Bitcoin, mining stocks and gold regain footing as Trump walks back tariff threats

Quick Take Bitcoin reclaimed the $114,000 level as global markets staged a broad recovery led by U.S. equities and gold. Signs of a U.S.–China trade thaw helped steady investor sentiment after one of the most volatile weekends of the year.

Markets rebounded sharply on Monday after a tense weekend capped by U.S. President Donald Trump's surprise threat to reimpose tariffs on Chinese imports late Friday, a move that rattled global risk sentiment before being softened in subsequent remarks.

Crypto bore the brunt of the selloff, with total market capitalization plunging nearly 11% from about $4.24 trillion to $3.78 trillion, before recovering to reclaim the $4 trillion mark Monday morning. Bitcoin climbed back above $114,000 while ether traded over $4,100, according to The Block price data .

The rebound extended across traditional markets, with the S&P 500 up more than 1.5% in the first few hours of trading on Monday, putting it on track for its strongest session since May and adding roughly $850 billion in market value.

This optimism has spilled over into crypto-related equities , particularly bitcoin miners. Bitfarms (ticker BITF) and Cipher Mining (CIFR) surged 22% and 17%, respectively, while Marathon Digital Holdings (MARA) and Hut 8 (HUT) each gained nearly 10% on the day. However, crypto exchange stocks continue to lag the rebound. Gemini Space Station (GEMI) and Bullish (BLSH) each fell more than 3%, while Coinbase (COIN) slipped about 2%.

But precious metals like gold and silver came out on top. Gold continued on its move higher, hitting a fresh all-time high above $4,120, while silver futures contracts closed in on their own all-time high near $50. Kevin Rusher, founder of real-world-asset platform RAAC, said the move highlights gold’s enduring appeal amid volatility.

"It's a testament to why gold is at an all-time high," Rusher said, adding that "perhaps crypto is still significantly more vulnerable, thanks to what is still a huge liquidity issue."

Tariff timeline

Investor nerves eased Monday on the back of signals from Washington that suggested trade tensions may not escalate as feared. Over the weekend, senior administration officials emphasized that U.S.–China relations remain "good," and Treasury Secretary Scott Bessent said that 100% tariffs on Chinese imports "don’t have to happen."

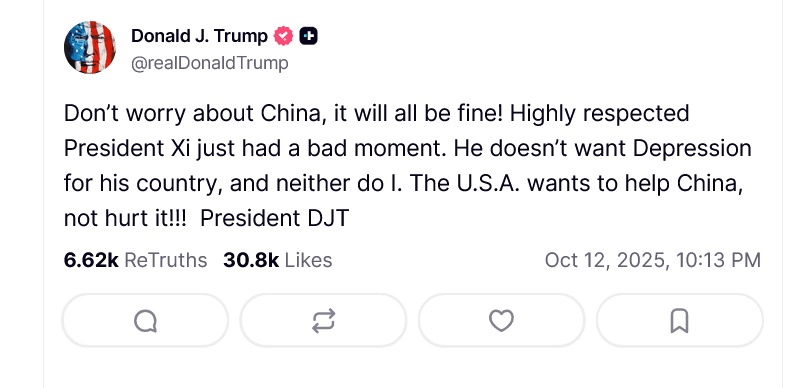

The softer tone marked a sharp reversal from late Friday, when Trump’s social media posts reignited fears of sweeping tariffs. Those remarks followed about a day after China unveiled new export controls — measures that initially drew little market reaction until Trump’s comments sent traders scrambling to de-risk.

Beijing later clarified that the restrictions were limited in scope and not a full export ban, prompting Trump to post that " it will be all fine " on Truth Social. By Monday morning, administration officials were already signaling that the proposed tariffs were unlikely to take effect.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto fundraising hits record $3.5B last week amid market volatility

CME Group launches CFTC-regulated Solana and XRP options

Cosmos Health expands Ethereum holdings to $1.8M under $300M digital assets facility

BIG XRP News: Why XRP Might Be Quietly Positioning for a $12 Shock