Date: Wed, Oct 08, 2025 | 02:40 PM GMT

In a landmark moment for decentralized finance (DeFi), MetaMask, the world’s leading self-custodial crypto wallet with over 30 million monthly active users, has unveiled in-wallet perpetual futures trading through Hyperliquid, the top decentralized perpetuals exchange – signaling a major leap in how traders can interact with DeFi markets.

Source: @MetaMask (X)

Source: @MetaMask (X)

MetaMask x Hyperliquid: Trading Without Leaving Your Wallet

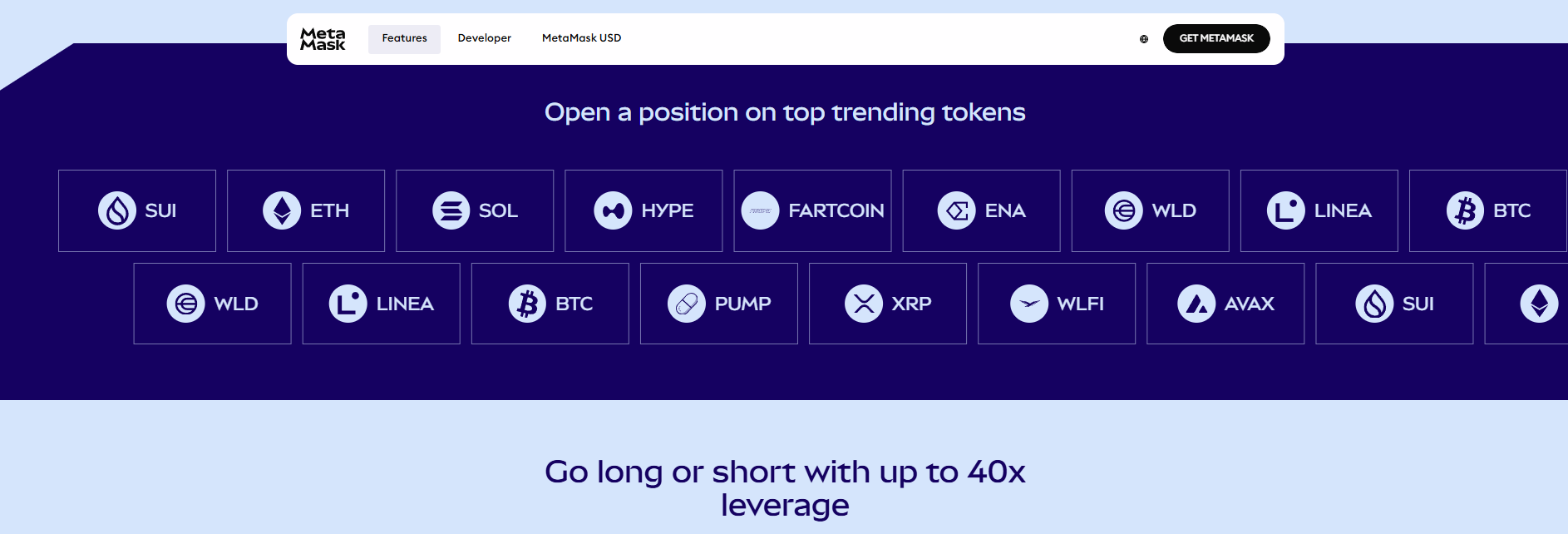

MetaMask’s latest integration allows users to trade perpetual contracts directly within the wallet, offering up to 40x leverage in supported regions. This move combines convenience, control, and advanced trading functionality — all without compromising on decentralization.

By embedding this functionality, MetaMask becomes one of the first-ever self-custodial wallets to offer native perpetual trading, a feature long dominated by centralized exchanges.

Source: metamask.io

Source: metamask.io

Why This Marks a Major Milestone in DeFi

This integration is more than just a feature — it’s a signal of DeFi’s growing maturity. Until now, most traders had to rely on centralized exchanges (CEXs) for perpetual contracts due to their liquidity and execution efficiency. But with Hyperliquid’s integration, MetaMask has effectively removed the last barrier: users can now trade complex derivatives without leaving their wallets.

As the DeFi space continues to evolve, this step from MetaMask signals a paradigm shift: the future of trading might no longer depend on centralized exchanges at all.