XRP Price Prediction — Ripple Eyes $5 as Market Analysts Project 40% ETF-Driven Upside

XRP has entered a renewed market optimism as analysts predict a 40% ETF-led upside that could take the token towards the $5 level. The outlook is promising based on strong on-chain data that has seen whale accumulation and fresh capital entering Ripple’s ecosystem.

According to market data, over the past few days, whale wallets ranging between 10 and 100 million XRP have added more than 250 million tokens, approximately $125 million worth of XRP. This buildup has strengthened bullish sentiment, indicating that large investors are lined up for another massive rally. With ETF speculation increasing to a fresh record and liquidity building, the long-term momentum behind the recovery appears to be strengthening for XRP, both from a retail and an institutional perspective. Amid this optimism, another cryptocurrency, MAGACOIN FINANCE, has risen on analysts’ radar, currently regarded as one of the most successful altcoins of the year.

Ripple’s Market Position Strengthens Ahead of ETF Momentum

Ripple is further growing its global value chain with partnerships with top banks and payment service providers. Several leading financial institutions are already implementing the company’s technology for cross-border transactions, underscoring its increasing relevance in the traditional finance domain.

Recent announcements, such as Ripple’s strategic partnership with Bahrain Fintech Bay, highlight Ripple’s dedication to promoting blockchain adoption in emerging markets. This convergence of traditional and decentralized finance has solidified Ripple’s role as a central player in global payments. As ETF speculation intensifies, these developments solidify Ripple’s long-term price outlook, positioning XRP as a consistent contender on watchlists.

XRP Price Analysis and Current Market Trends

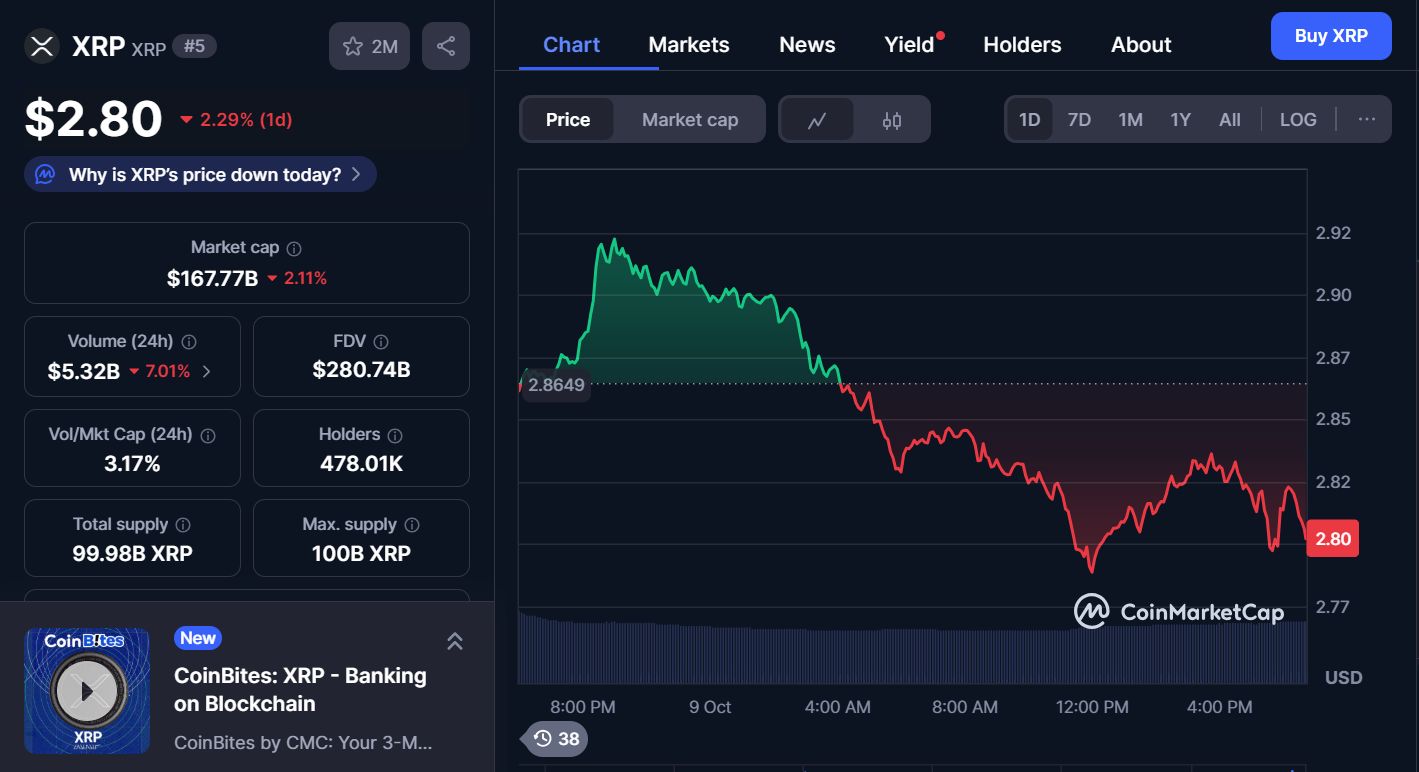

XRP is trading at around $2.97, holding strong support above the $2.80 mark, a strong price zone which analysts cite as the key point for the next breakout. Technical analysis indicators show that this support has proven to be strong against volatility, indicating that the market has been building confidence.

Source: CoinMarketCap

Trading volumes have also surged in recent weeks, as both whales and retail investors show increasing interest. With ETF optimism driving inflows, XRP has built up a distinct bullish structure that aligns with its long-term price outlook for 2025. If there is persistent momentum, a move towards the $5 resistance level is anticipated, indicating renewed market confidence for XRP.

Market Analysts Project 40% ETF-Driven Upside

Analysts anticipate ETF-related gains propelling XRP by a minimum of 40%, as institutional demand continues to grow exposure to legally acceptable crypto assets. Canary Capital CEO Steve McClurg now projects that the ETF could see another $10 billion inflow, up from the previously projected $5 billion. He stated that high investor demand would result in XRP being one of the top ten ETF launches of all time.

Historical evidence supports this view. In past cycles, XRP inflows of $61 million have generated a $16.6 billion market cap increase for the asset, a multiplier of 272X XRP’s cost. Even with reduced levels, analysts believe ETF inflows could still create meaningful upside, taking XRP closer to its long-term target of $5.

As XRP positions for a 40% upside, analysts are also switching their focus to another upcoming altcoin, MAGACOIN FINANCE. The project has become a trending topic amongst market watchers who predict up to 1,400% gains by the end of the year. This valuation projection is the result of an unparalleled surge in whale participation, pushing the early rounds of funding to close prematurely. Massive accumulation from large investors has sparked robust momentum that is triggering excitement across trading communities.

This return of whales is a clear indicator that institutional buyers are forecasting a bull rally is coming. Their aggressive entry confidence has led retail investors to rush in to not miss the expected returns. This FOMO effect has heightened the discussion around the project’s ecosystem, with analysts calling MAGACOIN FINANCE one of the most mentioned new tokens currently in circulation. Its liquidity is increasing visibly, which is establishing it as one of the most promising high-ROI altcoins in 2025.

Factors Supporting the XRP $5 Target

Several factors are fueling XRP’s expected bull run. ETF-led inflows are likely to add liquidity while institutionalizing exposure. Ripple’s growing integration across global banking networks serves as a stable demand base.

Whale accumulation activity also sustains multiyear price stability, meaning major holders remain convinced. Combined with improving macro sentiment and increasing cryptocurrency inflows, these factors add to the positive case for XRP to reach the $5 mark during the upcoming market rally.

Final Thoughts

The latest XRP price prediction reinforces confidence in Ripple’s market outlook, with analysts pointing to ETF inflows as the next major catalyst. A 40% move remains realistic if institutional demand meets current projections.

Alongside XRP’s institutional resurgence, MAGACOIN FINANCE continues to capture market attention as a high-ROI opportunity driven by whale accumulation and retail excitement. Together, these assets define the dual narrative of 2025, XRP for institutional strength, and MAGACOIN FINANCE for exponential returns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."