10.11 Flash Crash Behind the Scenes: Whale Initiates $1.1 Billion Short Position Three Days in Advance, Rakes in $200 Million in a Single Day

Is Insider Trading Really the King of Cryptography?

Original Article Title: "The Whale Knife Fight Behind the Biggest Liquidation Day in Crypto History: Air Force Drunk, Knife Drawn"

Original Article Author: Wenser, Odaily Planet Daily

Upon waking up, I wasn't the only one who thought they were seeing things.

According to Coinglass data, the total liquidation amount in the past 24 hours was $19.133 billion, with as many as 1,618,240 liquidated positions. OKX's market data shows that BTC once dropped to $101,500; ETH dropped to $3,373; SOL dropped to around $144. For more details on the spot price situation, see "A Terrifying Night of Plummet: Single-Day Liquidation Hits Record $19.1 Billion, Wealth Flows Wildly" and "Amidst the Big Drop, Who 'Licked the Blood' at the Edge of the Knife to Earn Billions? What Instant Fortune Opportunities are Right Before Our Eyes?".

Although the prices of major mainstream coins have seen varying degrees of recovery, this is still a wealth feast belonging to the bears. And the biggest winner with overflowing pockets in this wave of extreme market conditions is undoubtedly a BTC OG who is suspected of insider trading and a crypto whale who opened a nine-figure short position. Odaily Planet Daily will briefly analyze the insider whale's related operations and potential identity in this article.

The Crypto Whale Opens a Nine-Figure Short Position, Raking in $200 Million in a Single Day

Perhaps no one expected such a massive pullback in the BTC price after reaching a new high, except for some insiders and a few sharp-eyed crypto whales.

Bitcoin OG Whale Opens Massive Short Position Three Days in Advance, Operation Records Detailed

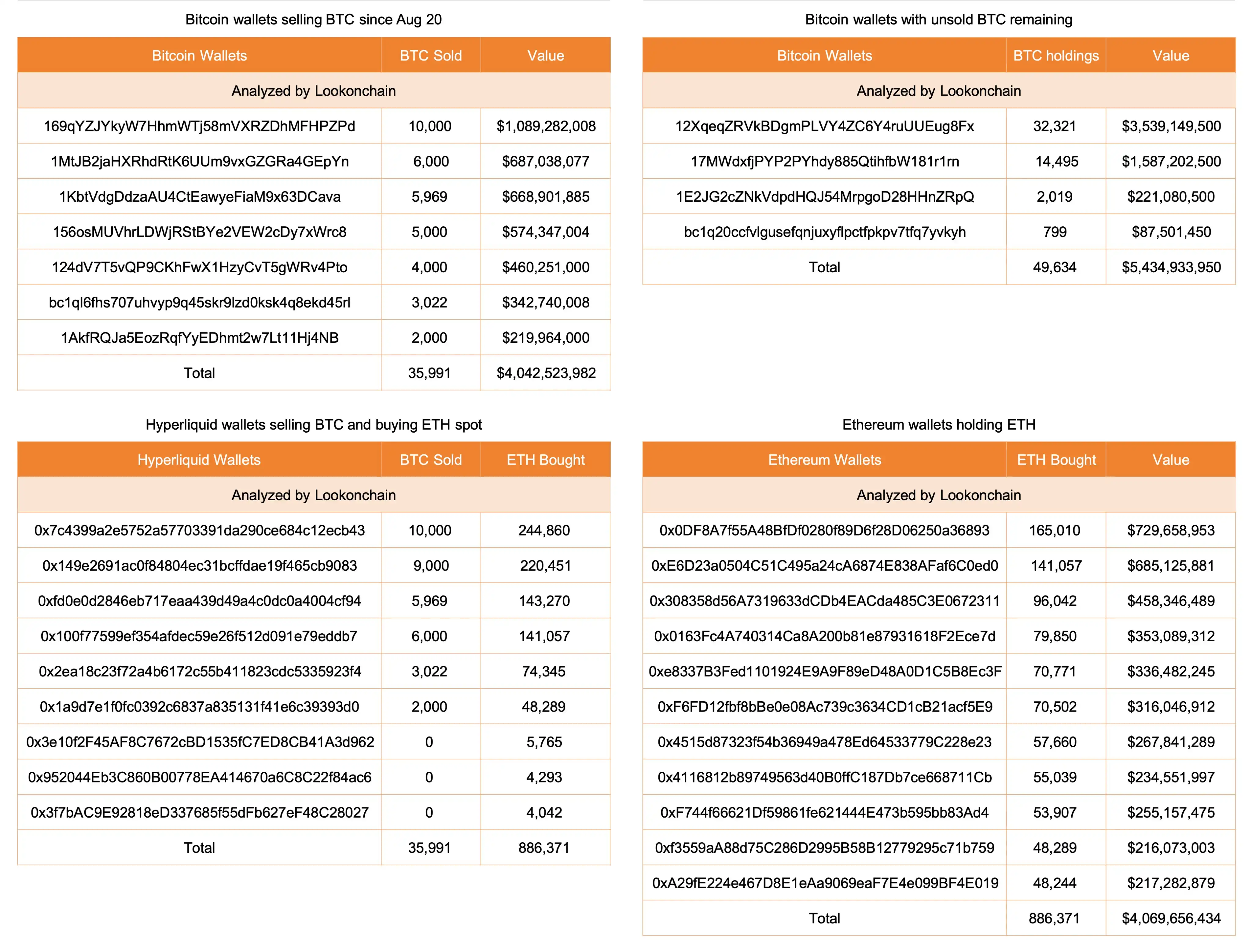

A BTC OG whale with unrealized gains exceeding $70 million began trading as early as August 20th: According to LookonChain monitoring, since August 20th, this trader/institution has sold nearly 36,000 BTC and bought over 886,000 ETH on Hyperliquid, with an ETH/BTC exchange rate of 0.0406; across their other four wallets, they still hold over 49,000 BTC worth $5.43 billion.

On October 8, the whale once again sold 3000 BTC, worth $3.63 billion. Currently, out of the 3 related addresses, 2 addresses have been emptied; one address still holds

Address List:

bc1pxeg2c8yy5gklex2z8qvmxlwgvf7kzhx07a68xek52kfl0s9dc20qjydsuu (emptied);

0x757f88e931ef4d57c23b306c5a6792fc0d16edb2 (Hyperliquid address, emptied);

0x4f9A37Bc2A4a2861682c0e9BE1F9417Df03CC27C (holds $426 million USDC).

On October 10, the whale started its own 「insider short-selling performance」 —

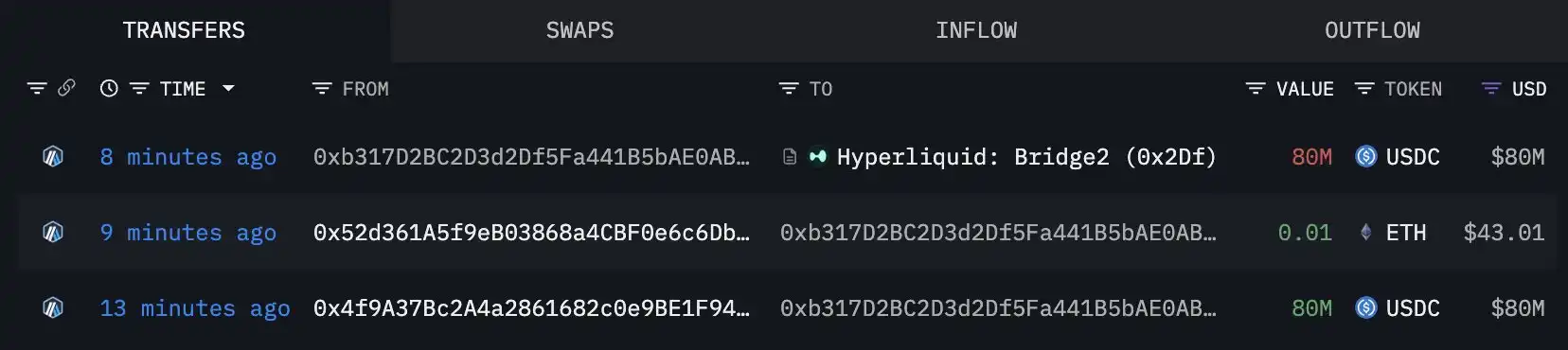

It first deposited $80 million into Hyperliquid, opened a 6x short position for 3477 BTC; in addition, it also deposited $50 million USDC into Binance. Address: 0xb317D2BC2D3d2Df5Fa441B5bAE0AB9d8b07283ae;

Subsequently, it increased its short position again, increasing the BTC short position to 3600 BTC.

Yesterday afternoon, it targeted ETH for short-selling, deposited $30 million into Hyperliquid, and opened a 12x short position for 76,242 ETH. On-chain address seen here, and currently, this address has been emptied.

On the night of the 10th, the whale's short position continued to increase, reaching around $1.1 billion, with the BTC short position worth $752 million; the ETH short position worth $353 million.

And as Trump launched another tariff war last night, causing a market downturn, the whale's short position also turned losses into gains, briefly profiting over $27 million;

Today's breaking news, data from Hypurrsan shows that the whale who previously shorted BTC and ETH has withdrawn $60 million USDC back to Arbitrum, making a profit of $72.33 million in the past 24 hours.

In an extreme market situation, Hyperliquid emerges as the winner again, with HLP daily profits exceeding $40 million

Furthermore, according to on-chain analyst @mlmabc, the whale's daily profit on Hyperliquid is approximately $190-200 million; on the other hand, amidst the extreme market situation, Hyperliquid also got a piece of the pie: HLP's daily profit soared to $40 million; the annual interest rate skyrocketed to 190%; and the overall capital return reached 10-12%.

The hidden identity of the insider whale: Is it related to Trend Research?

As for the behind-the-scenes identity of the whale, there is currently no conclusive evidence.

However, according to Lookonchain analysis, the high-profile Ethereum whale who flipped to Bitcoin may be associated with Trend Research, a subsidiary of Yee Research. The evidence is that wallet 0x52d3 previously sent 0.1 ETH to this Bitcoin OG address as a gas fee, and then deposited 1.31 million USDC to Trend Research's Binance deposit address.

Odaily will also continue to follow market dynamics and bring more news about this crypto whale/institution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ultiland: The new RWA unicorn is rewriting the on-chain narrative of art, IP, and assets

Once attention forms a measurable and allocatable structure on-chain, it establishes the foundation for being converted into an asset.

Crypto 2026 in the Eyes of a16z: These 17 Trends Will Reshape the Industry

Seventeen insights about the future summarized by several partners at a16z.

The Federal Reserve's $40 billion purchase of U.S. Treasuries is not the same as quantitative easing.

Why is RMP not equivalent to QE?