Crypto Investment Products Amass $3,170,000,000 in Weekly Inflows Despite Market Turmoil: CoinShares

Institutional crypto investment products enjoyed massive inflows last week despite uncertainty in the US markets, according to a leading digital asset research manager.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that year-to-date (YTD) institutional crypto inflows reached nearly $50 billion last week despite the volatile state of US-China tariff relations.

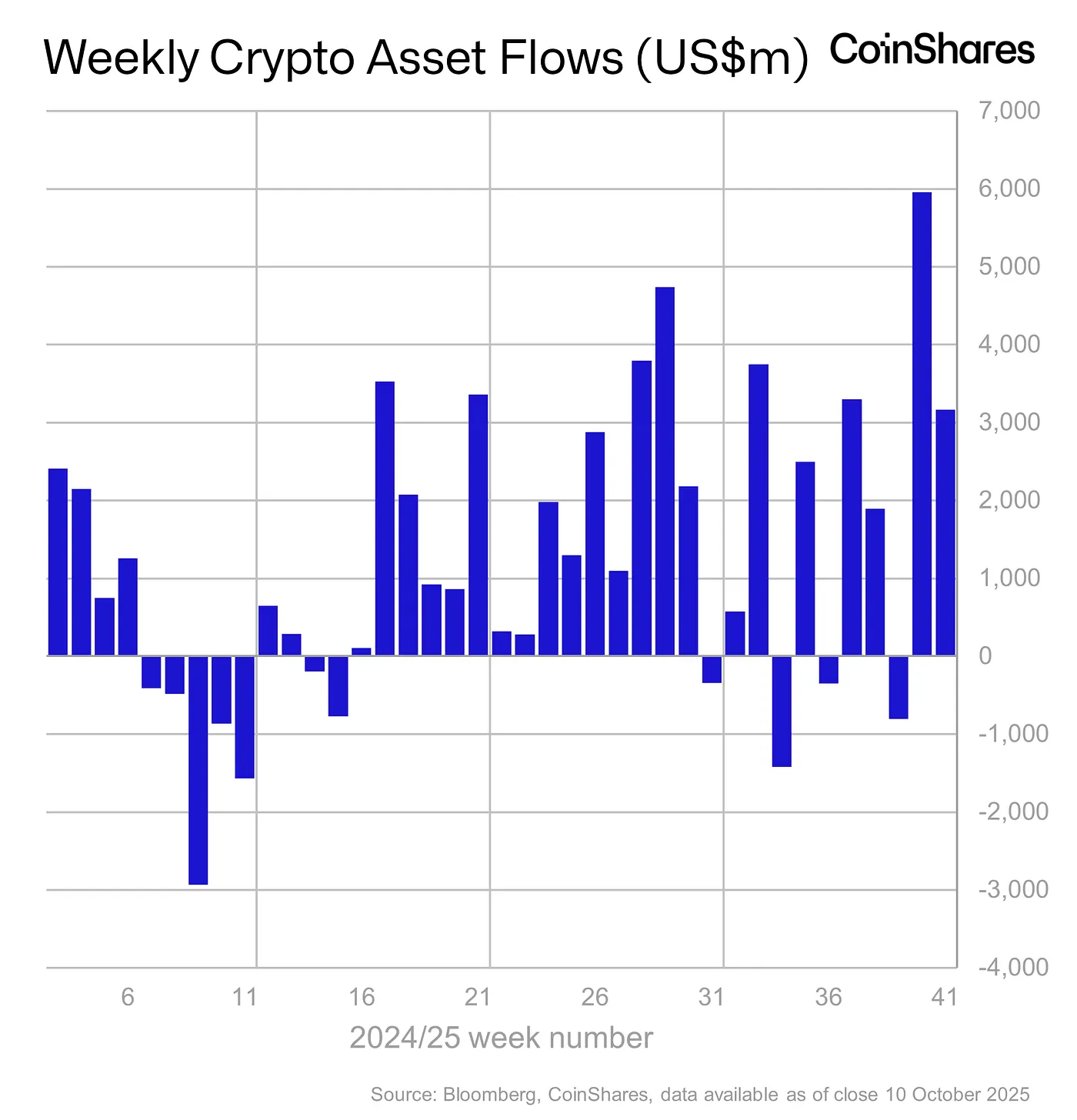

“Digital asset investment products recorded inflows of US$3.17bn last week despite the significant price correction cause by the China tariff threats by the US. Friday saw little reaction with a paltry US$159m outflows. Year-to-date (YTD) inflows have now surpassed the record inflows last year, totalling US$48.7bn so far in 2025.

Weekly volumes on digital asset ETPs were the largest on record at a whopping US$53bn for the week, double the 2025 weekly average, with Friday volumes being the largest daily on record at US$15.3bn. Total assets under management (AuM) following the tariff announcement fell by 7% from last week’s peak to US$242bn.”

Source: CoinShares

Source: CoinShares

Bitcoin ( BTC ), as is often the case, enjoyed the lion’s share of inflows, raking in $2.67 billion in inflows, raising YTD inflows to $30.2 billion.

Leading smart contract platform Ethereum ( ETH ) brought in $338 million in inflows last week despite outflows of $172 million last Friday.

Solana ( SOL ) and XRP exchange-traded products (ETPs) also enjoyed big inflows last week at $93.3 million and $61.6 million, respectively.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ray Dalio Warns of Potential US Dollar Crisis

As NFT Transactions Decline, Institutional Actions Ignite a New Era of Utility

- NFT sales plummeted 42% to $93.18M weekly, with Pudgy Penguins dropping 76% to $3.8M. - Coinbase's $25M UpOnly NFT purchase triggered 7,900% UPONLY token surges, showcasing NFT utility beyond speculation. - Moonbirds' Soulbound Token (SBT) initiative and Ethereum's $35M weekly sales highlight evolving NFT functionality. - 57% institutional interest in tokenized assets signals market maturation, prioritizing utility over pure collectibles.

Cardano News Today: "Institutional Interest in Crypto Faces SEC Stalemate as T. Rowe Enters ETF Race"

- T. Rowe Price, a $1.8T asset manager, filed for an actively managed crypto ETF covering 5–15 coins including ADA, XRP, and SOL. - The SEC's 22-day government shutdown delays approvals, creating regulatory uncertainty for over 155 pending crypto ETF applications. - The ETF uses dynamic allocation strategies to diversify exposure, signaling growing institutional confidence despite market volatility. - Cardano's inclusion highlights rising institutional adoption, though mixed market dynamics show both optim

Chainlink Paves the Way for Wall Street Entry as Early Sales Spark the Next Crypto Surge

- Chainlink’s oracle networks gain Fed adoption, enabling secure blockchain integration for institutions. - BullZilla emerges as a high-potential presale, competing with AlphaPepe and OzakAI for investor attention. - Sallie Mae reaffirms 2025 guidance amid loan growth, while Oracle sees institutional interest in AI partnerships. - Market risks include regulatory scrutiny, economic uncertainty, and competitive pressures in presales.