BREAKING: Ethereum Crashes Below $4K as Crypto Market Suffers Massive Selloff

Ethereum Takes a Major Hit – Down Over 10%

Ethereum ( $ETH ) has joined $Bitcoin in one of the worst market crashes of 2025, dropping over 10% in 24 hours and breaking below the $4,000 mark for the first time in weeks. The current price sits around $3,900, after hitting a low near $3,436 during the panic selloff.

The sharp drop follows the market-wide crash triggered by Trump’s 100% tariff announcement on China, set to take effect on November 1st — a move that sent shockwaves across global risk assets, from stocks to crypto.

Chart Analysis: ETH Breaks Key Support

As seen in the attached chart, Ethereum experienced a massive red candle, collapsing below its 50-day SMA (~$4,400) and slicing through the critical support at $4,356.

ETH/USD 1-day chart - TradingView

Key takeaways from the chart:

- ETH plunged over 10.6% in one day, wiping out weeks of gains.

- Next major supports lie around $3,840, $3,500, and $3,200.

- The 200-day SMA sits near $3,098, a potential long-term floor if the selloff deepens.

This breakdown confirms a strong bearish reversal, as ETH failed to sustain its breakout and quickly reversed into a liquidation-driven dump.

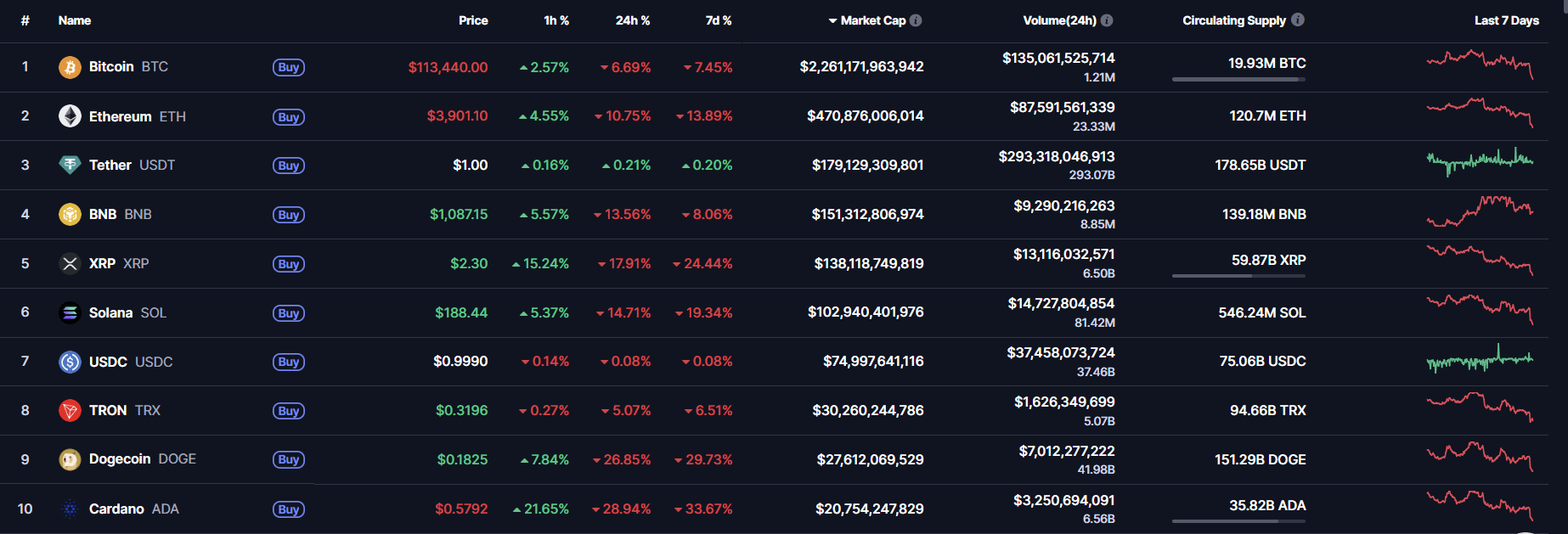

Altcoins Join the Crash

$Ethereum wasn’t alone — the entire altcoin market turned red, with top assets showing heavy double-digit losses:

- $BNB: down 13.09%, now trading near $1,093

- $XRP: down 17.16%, sitting at $2.32

- Solana ($SOL): fell 14.31% to $189.21

- TRON ($TRX): down 5.06% to $0.32

- Even top memecoins like $DOGE plunged 26.48%, showing the intensity of the crash

Across the board, over $400 billion in market capitalization vanished, dragging total crypto valuation from over $4.1 trillion to below $3.7 trillion before a slight recovery attempt.

Why the Market Is Crashing

The selloff was triggered by the BREAKING news that President Trump has imposed a 100% tariff on all Chinese imports, effective November 1st.

This announcement has raised fears of:

- A renewed U.S.–China trade war,

- Higher inflation, and

- Reduced global liquidity — all of which are bad for speculative assets like crypto.

With investors rushing to safer positions, risk assets were dumped heavily, causing cascading liquidations across futures markets.

What’s Next for Ethereum?

Traders are now watching whether ETH can hold above $3,800–$3,500. If this range fails, the next stop could be $3,200–$3,100, near the 200-day moving average.

However, a quick rebound remains possible if Bitcoin stabilizes around the $111K–$113K zone. In that case, ETH could retest $4,200–$4,400 before regaining bullish momentum.

For now, the short-term outlook remains bearish, with volatility expected to stay high through the coming week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Elon Musk: Bitcoin’s Value Is Built on Energy, Not Trust

California Crypto Law: SB 822 Protects Unclaimed Digital Assets

Bitcoin Profit Resilience: 90% of Supply Still in Green

Market Maker Wintermute Reviews "1011", the Largest Liquidation Day in Crypto History

The US imposition of tariffs on Chinese goods has triggered a wave of risk aversion in the market, leading to a decline in the stock market and large-scale liquidations in cryptocurrencies. After a synchronized sharp drop, the spot market quickly rebounded, with BTC and ETH showing the strongest resilience. Options market trading volume reached a record high, and demand for short-term put options surged. The perpetual contracts market underwent an extreme test, with a significant increase in on-chain liquidation activities. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.