BlackRock’s Bitcoin Empire Nears $100 Billion — But What’s the Real Endgame? | US Crypto News

BlackRock’s iShares Bitcoin Trust is on track to hit $100 billion in assets, reshaping Bitcoin’s role in global finance. As its holdings grow, concerns mount over centralization and the firm’s deeper ambitions in asset tokenization.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to read how a single fund is rewriting the rules of finance, blurring the line between crypto and traditional markets. With it, concerns arise that its next milestone could change how power itself moves through money.

Crypto News of the Day: BlackRock’s Bitcoin Juggernaut Nears $100 Billion

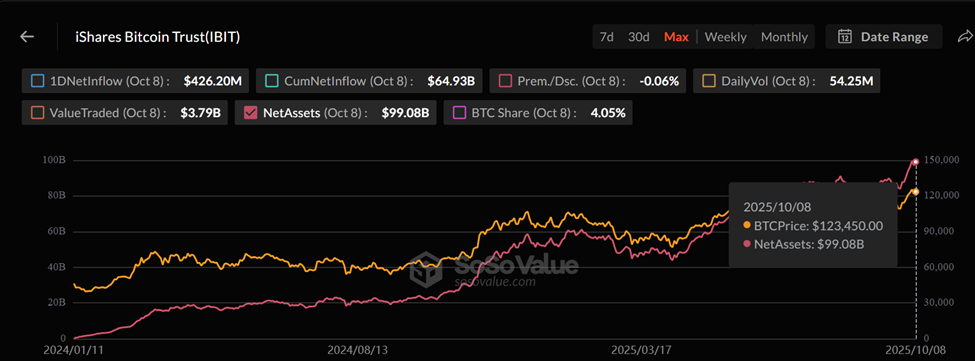

BlackRock’s iShares Bitcoin Trust (IBIT) is closing in on a historic milestone of $100 billion in assets under management (AUM), just 22 months after its launch.

According to ETF analyst Eric Balchunas, the fund has already surpassed legendary funds like VIG. It is now ranking 19th overall in AUM, signaling how fast Bitcoin has embedded itself into institutional finance.

IBIT WATCH: lost a bit of aum yesterday bc of btc price decline but made it up w inflows. Still at $99b. So close yet so far. Just passed $VIG (an etf legend) to take the 19th spot in overall aum. pic.twitter.com/w5Lto2OaTP

— Eric Balchunas (@EricBalchunas) October 9, 2025

According to Onur, a Near Protocol ambassador and popular user on X (Twitter), IBIT’s $245 million annual fees reflect the extraordinary pace of institutional adoption.

It now outpaces every other BlackRock ETF, some over a decade old. With $1.8 billion inflows last week alone and a path to $100 billion faster than any fund in history, IBIT shows how deep institutional adoption runs when Bitcoin rallies.

This milestone is not happening in isolation, coming as part of a larger shift in how capital moves through crypto markets. Analysts increasingly argue that net inflows now matter more than fundamentals or narratives.

“The only thing that matters in crypto right now is flows…net inflows (buy pressure) are infinitely more important than…fundamentals or narrative,” said analyst Miles Deutscher.

That observation aligns with IBIT’s dominance in ETF flows. Over the past week alone, IBIT accounted for $3.5 billion in inflows, roughly 10% of all ETF flows across the US market. Even long-time laggards like GBTC saw inflows, a signal, Balchunas noted, that “the fish are hungry.”

BlackRock’s Growing Bitcoin War Chest Sparks a Debate About Control

Behind these flows sits a staggering accumulation of Bitcoin. As of this week, BlackRock controls more than 802,000 BTC, following a fresh purchase of 3,450 coins.

🚨Blackrock Buys 3450 BitcoinNow Holds 802,200 BTC1M Bitcoin Soon. pic.twitter.com/NBEjRTrd12

— Thomas Fahrer (@thomas_fahrer) October 9, 2025

At the current trajectory, the asset manager could soon hit 1 million BTC holdings, a figure representing a seismic shift in Bitcoin ownership concentration. A recent US Crypto News publication highlighted that the asset manager is nearing Satoshi Nakamoto’s Bitcoin stash.

However, it is worth noting that other factors significantly affect BlackRock’s prospective $100 billion milestone. For perspective, Balchunas first anticipated BlackRock’s IBIT reaching $100 billion in July, which was over three months ago.

“I wrote last week that IBIT could hit $100 billion this summer, but hell, it could be this month. Thanks to recent flows + overnight rally, it’s already at $88 billion,” Balchunas wrote at the time.

Factors such as fluctuating flows and Bitcoin price volatility have been at play, derailing the landmark target.

Notwithstanding, this fast-paced accumulation is intensifying questions about who ultimately controls Bitcoin’s future.

While ETFs are expanding access, they are also centralizing custody and decision-making power in the hands of financial giants.

Based on this, some critics see BlackRock’s ambitions extending beyond Bitcoin. Investigative journalist Whitney Webb warns that Larry Fink’s vision involves tokenizing and financializing natural assets on a “universal ledger” that would allow unprecedented tracking and control.

“BlackRock being able to unlock and take control of as many natural assets as possible… is obviously a way for them to expand their control not just over people and the existing financial system, but really over the natural world as well,” Webb said in a recent interview.

The convergence of Bitcoin ETF dominance and broader asset tokenization plans suggests a new financial infrastructure where Bitcoin could serve as both a liquidity magnet and a building block in a far more centralized global ledger.

Chart of the Day

BlackRock IBIT ETF Net Assets. Source:

SoSoValue

BlackRock IBIT ETF Net Assets. Source:

SoSoValue

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Crypto ETFs are about to get a major upgrade — Here’s what’s driving it.

- Ethereum price could rally to $12,000 if history rhymes — Here’s why.

- Arthur Hayes: Bitcoin’s 4-year cycle is dead, long live liquidity.

- CZ changes the rules with “Meme Rush” — Here’s what Binance is really building.

- Ethereum whales pin nearly $4 billion on breakout hopes, but $4,620 is the key.

- A $130 million sell-off hits XRP, but one chart pattern signals a possible reversal.

- Why a decline below $120,000 may follow Bitcoin’s record high.

- Sui TVL hits a new all-time high — Is a price breakout next?

- Why Lighter may answer Ethereum’s Perpetual DEX problem.

- Five alarming signs the US is slipping further into recession this October.

- Polymarket could host the biggest crypto airdrop ever: Here’s why.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 8 | Pre-Market Overview |

| Strategy (MSTR) | $330.80 | $328.90 (-0.57%) |

| Coinbase (COIN) | $387.27 | $384.70 (-0.66%) |

| Galaxy Digital Holdings (GLXY) | $41.39 | $41.11 (-0.68%) |

| MARA Holdings (MARA) | $20.20 | $20.24 (+0.20%) |

| Riot Platforms (RIOT) | $21.99 | $22.00 (+0.045%) |

| Core Scientific (CORZ) | $17.53 | $17.53 (+0.022%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Once embroiled in a market manipulation scandal, can Meteora achieve a revival with the help of TGE?

Closely connected with Jupiter, allegedly involved in market manipulation, and with its token "delayed" for two years, the most controversial DEX on Solana is finally about to have its TGE.

What major projects are scheduled to launch their tokens later this year?

Which upcoming token launch projects are worth looking forward to?