$2 Billion Longs Liquidated, BTC Plunges 20% Instantly—How a "Policy Surprise" Shook the Entire Market

The past 24 hours will be recorded in crypto history.

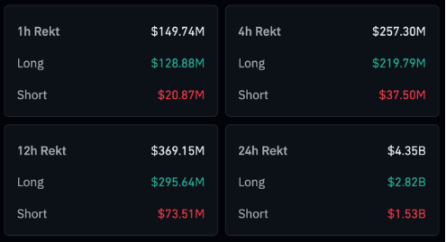

Bitcoin, Ethereum, and major altcoins experienced a cliff-like plunge within just two hours, with over $20 billion in long positions liquidated, sending the market from euphoria into panic.

Just a week ago, the community was celebrating Bitcoin reaching a new all-time high.

Now, green candlesticks have almost become a thing of the past.

1️⃣ Crash Trigger: Trump’s “Tariff Declaration”

The plunge was not caused by the market itself, but by a policy shock.

Just an hour before the crash, Trump announced in a public speech:

“Starting November 1, the US will impose a 100% tariff on Chinese goods.”

This is not only an escalation of trade barriers, but also a direct blow to global inflation, supply chain, and liquidity expectations.

Risk assets fell in tandem, and the crypto market became the first to explode.

2️⃣ Bitcoin Leads Chain Liquidations

After the news broke, BTC price quickly fell below $102,000, triggering large-scale automatic liquidation mechanisms.

The chain reaction in the derivatives market caused major altcoins to plummet instantly—

For example:

$ATOM dropped from $4 to $0.01 in an instant

Projects such as $TON, $JUP, $SAND all plunged by more than 90%

The average drop among the top 100 tokens on CoinMarketCap exceeded 50%

This crash not only destroyed leveraged positions but also completely shattered the confidence of short-term speculators.

3️⃣ The Key Link Between US Stocks and the Crypto Market

It is worth noting that the main drop occurred after the S&P 500 closed.

This means institutions have not yet fully reacted to the news.

The true direction of the market will become clearer when US stocks open.

Two scenarios are worth watching in the future:

If the S&P500 continues to fall after opening, BTC may see a second bottom test;

If the S&P500 moves sideways or shows signs of accumulation, it could mean the crypto market stabilizes in the short term.

4️⃣ Positive Signals After Market “Liquidation”

Although the short-term losses are severe, from a cyclical perspective, this crash may be a “deep cleansing.”

After a large amount of high-leverage capital is cleared out, the market structure becomes healthier.

Every large-scale liquidation in history has laid the foundation for the next rebound.

The current market sentiment is extremely fearful, which often means—

The process of bottom formation is underway.

5️⃣ How Should Investors Respond?

This is not the time to blindly buy the dip or to panic sell emotionally.

Focus on the following points:

✅ Observe the market linkage after US stocks open

✅ Watch whether on-chain funds start to flow back in

✅ Avoid using high leverage

✅ Set clear buy zones for potential rebounds

Short-term volatility is intense, but the long-term trend is still driven by macro liquidity.

Rationality, patience, and discipline are the most important survival rules at this moment.

Conclusion:

A single sentence from Trump triggered a chain reaction in the market.

But this crash is not just a “black swan event,”

It is also the most typical liquidity clearing phase in the crypto market cycle.

Those who remain calm in panic often become the winners of the next cycle.

Remember: the real bottom is never the most panic-inducing candlestick, but the calm positioning that follows the panic.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

Fed rate cut may pump stocks but Bitcoin options call sub-$100K in January

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.