SNX Crypto Price Soars 130% Amid Whale Accumulation

- Synthetix token SNX surged 130% amid market excitement.

- Whale accumulation and trading activity key drivers.

- Anticipated DEX launch catalyzed market interest.

SNX crypto soared by 130% due to major whale accumulation and heightened trading activity, fueled by anticipation for Synthetix’s new perpetual DEX and trading competition. On-chain demand spiked with trading volume reaching $1.1 billion, asserting strong market interest.

Driven by whale accumulation, reduced SNX exchange supply, and heightened trading volume, the market reacted positively. The anticipation surrounding Synthetix’s imminent perpetual DEX launch further fueled bullish sentiment.

The SNX price spike followed significant whale accumulation, with token supply on exchanges dropping. Reduced supply coupled with an increased demand catalyzed the price appreciation. As of October, this context preps for an upcoming DEX.

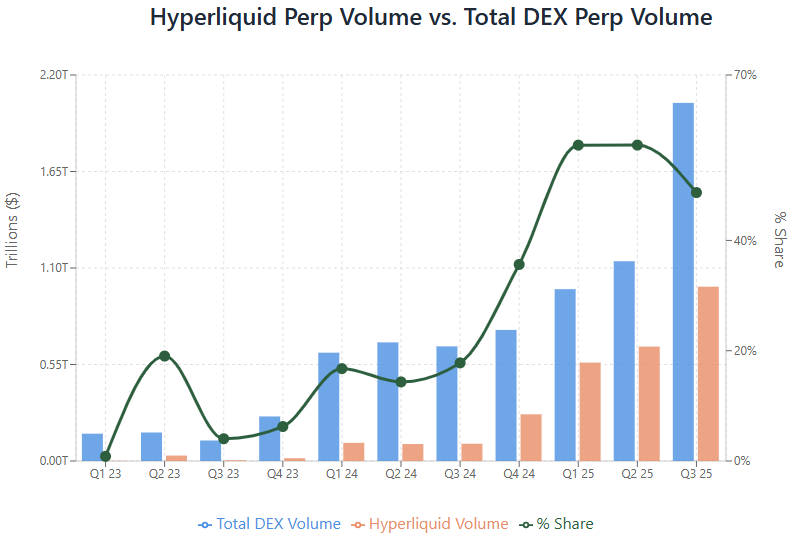

Synthetix’s new perpetuals DEX launch is imminent. The DEX aims to bring enhanced trading options and attract users following mishaps by competitors Hyperliquid and Lighter. The promise of improved services fosters optimism.

The surge in SNX trading activity and whale participation altered market dynamics, increasing SNX’s exposure among traders. The daily trading volume skyrocketed, underpinning the demand, with implications for competing platforms.

The spike represents a significant financial implication where shifting capital flows occurred as altcoin sectors receded, benefiting Synthetix’s innovative approach. Competing derivatives protocols felt pressure to maintain their positions.

Further capital displacement from traditional altcoin investments into DeFi derivatives was observed. This transition showcases increased appetite for utility-based crypto solutions over speculative assets in current market scenarios.

“The new Synthetix perp DEX will soon launch … I am sure there is new optimism on what Synthetix can deliver.” — Route2FI, DeFi Trader and KOL

The SNX movement implies continued optimism for DeFi’s longevity. Historical trends show parallels to past protocol launches, supporting the current sectoral rotation towards substantial use cases amidst market fluctuation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With the expectation of Polymarket issuing tokens, which ecosystem projects are worth speculating on?

After the meme craze fades, perhaps it's time to refocus on the prediction market.

BTC Weekly Watch: Has the Market Code Emerged? Dynamic Take-Profit Strategy Suggestions Included

Monad airdrop query goes live, almost all testnet users “get rekt”?

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.