Key Notes

- Wallets inactive for 3-5 years transferred 32,322 BTC worth $3.9 billion, marking the year's largest dormant movement.

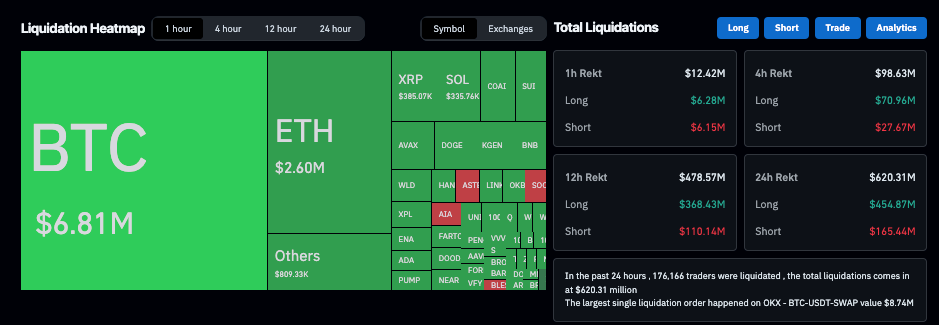

- The selloff triggered $620 million in crypto liquidations, with 74% coming from long positions across the market.

- Bulls reduced liquidation losses from 74% to 55% within hours, signaling potential stabilization around $120,000 support.

Bitcoin BTC $122 394 24h volatility: 1.6% Market cap: $2.44 T Vol. 24h: $80.06 B price touched new all-time highs above $126,192 on Monday, October 6, before retreating 4% toward $120,000 amid intense profit-taking on Tuesday. On-chain data shows the pullback coincided with unusual activity from dormant wallets, while derivatives indicators point to early rebound prospects.

As Bitcoin corrected 4% on Tuesday, J. Martin, an analyst at CryptoQuant, alerted his 42,700 followers to on-chain data showing long-term holders taking profits at the top.

JUST NOW 🚨

32,322 BTC (~$3.93B) just moved on-chain from wallets that were dormant for 3 – 5 years.

👉 This is the largest 3y – 5y Bitcoin movement of 2025 so far. pic.twitter.com/9vVbAdcrdA

— Maartunn (@JA_Maartun) October 7, 2025

According to Martin, wallets inactive for 3 to 5 years were spotted moving 32,322 BTC, worth roughly $3.9 billion, the largest single-day transfer from dormant wallets for the year.

Such a spike in long-term wallet activity introduces short-term bearish pressure. First, reintroducing such large volumes of long-held Bitcoin within a short period dilutes circulating supply and amplifies sell-side pressure. Second, it spooks new entrants, who may delay purchases to avoid haircut impact from active long-term holder sell-offs.

Bulls Aim for Early Rebound as Crypto Liquidations Top $620M

Historical trends show that large dormant movements near Bitcoin bull cycle tops. However, active demand among crypto ETFs and corporate treasury firms could see the dormant BTC supply absorbed by buyers during the correction phase.

Bitcoin’s 4% correction amid the $3.9 billion long-term holder sell-off triggered widespread volatility across crypto markets, causing $620 million in total liquidations, according to Coinglass data . The $454.87 million leveraged long positions closed accounted for 74% of the losses, while shorts saw $165.44 million wiped out.

However, derivatives data suggests bulls are beginning to counteract the selling momentum. Over shorter timeframes, liquidation ratios show a narrowing gap between long and short positions.

Crypto bulls cut loss-incidence from 74% to 55% | Coinglass, October 7, 2025

At the time of this report, total liquidation within the past hour totaled $12.42M with $6.28M long and $6.15M in shorts, with bulls cutting the 74% loss incidence to 55%.

The progressive reduction in long-liquidation dominance signals that bulls are regaining balance, counteracting the downward price action with covering positions, as Bitcoin stabilizes around the $120,000 support zone.

On Tuesday, US JP Morgan Chase CEO Jamie Dimon also declared that a US government shutdown is unlikely to impact financial markets.

Blackrock’s record-setting ETF inflows and Strategy reaffirming long-term buying commitment following $3.9 billion Q3 profits could reignite investor confidence in Bitcoin’s price discovery. A rebound from $120,000 could spark a $130,000 breakout attempt as markets anticipate another US Fed rate cut decision.

next