Following a weekend marked by high volatility, the cryptocurrency market showed significant recovery momentum on Monday morning. XRP experienced an approximately 8% increase, regaining around 30 billion dollars in market value as investor confidence started to mend after a tariff shock. Meanwhile, Dogecoin $0.208131 surged by 11%, driven by an uptick in institutional entries and increased buyer volume.

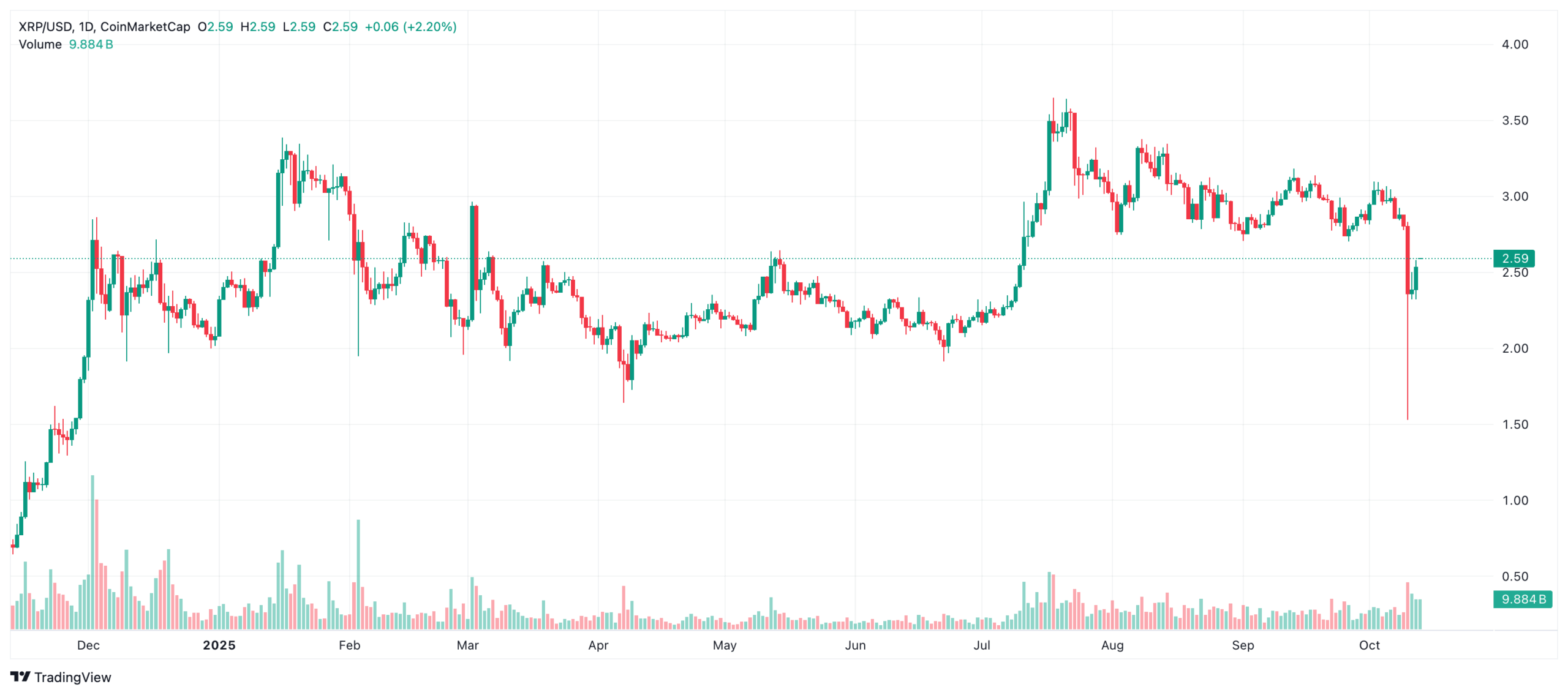

XRP’s Remarkable 30 Billion Dollar Comeback

XRP rebounded from last week’s steep sell-off, rising from $2.37 to $2.58, marking one of its most actively traded days. The influx of high-volume purchases from institutional investors reinforced the buying trend, fostering stability above the $2.57–$2.59 range.

XRP

XRP

Analysts indicate that closures above $3.12 could confirm a robust weekly performance historically. Conversely, dips below $2.50 keep the risk of a retreat towards $2.42 alive. Despite cross-asset sales driven by tariffs, XRP’s price action maintains an ascending channel structure.

Liquidations exceeding 19 billion dollars over the weekend cleared leverage, selectively reshaping risk appetite. Despite the weak trend in indices, there are selective entries from institution-driven desks into XRP. Observing whether $2.57 acts as new support, and if the $2.70-$2.75 target range becomes accessible will be pivotal in the following hours.

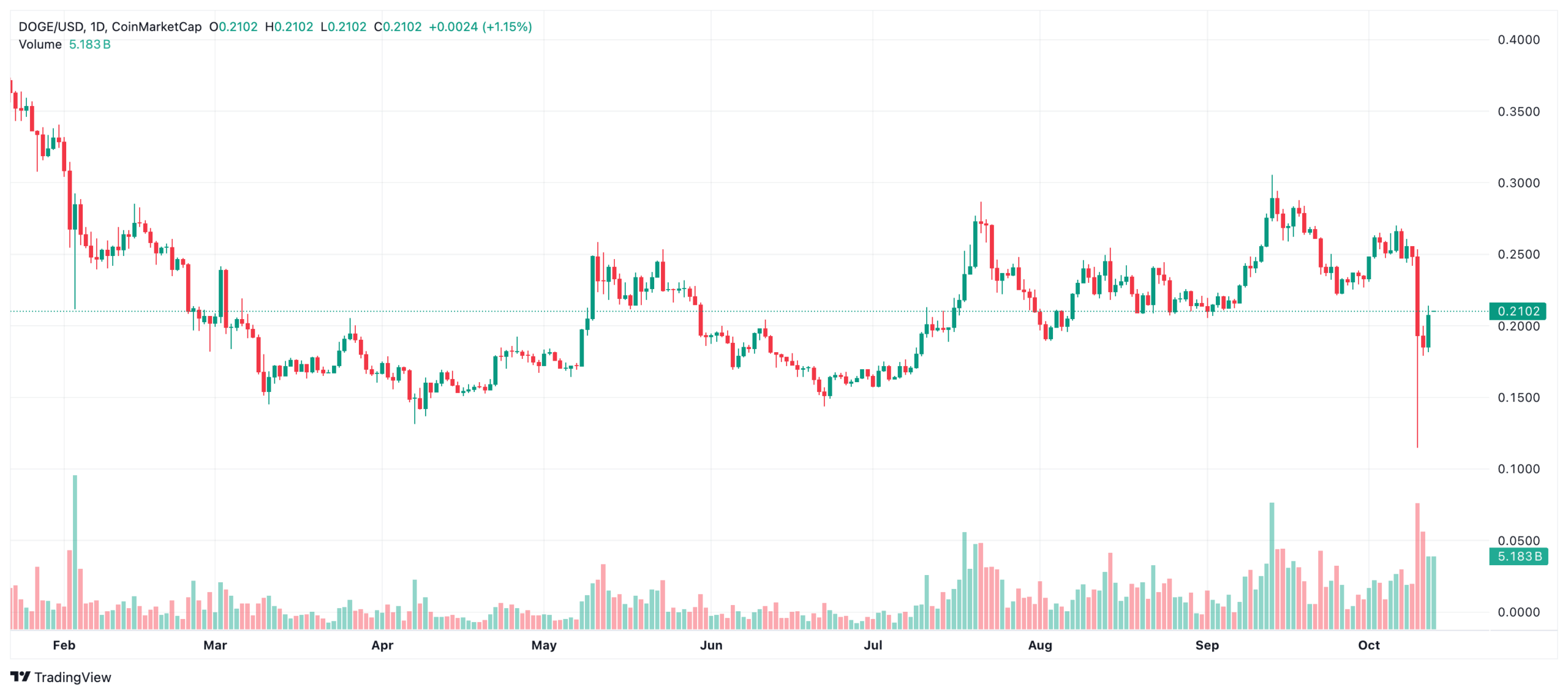

Dogecoin’s Volume Surge

Dogecoin, with an 11% rise within 24 hours, approached the $0.22 threshold. Buyer volume surged to roughly four times the daily average, supporting the momentum. Breakout attempts spearheaded by institutional desks fortified the ground at $0.19, while confirmation closures are awaited to surpass the supply concentrated at the $0.22 area. Technical indicators suggest the upward trend remains intact, with the $0.24-$0.25 range as a short-term target. A break below $0.20 could trigger short-term unraveling.

Dogecoin

Dogecoin

The rally in the largest memecoin encompasses a volume of professional fund flows that cannot be merely attributed to individual interest. Growth in open positions and Blockchain accumulation signals suggest a shift in the memecoin market, favoring DOGE. The focus remains on the end-of-day closure to confirm a level above $0.22, essential for institutional continuity into the week.