- Solana falls 4%, hovering around $220.

- $50.9M in liquidations hit the SOL market.

Today, the crypto market cap has posted a slip of 2.23%, falling to $4.16 trillion. Followed by this, the broader market sentiment is now neutral, with the Fear and Greed Index reading settled at 55. All the major assets have lost momentum, visiting their recent lows, including Bitcoin (BTC) and Ethereum (ETH). Among the altcoins, Solana (SOL) has steadily dropped 4.58% in the last 24 hours.

The bulls were present in the SOL market in the morning hours, and the price traded at around $231.57. As the potential bears stepped in, the asset bottomed to the $218.18 range. At the time of writing, Solana traded within the $220.22 mark. Meanwhile, the daily trading volume is up by over 24%, reaching $9.2 billion. As per Coinglass data , the market has experienced a 24-hour liquidation of $50.90 million worth of SOL.

The ongoing bearish correction could push the price down to its key support range of $219. Notably, more downside of Solana might occur with the emergence of a death cross. Contrarily, if the altcoin bulls show up, the nearby resistance is found at around $221. Further breakout could trigger the formation of the golden cross, expecting SOL to see more upside.

Solana’s Technical Analysis Confirms Downward Momentum

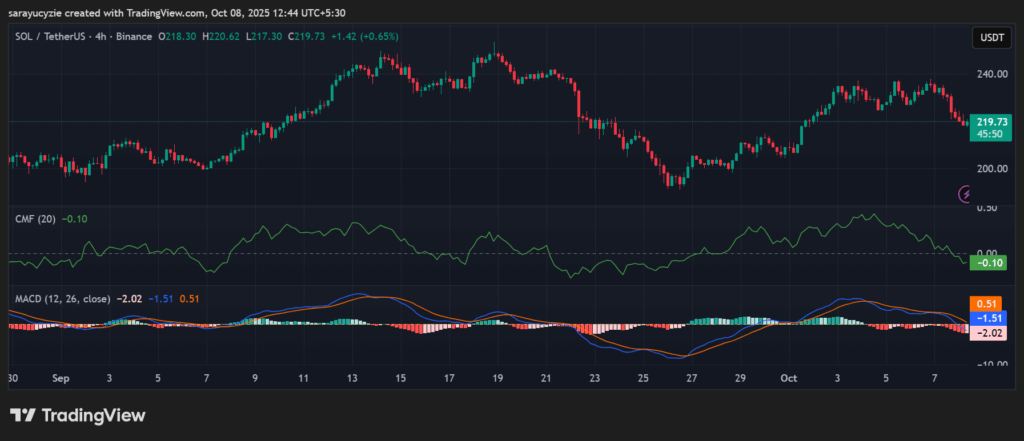

Solana’s Moving Average Convergence Divergence (MACD) line is positioned below the zero line, but the signal line is above zero. This crossover implies a mixed momentum. The overall trend is bearish, and the short-term momentum is still stabilizing. Besides, the Chaikin Money Flow (CMF) indicator found at -0.10 points out the moderate selling pressure in the market. The money is flowing out, and SOL may face downward pressure unless buying momentum increases.

SOL chart (Source: TradingView )

SOL chart (Source: TradingView )

The asset’s Bull Bear Power (BBP) value at -13.35 indicates a strong bearish dominance in the SOL market. The price could continue downward unless buying pressure returns. In addition, the daily Relative Strength Index (RSI) at 38.09 suggests the asset may approach the oversold territory . At this point, the market shows mild negative sentiment, with sellers in control. Also, Solana could be nearing a support level where buyers might step in.

To summarize, the four-hour price graph reports that the bears are hovering in the market. More downside correction will sharpen the current momentum, and to reverse the momentum, the powerful bulls have to step in. Looking to the future, our in-depth financial report details the long-range price trajectory for Solana (SOL), through 2025 and stretching through 2030.

Top Updated Crypto News

BNB Breaks Limits: Is the Correction Over or Merely Pausing?