Key Notes

- Strategic investors including PAG Pegasus Fund back DDC's Bitcoin treasury strategy with 180-day lock-up commitments.

- The company targets expanding holdings from 1,058 BTC to 10,000 BTC by the end of 2025 amid institutional demand.

- Kalshi traders place $205K in fresh bets on Bitcoin hitting $130K this month as corporate treasury buying accelerates.

On Oct. 8, DDC Enterprise Limited secured $124 million in a new equity financing round at $10.00 per Class A share, representing a 16% premium to its Oct. 7 closing price, as Bitcoin BTC $123 595 24h volatility: 2.3% Market cap: $2.46 T Vol. 24h: $66.44 B traded within a tight 2% range between $120,600 and $123,500 on Oct. 8.

According to the press release , the investment round is led by PAG Pegasus Fund and Mulana Investment Management, with participation from OKG Financial Services Limited, a subsidiary of OKG Technology Holdings Limited. DDC’s Founder, Chairwoman, and CEO Norma Chu is also personally investing $3 million, demonstrating her confidence and long-term alignment with shareholders.

“We are proud to welcome PAG Pegasus Fund, OKG, and Mulana as strategic partners and shareholders, representing some of the most admired names in global finance and digital assets. Their investment is a strong endorsement of our vision and the growing importance of public Bitcoin treasuries,” said Norma Chu, Founder, Chairwoman and CEO of DDC Enterprise.

Further signaling long-term conviction, nearly all participants, including Chu, agreed to a 180-day lock-up period on the stock holdings following the deal’s closure. The company confirmed the newly raised capital will fund BTC purchases and advance its global stature as a leading Bitcoin treasury firm.

With current holdings of 1,058 BTC, the firm issued a target of 10,000 BTC by year-end 2025.

Kalshi Prediction Markets Hint at $130,000 Bitcoin Rally

With DDC’s $124 million treasury commitment and record ETF inflows providing strong liquidity support, short-term speculators remain optimistic that Bitcoin could post another leg higher before month-end.

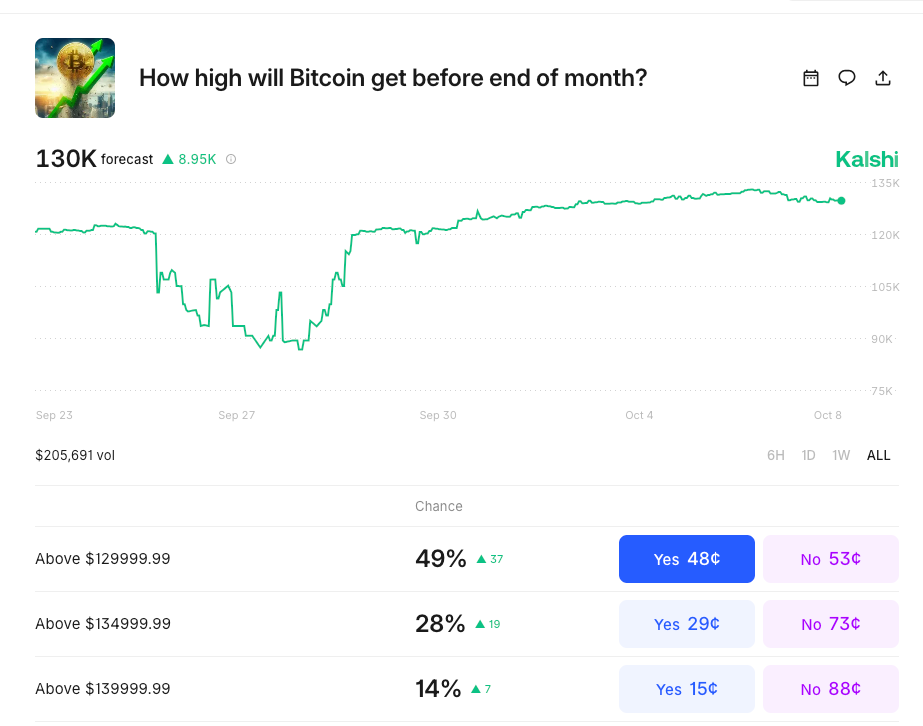

Prediction markets price in 49% change of BTC reaching $130,000 in October | Source: Kashi.com

Data from Kalshi’s real-time prediction markets show traders pricing a 49% probability of Bitcoin reaching $130,000 by Oct. 30, with over $205,000 in new wagers placed in the last 24 hours.

This bullish sentiment aligns with the risk-on sentiment observed among US institutional players since the government shutdown began last week. If US corporate demand continues to offset profit-taking pressure following Bitcoin’s latest all-time high, predictions market optimism could potentially set the stage for another breakout toward $129,999 in the weeks ahead.

next