October 13 Key Market Insights, A Must-Read! | Alpha Morning Report

Featured News

1.Due to Trump's Moderate Speech, Cryptocurrency and Major U.S. Stock Index Futures Rebound

2.Binance Has Compensated $283 Million to Users Affected by USDE and Other Assets' De-pegging, Spot "Zero Price" Only a Display Issue

3.$216 Million Liquidated Across the Network in the Past Hour, Mainly Short Positions

4.Cryptocurrency Total Market Cap Rebounds Above $4 Trillion, 24-hour Increase of 5.6%

5.Macro Outlook for the Week: Powell Speech on Tuesday Night

Articles & Threads

1.《Weekly Review | Epic Cryptocurrency Market Crash Leads to 1.6 Million Liquidations; Monad Airdrop Claim Portal to Open on October 14》

After hitting a historic high of $126,000, Bitcoin experienced an epic crash. The U.S. Bureau of Labor Statistics is expected to release the CPI report during the government shutdown, and Binance Alpha launched various Chinese narrative meme coins on the contract platform.

2.《Traders' View | Why Did This Epic Market Crash Happen, and When Is the Right Time to Buy the Dip?》

October 11, 2025, a day that will be engraved in crypto history. Influenced by U.S. President Trump's announcement of restarting the trade war, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported cliff-like decline, which quickly spread throughout the entire crypto market. However, why was this liquidation so intense? Has the market bottomed out? ReLive BlockBeats compiled perspectives from multiple market traders and well-known KOLs, analyzing this epic liquidation from the macro environment, liquidity, market sentiment, and other perspectives, for reference only.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

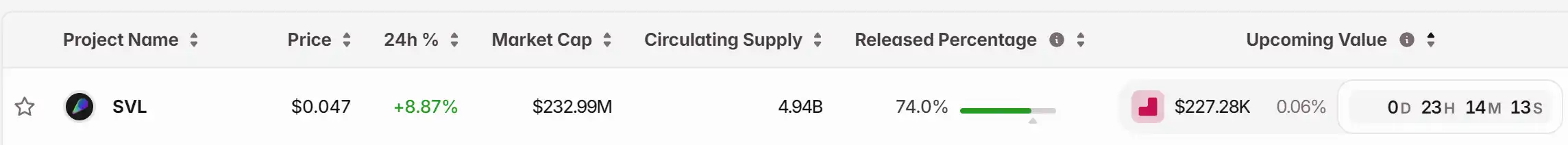

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Price Forecast Post-Listing: Understanding Institutional Attitudes and Market Fluctuations

- KITE's post-IPO price fell 63% by Nov 2025 amid divergent institutional strategies and retail sector uncertainty. - Analysts split between "Buy" ($30 target) and "Hold" ratings, citing operational gains vs. macro risks like the $3.4T deficit bill. - Q3 net loss (-$0.07 EPS) and 5,400% payout ratio highlight structural risks despite industrial real estate pivots and 7.4% dividend hike. - Institutional trading directly impacted price swings, with COHEN & STEERS' stake increase briefly stabilizing shares be

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook