US Shutdown Delays Key Economic Data Release

- US shutdown delays jobless claims data release amid economic concerns.

- Data unavailability complicates Federal Reserve decisions.

- Potential indirect effects on financial markets.

The US government shutdown delayed the release of initial jobless claims data for the week ending October 4, impacting economic analysis. This hindered the Fed’s ability to assess the labor market and influenced potential policy decisions.

The delay in releasing initial jobless claims data highlights the shutdown’s broader impact on economic analysis and planning.

The lack of data complicates the Federal Reserve’s ability to assess the labor market and formulate monetary policy. As Pantheon Macroeconomics warns,

“The FOMC will be flying blind at its meeting at the end of this month, if the government shutdown continues.”

The Bureau of Labor Statistics is unable to provide regular economic reports, affecting decision-making for both businesses and policymakers .

The absence of timely data may increase uncertainty in major financial markets, though cryptocurrencies remain unaffected directly. Oxford Economics suggests this might lead to further monetary policy adjustments.

With the absence of reliable economic data, regulators and financial institutions face increased challenges. Pantheon Macroeconomics warns of the Federal Reserve “flying blind,” potentially advocating for rate adjustments to hedge against future economic strain.

Past shutdowns, like the one in 2018-2019, have previously disrupted data releases. The current situation could replicate previous market uncertainties if unresolved. Financial projections become more complex without concrete data, as typically statistics guide market expectations and government strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News: Retail Traders Take Control of BTC Futures Market

EUL has plummeted by 407.66% over the past 24 hours during a significant downward trend

- EUL plummeted 407.66% in 24 hours to $7.819, with 1722.82% drops over 7 days, 1 month, and 1 year. - Technical indicators confirm deepening bearish momentum, with failed resistance breaks and no bullish reversal patterns. - Market participants reassess EUL's viability amid prolonged price erosion, while a backtest analyzes historical 10%+ daily drops to evaluate volatility patterns.

2Z surges by 129.07% within 24 hours during a period of brief market fluctuations

- 2Z surged 129.07% in 24 hours and 102.45% weekly on Oct 16, 2025, contrasting a 5880.93% annual decline. - Analysts attribute short-term gains to market corrections/speculative inflows but note unchanged fundamentals and bearish long-term trends. - Technical indicators signal overbought conditions post-rally, with RSI/MACD suggesting potential near-term pullbacks despite trend deviation. - A backtesting strategy proposes analyzing 5%+ daily gains since 2022 to evaluate post-spike performance patterns in

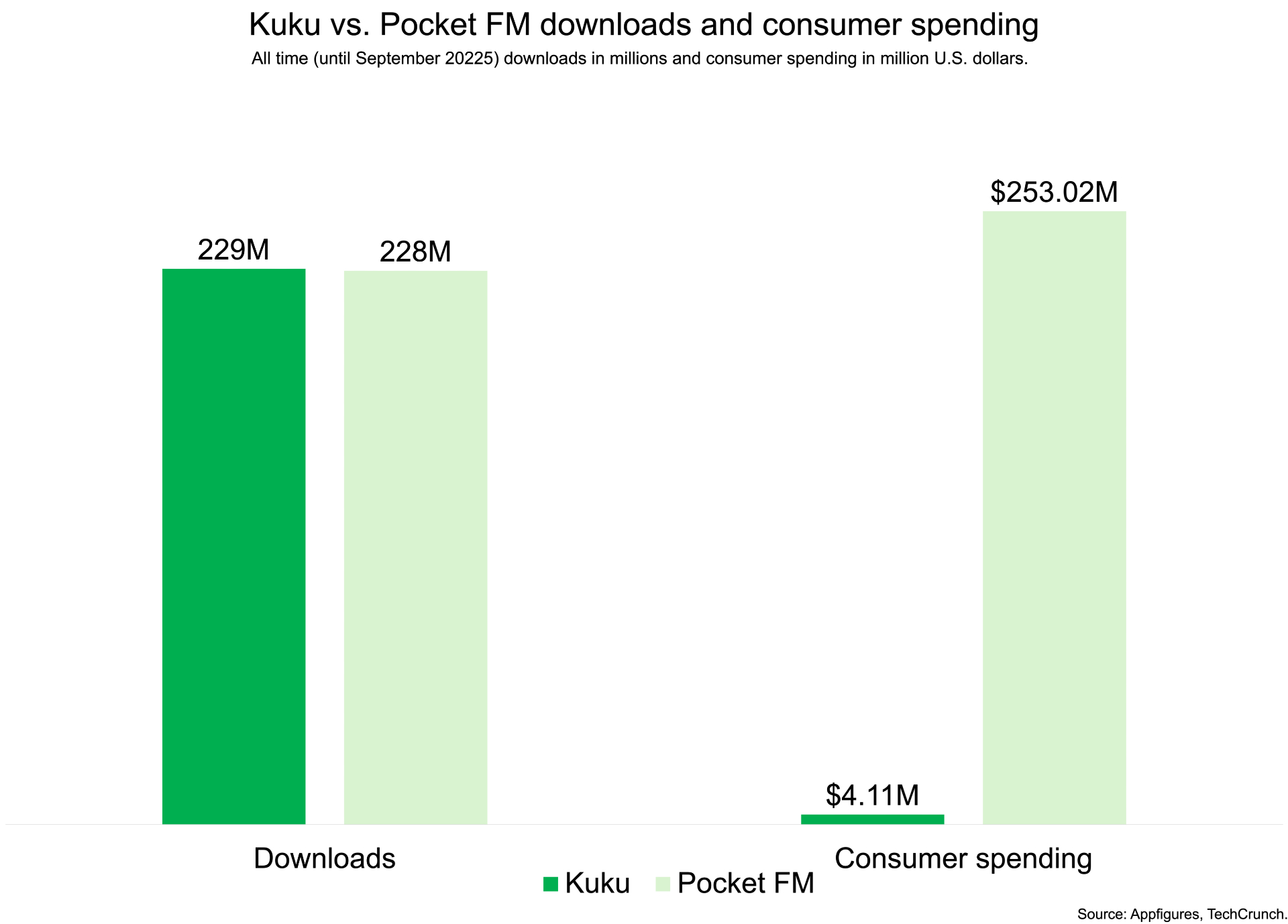

India’s Kuku secures $85 million amid escalating competition in the mobile content space