Bitcoin Faces New Rival as Tokenized Gold Surges Past $3 Billion — The Real “Digital Gold”?

Tokenized gold projects are booming, challenging Bitcoin’s “digital gold” status. As gold goes on-chain, Ethereum and Tether emerge as major winners in this shift.

Bitcoin has long been regarded as the ultimate store of value. However, a new generation of tokenized gold projects is making a compelling case for itself, grounded in centuries of monetary history.

As the gold price soars and blockchain-based gold tokens surpass a $3 billion market capitalization, the debate over what truly qualifies as “digital gold” is intensifying.

Bitcoin Faces Its Oldest Rival Again as Gold Goes On-Chain

Recent developments suggest that the tokenization of physical gold is no longer a theoretical experiment, but a fast-emerging market reality.

In April, Kinka, a subsidiary of Japan’s publicly listed fintech company UNBANKED, officially issued physical gold-backed tokens on the Cardano blockchain using EMURGO’s tokenization engine.

Meanwhile, BioSig Technologies and Streamex Exchange Corporation finalized $1.1 billion in financing to launch a gold-backed treasury management platform on Solana in July. The initiative, led by Cantor Fitzgerald, Needham & Co., and CIBC, aims to bring the $142 trillion commodities market on-chain.

The momentum goes beyond these. Tether and Antalpha are reportedly raising $200 million to create a digital asset treasury centered on Tether Gold (XAUT), backed by bullion stored in Swiss vaults.

At the same time, SmartGold partnered with Chintai Nexus to tokenize up to $1.6 billion worth of gold from American investors’ retirement accounts, allowing holders to earn DeFi yields without losing tax-deferred status.

The “Digital Gold” Debate Rekindled

The growing wave of tokenized gold has revived the Bitcoin versus gold debate, a longstanding philosophical and financial rivalry.

According to economist Peter Schiff, a vocal Bitcoin critic, tokenized gold will always beat Bitcoin, quashing the need for a US dollar stablecoin.

However, Bitcoin advocates think otherwise. On-chain analyst Willy Woo noted that while gold tokens like XAUT grew by $1.25 billion since launch, Bitcoin’s value increased by $2.2 trillion over the same period.

It's never too late to leave Fantasy Island and join the real world Peter. Tether launched tokenised gold 5.5 years ago. In that time it grew $1.25B while BTC grew by $2.2 TRILLION.Same with ETF wrappers… BTC ETFs saw 10x more demand than gold ETFs when they launched.

— Willy Woo (@woonomic) August 15, 2025

Still, sentiment remains split among other experts. Garrett Goggin, founder of Golden Portfolio, calls tokenized gold “the ultimate currency.” Goggin holds this stance based on a tokenized gold unique mix combining the store-of-value strength of gold with the digital programmability of crypto.

“Tokenized gold is cool, but requires a custodian; thus, counterparty risk is always there. Bitcoin’s removal of counterparty risk was the entire innovation. You must know this by now,” Erik Voorhees, founder of Venice AI, challenged.

Similarly, Vijay Boyapati dismissed tokenized gold as repackaging the same problem, centralized custody.

Ethereum and Tether Benefit Most

Despite the philosophical divide, markets are rewarding the tokenization trend. Based on CoinGecko data, over $2.7 billion worth of tokenized gold now exists on Ethereum, making it the primary blockchain beneficiary.

🚨JUST IN: Over $2.7 billion worth of tokenized gold now sits on $ETH!

— Ethprofit.eth 🦇🔊 (@Ethprofit) October 7, 2025

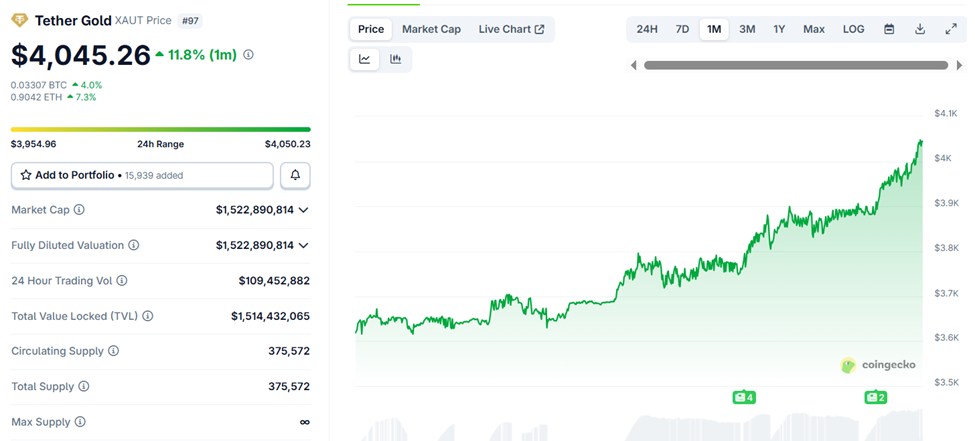

Tether Gold (XAUT) remains the most liquid and reputable tokenized gold asset globally. Its market capitalization is above $1.5 billion, and its price has risen almost 12% in the last month.

Tether Gold (XAUT) Price Performance. Source:

Tether Gold (XAUT) Price Performance. Source:

Tokenized gold and Bitcoin coexist, one rooted in physical scarcity, the other in digital trustlessness. However, as global demand for hard assets intensifies, the question of which truly deserves the “digital gold” title steadily moves from debate to data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meet the Game-Changing Stock That May Overtake Tesla in Seizing This $10 Trillion Market

Billionaires Invest in an AI Company That a Wall Street Expert Predicts Could Reach a $10 Trillion Valuation

Got $500? Here Are 2 Cryptocurrencies Worth Buying and Holding for the Long Term