30 top indicators show "zero trigger", Bitcoin is at the critical point before the main upward wave

I have been in this market for five years, experiencing three complete bull and bear cycles, going from losses to profits of over $3 million.

There is one thing I have learned: no one can precisely predict the top, but data can bring you closer to the truth.

I have tracked 30 historical bull market top indicators, from on-chain to macro, from capital flows to market sentiment.

The result is astonishing—so far, not a single one has been triggered.

This means: we are still in the stage before the main upward surge, and the real frenzy has not yet begun.

1️⃣ Data doesn't lie: All 30 top indicators have not flashed red

In the 2017 and 2021 bull market cycles, when half of these indicators turned red, the market crashed within just a few weeks.

And now? 0/30 triggered.

Whether it's MVRV Z-Score, Puell Multiple, Altseason Index, or NUPL,

all indicators are showing a "continue holding" signal.

This is not "faith," but a statistically significant calm confirmation: the market is still in the expansion phase.

2️⃣ Key on-chain indicators show: the bull market is not overheated

AHR999 Index is only 1.16 (historical tops require >4)

MVRV Z-Score is only 2.5 (while previous top ranges were 7–10)

Reserve Risk remains extremely low, indicating that long-term holders have no intention to sell

The significance of this data combination is very clear:

The market is far from the "crazy" stage,

and this is just the beginning of the "engine acceleration phase."

3️⃣ Institutional funds are still net inflowing, smart money has not exited

ETF capital flows remain positive.

Records of inflows over the past ten days show that there has not been a single large-scale redemption.

The behavior of institutional funds is very clear—they are quietly, steadily, and continuously accumulating,

waiting to offload when retail investors finally enter the market.

When "smart money" is still buying, a market top cannot form.

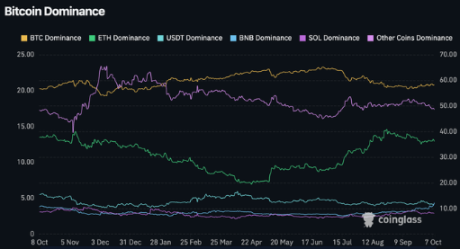

4️⃣ Altcoins and BTC dominance: capital rotation has not yet begun

Bitcoin dominance (BTC.D) is still as high as 58%.

At the bull market tops in 2021 and 2017, this figure had dropped below 40%.

This shows that funds have not yet flowed into the high-risk altcoin sector—

the real "frenzy" has not arrived.

Once BTC dominance drops sharply, that will mark the official start of the final speculative wave.

5️⃣ Macro environment: liquidity is expanding again, the fuel for the bull market has been injected

Global M2 money supply is rising, and the Federal Reserve along with many central banks have restarted the rate-cutting cycle.

Every similar macro backdrop in history—

2009, 2016, 2020—

directly drove parabolic rises in the crypto market.

Capital always chases volatility, and the crypto market is the primary battlefield for liquidity returning to the market.

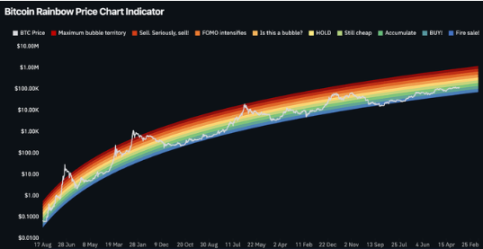

6️⃣ Sentiment indicators and model analysis: still far from extreme heat

The Fear & Greed Index has not yet entered the extreme greed zone

Rainbow Chart is showing green, not red

CBBI (Crypto Bull & Bear Index) is still below 90

At the 2021 top, these three indicators all flashed red almost simultaneously.

But today, they are still in a healthy range.

This means: exit signals have not yet formed.

7️⃣ Top characteristics are absent: all "overheating signals" are still dormant

The real top is always accompanied by four phenomena:

RSI and capital flows are extremely overheated

Altcoins surge while BTC stagnates

ETF redemption waves begin

Large on-chain transfers (whale sell-offs) rise significantly

Currently, all these signals are silent.

The data tells us:

The storm has not yet arrived, and now is the eve of energy accumulation.

8️⃣ Don't treat 2024 as if it were 2025

This is not the "frenzy at the end of the bull market," but the "accumulation before the main upward surge."

The right strategy now is not to panic or chase highs,

but to remain patient like in 2016, accumulate on dips, and follow the data and trends.

Models show:

The biggest explosive phase of the bull market has not yet begun,

and the real parabolic growth is still ahead.

Conclusion:

30 historical top indicators, zero triggered.

Capital flows remain positive, on-chain holders' confidence is stable, and macro liquidity is warming up.

These signals all point to one conclusion:

The main upward surge of the bull market has not yet started.

The real risk is not "rising too much,"

but "getting off too early."

When all indicators finally turn red simultaneously, sentiment reaches a boiling point, and ETF redemptions begin—

that will be the signal to exit.

But for now,

it is the best time to stick to your strategy, hold your positions patiently, and prepare for the final acceleration phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Those who refuse to evolve should stop fantasizing about an altcoin season.

The article reveals the harsh reality of the cryptocurrency market, noting that most investors incur losses by clinging to old narratives and tokens, while new investors who adapt to market changes profit through flexible strategies. The market has become fragmented, and the era of a unified altcoin season no longer exists. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the iterative update stage.

AiCoin Daily Report (October 13)

After the $20 billion liquidation disaster, how can crypto traders rebuild their risk defenses?

US-China trade war scare: What happened Friday and where things stand now