TL;DR

- ETH is up 8.5% in the last 24 hours and is now trading above $4,100.

- The coin could extend its recovery if the daily candle closes above $4,232.

ETH tops $4,100 after Friday’s flash crash

Ether, the second-largest cryptocurrency by market cap, is recovering excellently following Friday’s crash. The market crash saw ETH briefly touch the $3,500 region as it lost over 30% of its value within an hour.

However, the coin has now added 8.5% to its value over the last 24 hours and is now trading at $4,165 per coin. The crash was caused by President Trump announcing new tariffs against Chinese imports.

While commenting on the recent market events, Nick Forster, Founder at leading onchain options platform, Derive.xyz, stated that, on the day of the crash, options skew dropped sharply for both BTC and ETH, reflecting a rush into downside protection. Skew measures the relative demand for calls versus puts; a more negative value indicates higher demand for puts.

“Volatility spiked sharply across BTC and ETH markets. Typically, sharp selloffs only lift short-dated volatility (1-7 DTE) as traders expect near-term turbulence to subside. However, Friday’s downturn drove elevated volatility across all expiries, signaling expectations of sustained turbulence and a choppy road ahead,” Forster added.

ETH could surge higher if the daily candle closes above $4,232 resistance

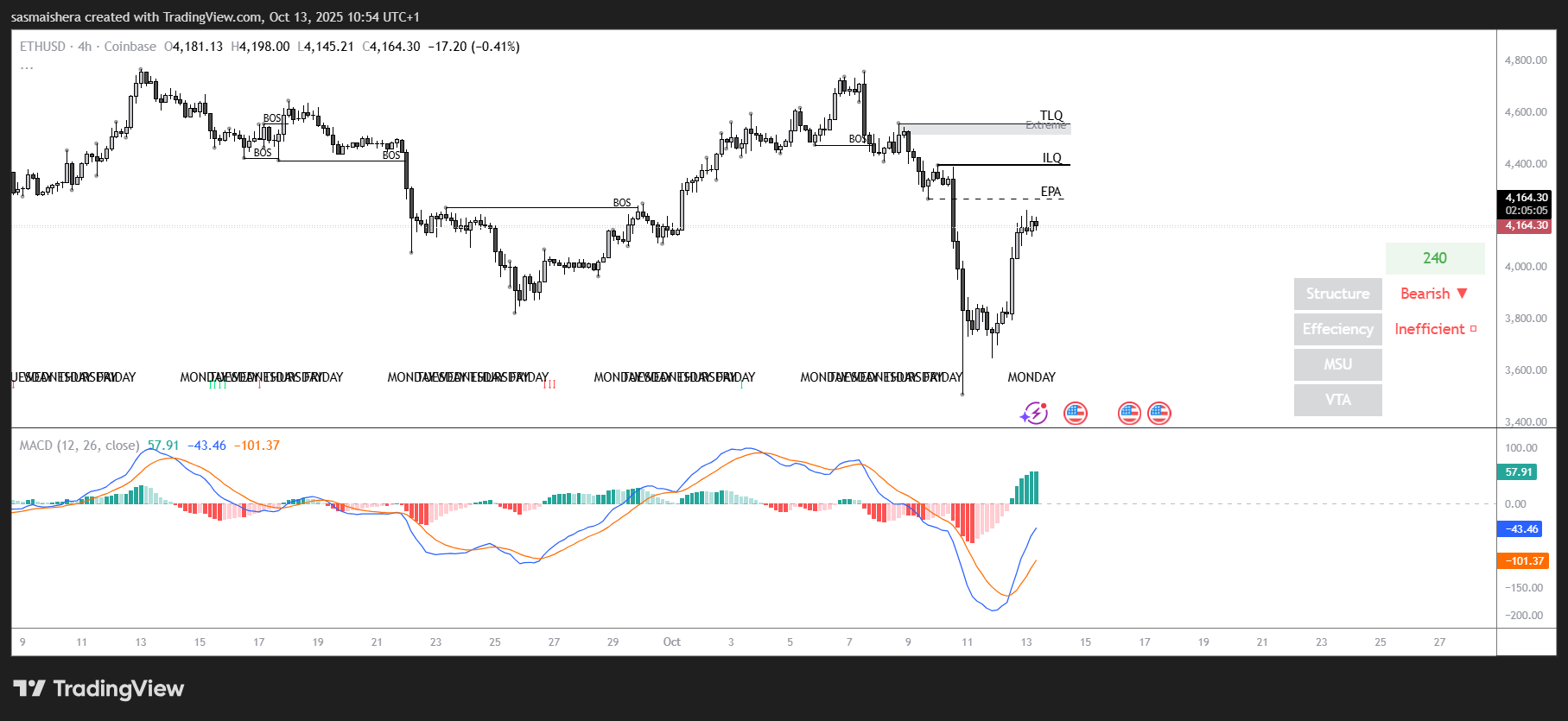

The ETH/USD 4-hour chart is bearish and inefficient thanks to Friday’s price action. ETH failed to find support around the daily level at $4,488 last week and dumped by over 20% on Friday. However, it has recovered slightly, closing above $4,150. At press time, ETH hovers at around $4,160.

Like Bitcoin, Ethereum’s MACD still supports the bearish view but could change soon as the buying pressure increases. The RSI of 54 is above the neutral 50, suggesting that buyers are regaining control of the market.

If ETH continues its recovery and closes above the daily resistance at $4,232, the coin could surge higher towards the next key resistance level at $4,488. However, failure to overcome the $4,232 resistance could see ETH extend its decline toward the 61.8% Fibonacci retracement level at $3,593 in the coming days.