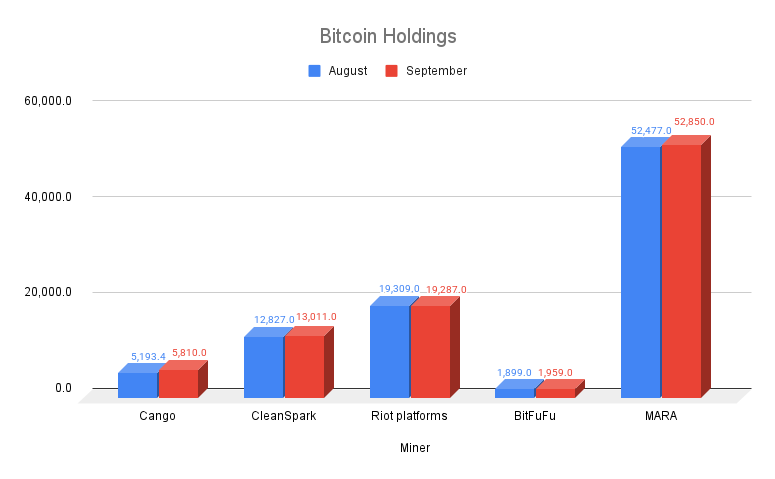

BTC holdings of selected companies. Source: BeInCrypto

BTC holdings of selected companies. Source: BeInCrypto

Meanwhile, Bitcoin’s network difficulty climbed to 142.34T in September, marking a new all-time high. This consistent increase in difficulty means that each unit of hashrate now yields fewer BTC, driving hashprice (revenue per unit of computational power) lower.

As a result, miners’ profit margins continue to tighten, especially for those with higher energy costs or less efficient hardware.

Bitcoin mining difficulty. Source:

Blockchain.com

Bitcoin mining difficulty. Source:

Blockchain.com

Notably, a new anti-Bitcoin mining bill in New York recently proposed a progressive tax on Bitcoin mining companies, with revenue redirected to lower utility bills for residents. The bill faces uncertain prospects but could disrupt multi-billion-dollar data center plans and increase cryptocurrency regulation in the state.

In summary, Bitcoin production in September revealed mounting technical pressure on the mining industry. As difficulty keeps rising and profit margins shrink, large miners like MARA, which have efficient infrastructure and a strategy of BTC accumulation, remain in a strong position.

Smaller firms must carefully consider selling BTC, cutting power capacity, or scaling operations to navigate the increasingly competitive and volatile landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Driving Blockchain Expansion and Business Integration

- ZKsync's Atlas Upgrade (Oct 2025) boosts blockchain scalability to 43,000 TPS, enabling real-time enterprise applications. - Deutsche Bank and UBS adopt ZKsync for tokenized settlements, proving institutional viability of ZK-based infrastructure. - ZK ecosystem sees $28B TVL and 50% token price gains, driven by deflationary tokenomics and $15B Bitcoin ETF inflows. - Analysts project $90B ZK Layer-2 market by 2031 (60.7% CAGR), with Fusaka upgrade (Dec 2025) targeting 30,000 TPS and regulatory compliance.

The Rise of ZK-Technology: Key Drivers and Changing Perspectives in Layer 2 Scaling Solutions

- ZK-technology's 2025 price surge stems from ecosystem upgrades, developer growth, and institutional adoption, reshaping blockchain infrastructure. - ZKsync's 43,000 TPS throughput and $3.3B combined TVL highlight maturing scalability, while 230% developer activity growth accelerates innovation. - 35 institutions including Goldman Sachs adopt ZK solutions for confidential transactions, with Polygon committing $1B to validate long-term viability. - Analysts project 60.7% CAGR for ZK Layer 2 market, reachin

Vitalik Buterin's Support for ZKsync and Its Influence on Layer 2 Scaling Technologies

- Vitalik Buterin's endorsement of ZKsync in November 2025 boosted its profile as a key Ethereum scaling solution with 15,000+ TPS and near-zero fees. - Institutional partnerships with Deutsche Bank and Sony , plus a 37.5M $ZK staking pilot, strengthened ZKsync's enterprise adoption and tokenomics. - The $0.74 token price surge and $15B capital inflow highlight market confidence in ZK-based infrastructure as Ethereum's primary scaling path. - Upcoming Fusaka upgrade (30,000 TPS) aims to challenge Arbitrum'

CyberCharge and SocialGrowAI Unite to Accelerate Web3 User Growth and Engagement