Bitcoin’s Record-Breaking Rally Driven by Strong Market Fundamentals, Says Glassnode

Bitcoin (BTC) has once again surpassed its previous records, climbing to new heights above $126,000. Unlike earlier speculative rallies, analysts say this surge reflects a stronger market structure and increasing institutional participation. More so, on-chain and ETF data suggest that Bitcoin may be entering a more stable phase of growth.

In brief

- Bitcoin surges above $126,000 as Glassnode cites strong fundamentals behind the record-breaking rally.

- ETF holdings hit $164.5 billion, showing rising institutional confidence and steady long-term demand for Bitcoin.

- On-chain activity jumps 11%, with most investors in profit as futures open interest tops $230 billion.

- Bitcoin sustains bullish momentum, trading above key averages with a Fear & Greed Index of 70.

Market Data Points to Fundamentally Driven Rally

Bitcoin reached a new all-time high this week , with data suggesting that the latest rally is backed by solid market fundamentals rather than speculation, according to on-chain analytics firm Glassnode.

The OG crypto climbed to a record $125,559 early Sunday, surpassing its previous peak of $124,457. On Monday afternoon, the coin reached a new all-time high (ATH) of $126,200. Glassnode’s latest Market Pulse report highlights that this rally differs from previous speculative surges, emphasizing its foundation in structural growth across key market sectors.

According to the report, Bitcoin’s latest all-time high reflects a coordinated expansion across spot, derivatives, and on-chain markets. Glassnode explained that improving liquidity, strong ETF inflows, and rising on-chain profitability suggest the breakout is driven by steady capital inflows and renewed investor participation rather than speculation.

ETF Inflows Highlight Growing Institutional Confidence In Bitcoin

Bitcoin exchange-traded funds (ETFs) continue to play a critical role in the ongoing market strength. The funds now collectively hold $164.5 billion in BTC, accounting for about 6.74% of Bitcoin’s total market capitalization. According to SoSoValue, cumulative net inflows into these ETFs exceeded $60 billion as of Friday , while daily retail ETF demand neared $1 billion.

This steady inflow reflects rising institutional confidence in Bitcoin’s long-term prospects. Additionally, the combination of ETF accumulation and consistent retail participation indicates sustained demand rather than short-term speculation.

On-Chain Activity Strengthens as Bitcoin Maintains Bullish Market Structure

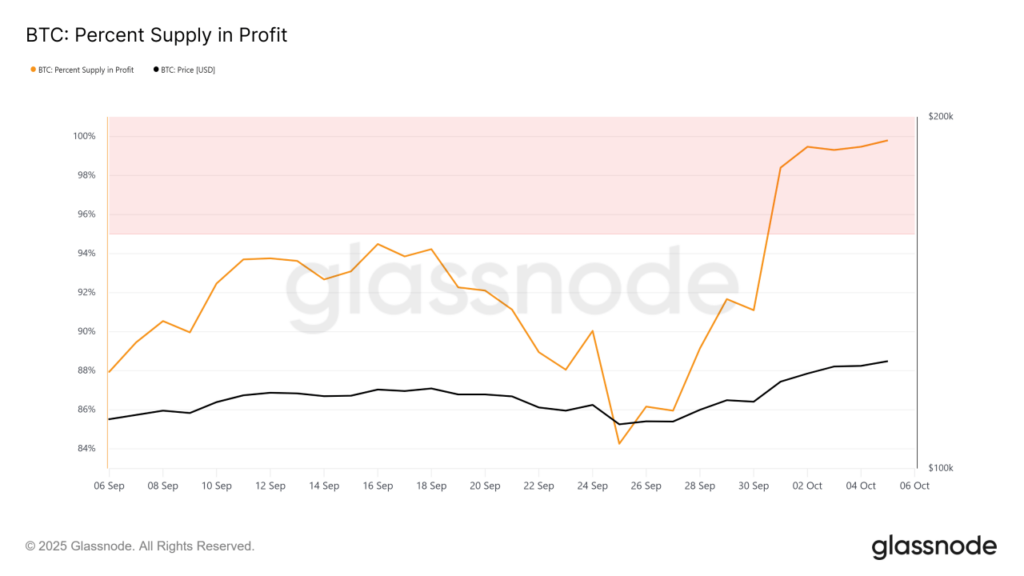

Glassnode data indicate that on-chain activity has increased sharply, with an 11% rise in active addresses. Nearly all Bitcoin investors are currently in profit, with open futures contracts totaling over $230 billion.

At the time of writing, Bitcoin is sitting at $124,100, down 2% from its fresh ATH.

Here are other key market trends to note:

- Market Capitalization: Bitcoin’s total market value rose 0.80% to reach $2.46 trillion.

- Dominance: BTC maintains a 57.87% share of the overall crypto market.

- Annual Performance: The price of Bitcoin has surged 95% over the past year.

- Technical Strength: BTC continues to trade above its 200-day simple moving average, indicating sustained upward momentum.

- Monthly Performance: The asset recorded 19 green days in the past 30 days.

- Market Sentiment: Bitcoin’s outlook remains bullish, with the Fear & Greed Index currently at 70 (Greed).

Futures markets likewise reflect heightened participation. Data from Coinglass indicate that total Bitcoin futures open interest has climbed to $232.63 billion. Despite the surge, liquidations remained moderate at $356.46 million, with shorts comprising roughly 52% of the total.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Price Prediction: As Bitcoin Reaches $126,000, ADA Poised for a Breakout

Cardano Price Prediction: As Bitcoin hits a new all-time high of $126K, ADA rebounds from the $0.85 support level. Can ADA retest $0.90, or will it fall back to $0.80?

Bitcoin still in ‘up only mode,’ but these are the key price levels to watch

How high could SOL price go if a spot Solana ETF is approved?

Bitcoin leads record-breaking inflows as investors chase the ‘debasement trade’