BlackRock’s iShares Bitcoin ETF Nears $100 Billion, Surpassing Longtime Top Funds

Less than two years after its debut, BlackRock’s iShares Bitcoin Trust ETF (IBIT) has become one of the firm’s most notable successes. The fund is approaching $100 billion in assets under management and now ranks as one of BlackRock’s top-earning ETFs. Despite the company’s long experience managing a variety of exchange-traded funds, none have expanded at this pace. IBIT’s strong revenue performance has already surpassed several of BlackRock’s long-established funds, showing growing acceptance of cryptocurrency in mainstream investing.

In brief

- BlackRock’s iShares Bitcoin Trust ETF has rapidly grown to nearly $100 billion in assets under management.

- IBIT reached this milestone in less than 22 months, showing strong demand for Bitcoin-linked investments.

IBIT Bitcoin ETF Outpaces BlackRock’s Top 12 ETFs

Eric Balchunas, senior ETF analyst at Bloomberg, reported that IBIT now produces around $244.5 million in annual revenue. That figure exceeds the earnings of two of BlackRock ’s well-established ETFs—the iShares Russell 1000 Growth ETF (IWF) and the iShares MSCI EAFE ETF (EFA)—by about $25 million each. With both IWF and EFA generating roughly $219 million annually, IBIT has moved ahead as the firm’s highest-earning fund .

What makes this achievement remarkable is the fund’s age. Every other BlackRock ETF among the company’s top 12 revenue producers has existed for more than a decade. IBIT, by contrast, reached this position in less than two years. Its rapid progress shows how demand for Bitcoin-linked investments has surged among institutions and individual investors alike.

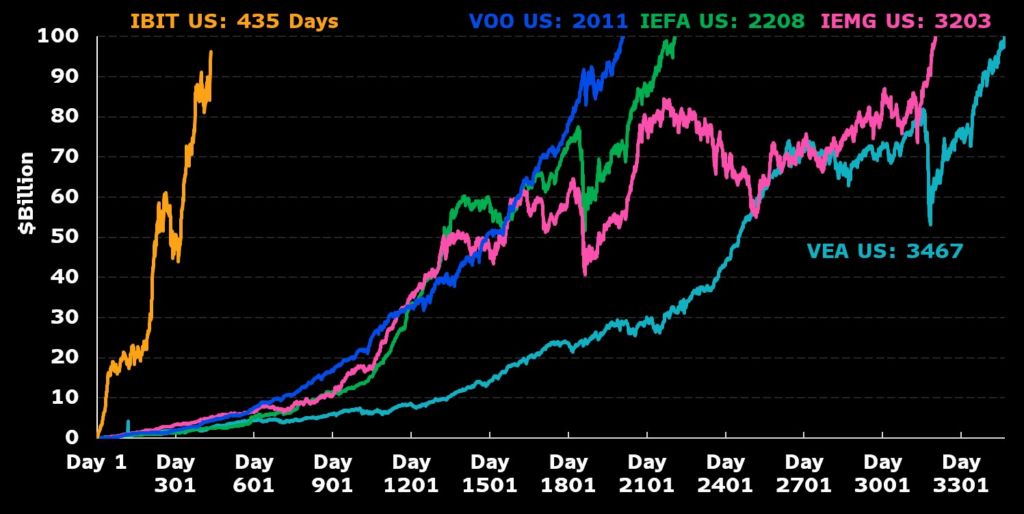

Balchunas also noted that the fund has accumulated nearly $97.8 billion in assets in only 435 days. If its momentum continues, IBIT is on course to become the quickest ETF in history to cross the $100 billion threshold. By comparison, Vanguard’s S&P 500 index fund (VOO) needed 2,011 days—over five years—to hit the same level.

IBIT reaches over $90B in assets in record time, surpassing the early growth of legacy ETFs.

IBIT reaches over $90B in assets in record time, surpassing the early growth of legacy ETFs.

IBIT’s Rising Inflows and Momentum

IBIT’s rise has also been marked by strong inflows and increasing investor interest. The fund remains the leading spot Bitcoin ETF in the United States and continues to attract the majority of new inflows into this market. Here is a look at its recent activity:

- Over the past week, U.S. spot Bitcoin ETFs saw $3.2 billion in total inflows, with IBIT bringing in about $1.8 billion, marking its second-largest weekly inflow since launch.

- In the last quarter, IBIT overtook Coinbase Global’s Deribit platform to become the world’s largest venue for Bitcoin options.

- The iShares Bitcoin Trust ETF also saw additional inflows of $970 million on Monday and $899.4 million on Tuesday, continuing its upward momentum.

Investor interest in BTC ETFs has been reinforced by a more supportive policy environment, with the Trump administration adopting a positive stance on cryptocurrency and signaling plans to establish the United States as a major hub for crypto activity, which has encouraged both investors and institutions to expand their exposure to Bitcoin through regulated products.

At the same time, analysts point out that Bitcoin’s price, which reached around $126,000 on Monday, has been supported by the large inflows from ETFs . Alongside this, corporations are increasing their Bitcoin holdings, and some countries are adding the digital asset to their reserves, all of which has strengthened overall demand and helped sustain the market’s momentum.

BlackRock Plans a New Bitcoin Income Fund

Building on IBIT’s success, BlackRock plans to launch a new Bitcoin-focused fund called the Bitcoin Premium Income ETF, which will generate returns by selling covered call options on BTC futures and collecting the premiums while still providing exposure to BTC through those futures.

To facilitate the new fund, BlackRock has filed to establish a Delaware trust company , signaling the firm’s plans to expand its BTC-based offerings and strengthen the infrastructure for its digital asset products.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From the Only Survivor of Crypto Social to "Wallet-First": Farcaster’s Misunderstood Shift

Wallets are an addition, not a replacement; they drive social interaction, not encroach upon it.

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.