How Did Zcash Defy The Crypto Market Crash To Hit An All-Time High?

Zcash (ZEC) defied a $20 billion crypto liquidation wave, soaring 450% in a month to reach a four-year high.

Zcash (ZEC) has emerged as one of the few digital assets to rally amid one of the harshest liquidation waves in recent crypto history.

As nearly $20 billion in leveraged positions vanished following President Trump’s unexpected tariff announcement, the privacy-focused cryptocurrency surged to a four-year high.

Why is Zcash Price Rising?

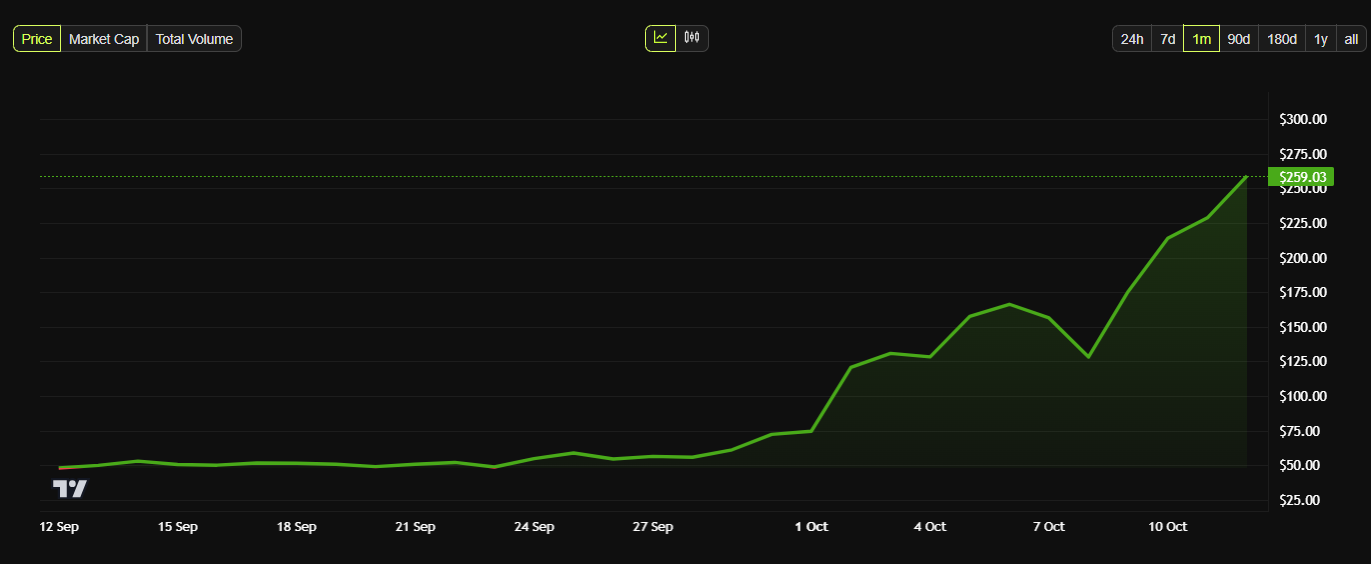

Data from BeInCrypto showed ZEC price briefly touching $282.59 on October 11 before easing to about $257.96. Even after that pullback, the token posted a 15% daily gain—its strongest since late 2021, when it last traded near $295.

This continues an upward movement for a digital asset that has climbed over 100% this week and nearly 450% in the past month.

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s rally has been aided by crypto traders’ rotation into privacy-centric projects following increased financial surveillance by global authorities.

Moreover, the token’s positive performance has been amplified by industry figures such as Barry Silbert, founder of Digital Currency Group. Notably, he has reshared multiple Zcash-related updates in recent days.

Outside of that, some community members have pointed out that Zcash remains undervalued relative to its fundamentals.

Mert Mumtaz, CEO of Helius Labs, argued that ZEC has operated as a proof-of-work, fully distributed network for nine years.

According to him, the project offers user sovereignty, advanced encryption, and Bitcoin-like tokenomics at a fraction of the market capitalization of peers such as Litecoin or Cardano.

Mumtaz also cited a “renaissance” of developer activity, with new contributors focusing on performance improvements and exchange integrations.

Considering this, he argued that the token “is the most obvious mispricing in crypto,” while adding that:

“The community using the power of crypto and public markets to breathe life back into the project,” Mumtaz said.

Launched in 2016, Zcash uses zero-knowledge proofs to enable private transactions without revealing the sender, receiver, or amount. These features are missing in top cryptocurrencies like Bitcoin and Ethereum.

So, as governments worldwide increase financial surveillance, Zcash’s shielded-transaction model is regaining relevance among privacy-minded users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Renewable Energy Learning: An Unseen Driver of Expansion in 2025

- 2025 wind energy education programs are critical for addressing a 100,000-technician labor gap and advancing green infrastructure. - Institutions like STL USA and NREL integrate AI analytics, blade recycling, and hands-on turbine training to meet industry demands. - Industry partnerships with OEMs and $36M+ in federal funding accelerate workforce development but face policy risks from DOI land-use restrictions. - Global clean energy investment reached $2.1T in 2024, with U.S. renewables accounting for 93

Investing in EdTech and Skills Training to Empower Tomorrow's Workforce

- Global high-growth sectors like AI, renewables, and biotech are reshaping workforce demands, driving rapid STEM education evolution through edtech and vocational training. - AI-powered adaptive learning and immersive VR/AR tools now personalize education, with 36% of 2024 edtech funding directed toward workforce-specific skill development. - Vocational programs and industry partnerships (e.g., U.S. EC4A, EU Green Deal) are closing STEM skills gaps, creating direct pipelines to 16.2M+ clean energy jobs by

The Rising Influence of EdTech on Career-Focused Investment Prospects

- Global EdTech market grows at 20.5% CAGR to $790B by 2034, driven by STEM/digital skills demand. - STEM workers earn 45% higher wages; 10.4% occupation growth vs 4.0% non-STEM, reshaping labor markets. - 2025 EdTech VC investments show 35% YoY decline, concentrating on AI tools and scalable upskilling platforms. - MENA/South Asia EdTech sees 169% funding growth, addressing equity gaps through global platforms. - AI-driven EdTech and M&A activity (e.g., ETS-Ribbon) highlight sector's shift toward outcome-

KITE Price Forecast Following Listing: Managing Post-IPO Fluctuations and Institutional Investor Outlook

- Kite Realty Group (KITE) fell 63% post-IPO despite strong retail occupancy and NOI growth, highlighting valuation disconnect between real estate fundamentals and tech IPO expectations. - Institutional sentiment split: COHEN & STEERS boosted holdings by 190% amid industrial pivot, while others divested $18. 3M , reflecting uncertainty over hybrid retail-industrial strategy execution. - Analysts remain divided on $24–$30 price targets, balancing KITE's 7.4% dividend increase and industrial shift against ma