October 11th Market Key Intelligence, How Much Did You Miss?

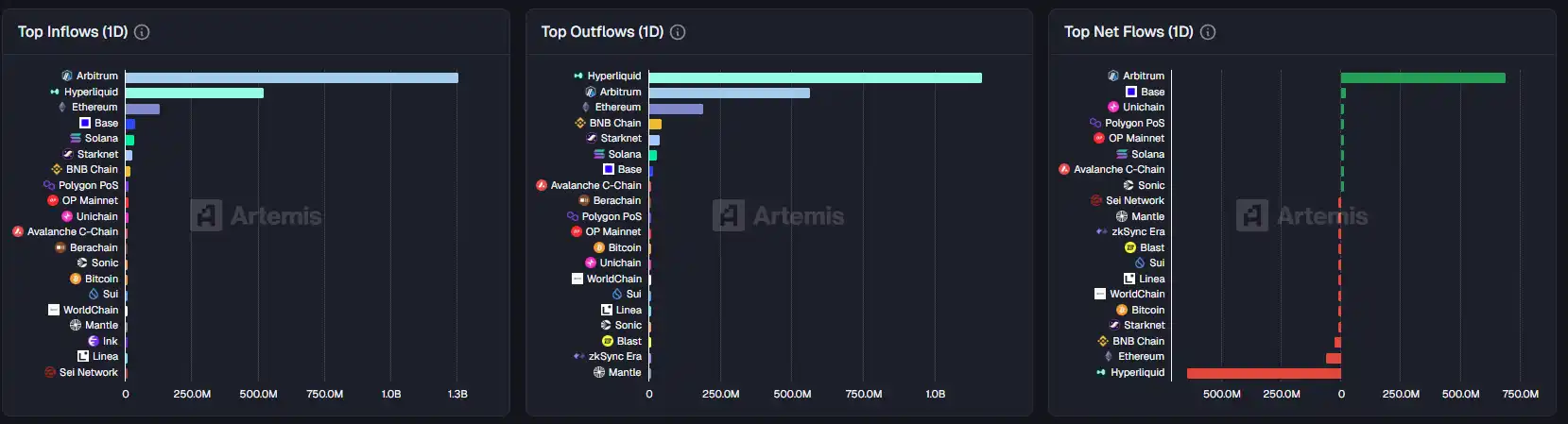

1. On-chain Flows: $691.7M USD inflow to Arbitrum today; $642.5M USD outflow from Hyperliquid 2. Largest Price Swings: $HAQIMI, $TRADOOR 3. Top News: Hyperliquid launches DEX-based live streaming platform "Based Streams," going live today at 8:30 PM

Featured News

1. Chinese Meme Token "Hakimi" Surpasses $87 Million in Market Cap with a 160% 24-hour Gain

2. Privacy Token ZEC Breaks Through $275 Against the Trend, with a Nearly 352% Gain in the Past 2 Weeks

3. US Crypto Stocks Experienced a Universal Decline Last Night, with CRCL and BMNR Dropping Over 10%

4. ZeroBase Founder States They Did Not Convert Stablecoins to USDe Nor Pledge USDe

5. Binance Indicates Review of Compensation Plan for De-pegging Incidents of Tokens like USDE, Will Strengthen Risk Management Mechanisms in the Future

Featured Articles

1. "Is This the Real Reason Behind the $20 Billion Liquidation in the Crypto Market?"

October 11, 2025, a day that will forever haunt crypto investors worldwide. Bitcoin's price plummeted from a high of $117,000, breaking below $110,000 within hours. Ethereum saw an even more brutal drop of 16%. Panic spread like wildfire in the market, with numerous altcoins crashing 80-90% in an instant, followed by a slight rebound but generally down 20% to 30%. In just a few hours, the global crypto market lost billions of dollars in market capitalization. On social media, cries of despair echoed worldwide, various languages melding into one collective elegy. Beneath the facade of panic, the true underlying chain of transmission was far more complex than it appeared.

2. "Trader's Insight: Why Did This Market Experience an Epic Plunge, and When Is the Right Time to Buy the Dip?"

On October 11, 2025, this day will be engraved in the annals of crypto history. Influenced by the announcement of the resumption of the trade war by U.S. President Trump, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported cliff-like drop, and the chain reaction quickly spread throughout the entire crypto market. According to Coinglass data, in the past 24 hours, the total amount of liquidations across the network reached as high as $19.1 billion, with over 1.6 million liquidated accounts—both in terms of amount and number of people, this event has set a new record in the ten-year history of cryptocurrency contract trading.

On-chain Data

On-chain fund flow on October 11

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altseason Start? TOTAL3 Chart Signals a Big Move

TOTAL3 hints at a major altcoin rally, mirroring the 2020 Altseason start after a sharp liquidation event.A Flashback to 2020’s Liquidation Candle

Avalon X Sets Sights on Becoming the ‘Ethereum of RWAs’ in Real Estate

Avalon X aims to be the “Ethereum of RWAs” by revolutionizing real estate through tokenization, global access, and a $1M crypto townhouse giveaway.How Avalon X Brings Real-World Assets On-ChainAvalon X vs Ethereum: Why Ethereum’s Model Inspires Avalon XAvalon X Presale Prizes, Townhouse, and $1M crypto giveaway

Bitmine Immersion acquires over $830M worth of Ethereum

Hackers' Wallets Lose $5,5 Million Selling and Buying Back ETH