Date: Thu, Oct 09, 2025 | 05:04 AM GMT

The cryptocurrency market is showing a brief pause in volatility after an impressive rally that pushed Bitcoin (BTC) to a new all-time high of $126,000, before easing to around $122,000. Meanwhile, Ethereum (ETH) is holding steady near $4,450, signaling a period of consolidation across major assets.

Amid this calm, Aptos (APT) sees 5% daily decline, but what’s happening beneath the surface tells a more interesting story — the token is retesting a major breakout zone, which could soon determine its next major direction.

Source: Coinmarketcap

Source: Coinmarketcap

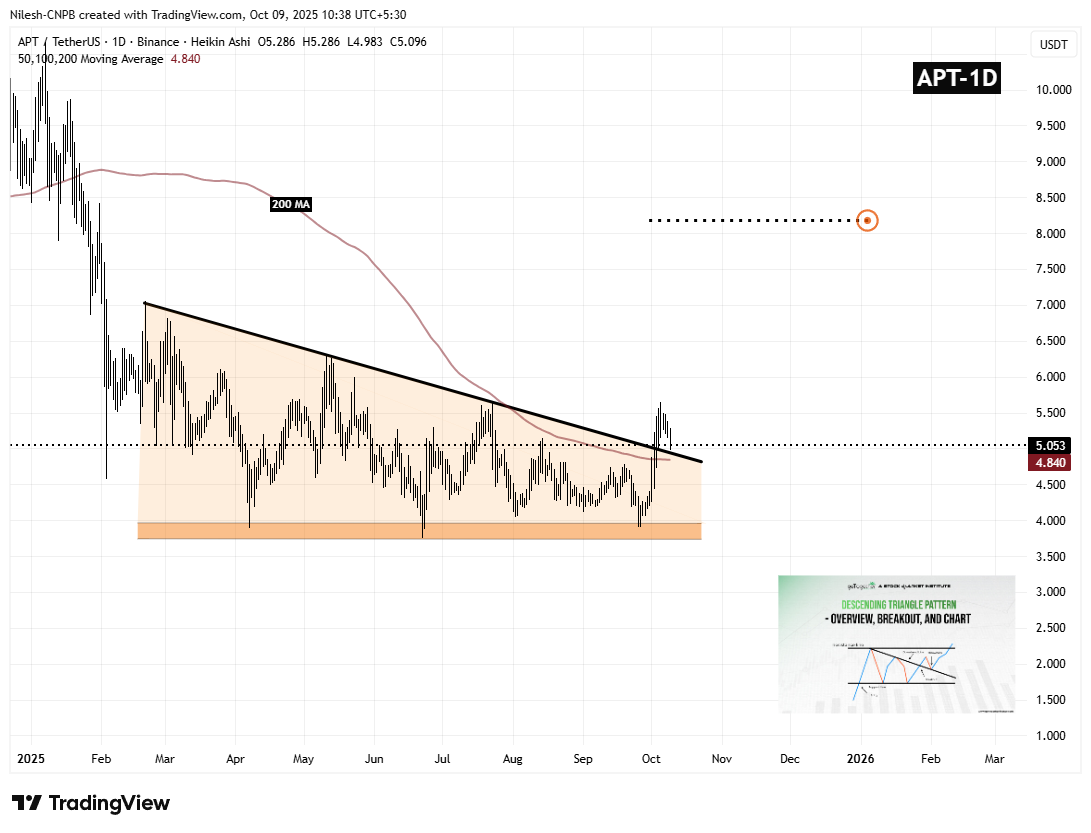

Retesting the Descending Triangle

For several weeks, APT traded inside a Descending Triangle, a pattern often seen as bearish since it tends to break to the downside. However, APT surprised traders by doing the opposite — breaking out upward through the triangle’s descending resistance line.

This bullish reversal began when APT found strong demand around $3.97, triggering accumulation and a swift push higher. The breakout above $5.03 confirmed a shift in market structure, drawing renewed confidence from traders.

Aptos (APT) Daily Chart/Coinsprobe (Source: Tradingview)

Aptos (APT) Daily Chart/Coinsprobe (Source: Tradingview)

Following the breakout, APT climbed to a local high of $5.648, where some profit-taking caused a short-term pullback. Now, the price is revisiting the breakout zone near $5.0, which aligns with the former resistance trendline — an area that often transforms into support after a successful breakout.

This retest phase is critical; if buyers step in here, it could signal the continuation of the bullish move.

What’s Next for APT?

The current setup looks technically constructive, but the next few sessions will be key. Bulls are now focusing on defending both the breakout level around $4.95 and the 200-day moving average (MA) near $4.84.

If APT manages to hold these supports and regain upward momentum, the next target for buyers would be to reclaim the recent local high at $5.648. A confirmed breakout above that level could potentially open the door to the next resistance zone near $8.18 — representing a possible 62% upside from current prices.

On the other hand, if APT fails to hold the $4.95 area or slips below the 200-day MA, the bullish breakout could be invalidated, leading to a deeper consolidation phase before any further upward move.