- Chainlink: Grayscale’s ETF filing and steady accumulation signal strong institutional confidence and growth potential.

- Stellar Lumens: Expanded holdings and new ETF listing boost accessibility and long-term investor interest.

- Filecoin: Quiet accumulation and AI integration position FIL for future decentralized storage demand.

Grayscale’s recent investment activity is drawing serious attention across the crypto market . The firm, known for opening institutional doors to digital assets, appears to be quietly increasing exposure to several promising altcoins. LINK, XLM, and FIL now sit among its most interesting holdings. Each represents a unique corner of blockchain innovation, and their growing presence in Grayscale’s portfolio hints at major upside potential ahead.

Chainlink (LINK)

Source: Trading View

Source: Trading View

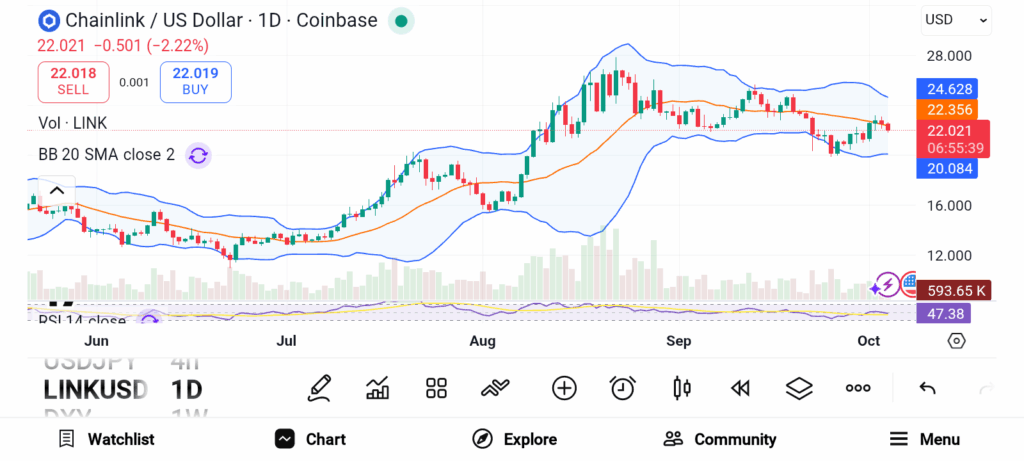

Chainlink’s LINK stands out as one of Grayscale’s most strategic holdings. In early September, the asset manager filed for a spot Chainlink ETF in the United States. The proposal involves converting the existing Chainlink Trust into an ETF listed on NYSE Arca under the ticker GLNK. Coinbase Custody would serve as the custodian, adding another layer of credibility for institutional investors. This move reflects growing confidence in Chainlink’s long-term value.

The project has shown consistent resilience through periods of market uncertainty, including during the U.S. government shutdown. Data from 2024 showed that institutional accumulation began long before prices started to climb. As holdings increased, so did optimism, suggesting that many investors may already be benefiting. The combination of steady buying pressure and a potential ETF listing strengthens Chainlink’s outlook.

Stellar Lumens (XLM)

Source: Trading View

Source: Trading View

One of the biggest reasons for a positive trend in Stellar Lumens is the increasing interest by Grayscale in the digital payment network. Data from Coinglass shows that the amount of XLM held by Grayscale rose from 100 million to 120 million tokens over the period from July to October 2025.

Despite the price volatility, the incremental buying demonstrated market participants’ belief in Stellar’s potential. In January, the Stellar Lumens Trust (GXLM) managed by Grayscale was converted into an ETF, listed on NYSE Arca. The change enhanced the levels of liquidity, lowered the premiums.

Filecoin (FIL)

Source: Trading View

Source: Trading View

Filecoin presents a different kind of opportunity within Grayscale’s portfolio. While LINK and XLM have already experienced rallies, FIL remains quietly accumulated. Grayscale’s Filecoin Trust allows investors to gain exposure to decentralized storage without managing the asset directly. The company’s Decentralized AI Fund also holds Filecoin.

This inclusion highlights Filecoin’s growing role at the intersection of decentralized storage and artificial intelligence. Despite recent quiet price action, accumulation data suggests growing institutional interest.As demand for decentralized data storage rises alongside AI growth, Filecoin could become a key beneficiary.

Grayscale’s latest holdings reveal growing confidence in Chainlink, Stellar Lumens, and Filecoin. LINK stands strong with an ETF proposal and consistent institutional demand. XLM gains traction through its new ETF and cross-border payment focus. FIL offers early exposure to decentralized data and AI growth. These three altcoins highlight where smart institutional money is flowing next.