Arthur Hayes: How Do the US Dollar and Chinese Yuan Kill the Bitcoin Cycle?

Author: Arthur Hayes

Original Title: Long Live the King!

Compiled and Translated by: BitpushNews

How does society arbitrate scarcity, given that humanity has not yet reached the post-scarcity existence of science fiction utopias? Infinite abundance of energy does not allow us to consume whatever we want, whenever we want, and this has not eliminated the need for that devilish structure called money to allocate scarce resources.

Money, combined with markets, has produced the best tool to inform society about what to produce, in what quantity, and who should receive it.

The market price of a commodity arbitrates scarcity. Therefore, the price of money and its quantity are the two most important variables in any society. Distorting one or both will lead to societal dysfunction. Every economic “-ism” offers a theory that either denigrates or praises the market, and all involve moderate monetary manipulation.

Although the free market is the perfect way to arbitrate scarcity, this does not mean that giving more freedom to markets will lead to a linear progression toward economic Valhalla. People want to suppress economic volatility by regulating markets and money. This is the primary purpose of government. Governments provide goods and services that people believe are best left to collective control. Or governments constrain markets to prevent immoral outcomes such as human slavery. With these powers, governments must exert some control over the price and quantity of money. Sometimes governments are benevolent, and at other times they are despotic monetary dictators. Because governments are legally allowed to kill their citizens to punish lawbreaking, they can enforce the use of a particular type of money. This leads to both good and bad consequences.

All governments, regardless of the governing theory guiding them, inevitably always devalue their currency supply in pursuit of a device to transport them to a post-scarcity society. Achieving post-scarcity will not come from clever ways of printing money, but will require a deeper understanding of the physical universe and the ability to manipulate its structure for our use.

However, a politician cannot wait decades or centuries for a scientific revolution. Therefore, the expedient for people in a volatile and uncertain universe is always to print more money.

Although governments are powerful, people always find ways to preserve their sovereignty. In many cultures that have experienced centuries of local inflation under successive governments or dynasties, the culture has created gifting rituals marking major life milestones (birth, marriage, and death) involving the exchange of hard currency. In this way, people save through cultural rituals. No politician dares to subvert these rituals, or they will lose their mandate to lead and find themselves beheaded.

In modern times, when the power of centralized governments—whether democracies, socialist republics, communist states, etc.—has been strengthened by advances in thinking machines and the internet, how can we, the people, preserve our right to sound money? The gift Satoshi Nakamoto gave humanity through their Bitcoin white paper is a technological miracle, launched at a very important moment in history.

Bitcoin, in the current state of human civilization, is the best form of money ever created. Like all money, it has a relative value. Given that the “Pax Americana” quasi-empire rules through the US dollar, we measure the value of Bitcoin relative to the dollar. Assuming the technology works, the price of Bitcoin will ebb and flow with the price and supply of the dollar.

The purpose of this philosophical preface is to provide context that inspired my thoughts on the duration of the Bitcoin/dollar price cycle. There have already been three cycles, with all-time highs (ATH) occurring every four years. As the fourth cycle’s four-year anniversary approaches, traders hope to apply historical patterns and predict the end of this bull market.

But they apply this rule without understanding why it worked in the past. Without this historical understanding, they will miss why it will fail this time.

To illustrate why the four-year cycle is dead, I want to conduct a simple study on two charts.

The main theme is the price and quantity of money, i.e., the US dollar. Therefore, I will analyze charts of the effective federal funds rate and US dollar credit supply. The secondary theme is the price and quantity of the yuan originating from China. For most of human history, China has been the richest region on the map. It experienced a half-century interruption from 1500 to 2000, but today it is striving to reclaim the throne of the global economy.

The question is, at each Bitcoin ATH level, are there any obvious turning points that can roughly explain the price peaks and subsequent crashes? For each four-year period, I will provide a summary explaining the monetary trends at the time to interpret these charts.

US Dollar:

The white line is an indicator measuring the price and supply of US dollar credit. This is a combination of bank reserves held by the Fed and total other deposits and liabilities in the US banking system. The Fed publishes these two numbers weekly. [1]

The green line represents the effective federal funds rate, set by the FOMC.

The gold line is the Bitcoin/USD price.

Yuan:

The Chinese economy is more credit-dependent than the US, so I used Bloomberg Economics’ China Credit Impulse 12-month percentage change index. If you look at the year-on-year percentage change in nominal GDP, you get a similar chart.

Back to the Past

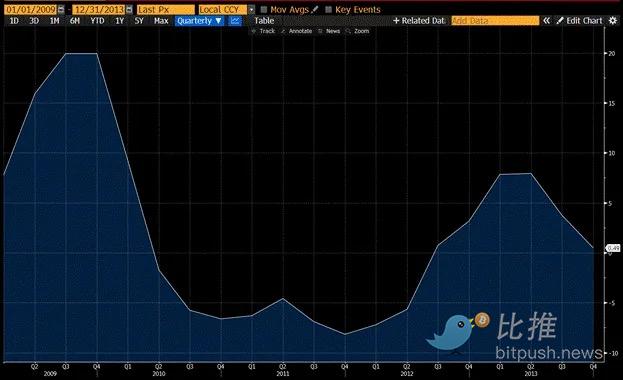

Genesis Cycle: 2009 to 2013

On January 3, 2009, Bitcoin produced its first block, known as the Genesis Block. The 2008 Global Financial Crisis (GFC) raged, destroying global financial institutions. With the assistance and abetment of a bought-and-paid-for US government, bankers nearly destroyed the world economy, but Fed Chairman Ben Bernanke “saved” the system by implementing unlimited quantitative easing (QE), announced in December 2008 and started in March 2009. [2] The Chinese helped the world economy by increasing credit-driven infrastructure spending. By 2013, both the Fed and the People’s Bank of China (PBOC) [3] wavered in their support for unlimited expansion of the money supply. As you will see, this led to a slowdown in credit growth or outright contraction of the money supply, ultimately ending the Bitcoin bull market.

US Dollar:

The price of the dollar (interest rate) was essentially 0%. The supply of dollars rose sharply, peaked at the end of 2013, and then fell back.

Yuan:

The massive increase in credit flooded the world with yuan, with trillions of yuan escaping from China into Bitcoin, gold, and global real estate. By 2013, although credit growth was still impressive, it was much less than before, and the slowdown coincided with the slowdown in US dollar credit growth.

The slowdown in US dollar and yuan credit growth burst the Bitcoin bubble.

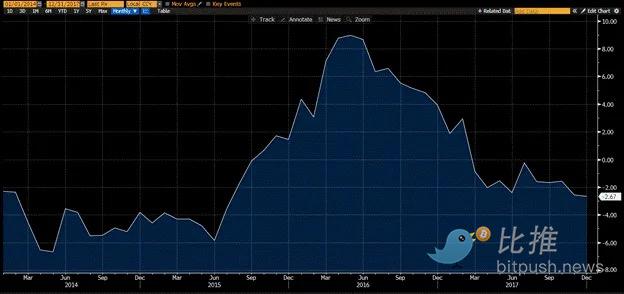

Token Offering Cycle: 2013 to 2017

During this period, Ethereum mainnet went live, ushering in the growth of new projects funded by public blockchain-based smart contract subscriptions. [4] Bitcoin rose from the ashes, not because of the dollar, but due to an explosion in yuan supply. As shown below, China’s credit impulse accelerated in 2015, while the yuan depreciated against the dollar. The supply of dollars declined, and interest rates rose. Bitcoin soared as massive amounts of yuan flowed through global currency markets. Eventually, as yuan credit growth slowed from its 2015 peak, tighter US dollar monetary conditions crept into the bull market and crushed it at the end of 2017.

Yuan:

US Dollar:

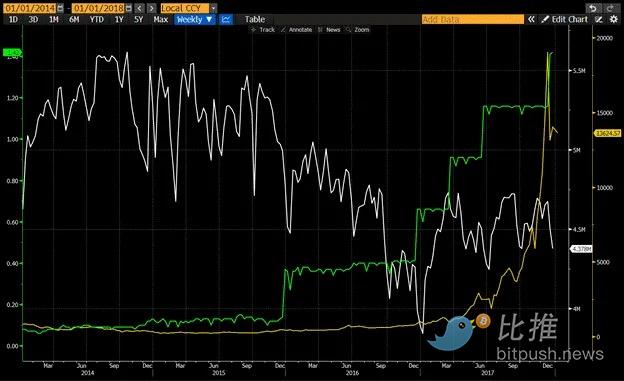

COVID Era: 2017 to 2021

Although COVID did kill millions, the crisis was exacerbated by poor government policies. COVID was a pretext to tame the public into accepting the loss of their freedoms, transcending any particular type of government theory in the regions ruled. In the spirit of “try anything,” COVID was the perfect opportunity for “Pax Americana” to unleash helicopter money, which also provided then-US President Donald Trump with the largest populist government relief since Franklin D. Roosevelt’s New Deal. Trillions of dollars were printed and flowed into crypto. Trump ran the economy hot, and all markets only went up.

US Dollar:

The supply of dollars doubled, and the price of money quickly fell to 0%.

Yuan:

Although China’s credit impulse rose during COVID, they did not go all out. They used COVID as an opportunity to attack the Chinese real estate bubble. This level of yuan credit growth did not prevent the local real estate price crash triggered by the “three red lines” policy. But this was intentional, and since no one was allowed in or out of China at the time, controlling capital outflows and social discontent on the mainland became very easy. As a result, China’s monetary policy did not make a substantial contribution to this round of the Bitcoin bull market.

The inflation caused by the economic policies of Trump and his successor Biden became difficult to handle by the end of 2021. Inflation soared, and those without substantial financial assets felt cheated. The federal government stopped stimulus, the Fed began to shrink its balance sheet, and announced rapid rate hikes. This marked the end of the bull market.

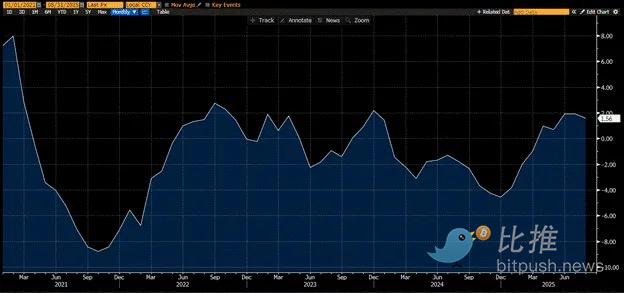

New World Order: 2021 -?

“Pax Americana” is nothing but a nostalgic dream. What happens next? This is what global leaders are trying to figure out. Change is neither good nor bad, but it creates economic winners and losers. Sometimes the losers are politically and economically powerful, which creates problems for the ruling party. To protect the public from the negative effects of change, politicians print money.

This time, the engine of credit growth comes from the Fed’s reverse repo program (RRP, magenta, Y-axis inverted). The price of money rises. The supply of money falls. But Biden needs to stimulate the market. Therefore, his female assistant, US Treasury Secretary Yellen, issued more treasury bills than notes/bonds to drain the RRP. This released about 250 billions of liquidity into the market. Her successor, Buffalo Bill Bessent, continued the policy until the RRP fell to its current near-zero value. China has experienced several rounds of deflation, and judging by the negative credit impulse, China is still committed to reducing housing prices and their importance to the Chinese economy. And, if there is no other guidance or change in the outlook for US and Chinese monetary policy, I would agree with many crypto traders—the bull market is over. But the rhetoric and recent actions of the Fed and PBOC suggest the opposite.

US Dollar:

Yuan:

In the US, newly elected President Trump wants to run the economy hot. He often talks about the need for US growth to reduce its debt burden. He criticizes the Fed for having too tight a money supply. His wishes are turning into action. The Fed will resume rate cuts in September, even though inflation is still above its own target.

The white line is the effective federal funds rate, the yellow line is core PCE, and the green horizontal line is the Fed’s 2% target.

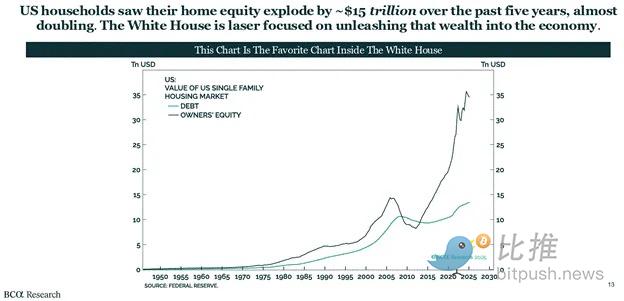

Trump also talks about lowering housing costs to unlock the trillions of dollars in home equity trapped by the rapid rise in housing prices after 2008.

Finally, Buffalo Bill Bessent will relax regulations on banks to allow them to increase lending to key industries. The future depicted by the ruling political elite points to lower, not higher, interest rates, and higher, not lower, money supply growth.

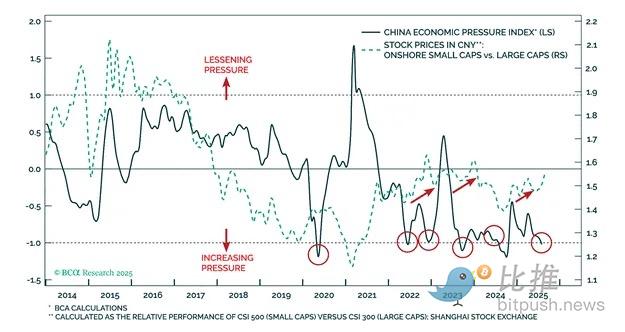

While China does not want to issue credit in the quantities of 2009 and 2015, they do want to end deflation. When economic pressures become too strong, as shown in the BCA chart above, Chinese policymakers print money. I do not believe China will currently be the driver of global fiat credit growth, but it will not hinder it either.

Listen to the monetary masters in Washington and Beijing. They have made it clear: money will become cheaper and more abundant. Therefore, Bitcoin will continue to rise in anticipation of this highly probable future. The king is dead, long live the king!

[1] Fed stands for the Federal Reserve Bank of the United States.

[2] QE stands for Quantitative Easing.

[3] PBOC stands for the People’s Bank of China.

[4] Token Offering refers to the process of publicly raising and selling digital tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?

Behind the 15 million financing, does Surf aim to become an AI analyst in the crypto field?

Cyber co-founder starts a new venture.