Japan Could Make a Major Change To Crypto Trading Rules

Japan’s financial regulators are preparing a pivotal legal change to treat crypto as a financial product, giving the FSA broader authority to tackle insider trading and tighten oversight of Web3 markets.

Japan’s financial regulators are planning to reclassify crypto’s legal status in a bid to fight insider trading. The FSA intends to submit a bill to Parliament next year.

This bill makes a minor legal tweak, yet one that could apply to everything from BTC to low-cap meme coins. In 2026, the FSA will also organize a new Crypto Bureau, which may help tackle future concerns.

Japan’s New Crypto Rules

Insider trading has long been a problem in the crypto industry, but a few recent incidents have made it seem worse. Last Friday, an unknown whale made a huge profit off Trump’s Black Friday tariff announcement, provoking widespread community outrage:

$190 million in profits in <24 hours. Maybe the greatest insider trade ever.

— Coffeezilla (@coffeebreak_YT) October 11, 2025

However, although “crime is legal now” is becoming a dominant attitude in the US, some countries are determined to stop this growing trend. Today, local media reported that Japan is preparing a bold move, aiming to reclassify crypto outright to prevent insider trading.

A Substantial Legal Tweak

Japan’s Financial Services Agency (FSA), its primary crypto regulator, has been aiming to ease Web3 restrictions for several months. Still, this doesn’t suggest that the country is prepared to take a laissez-faire approach to criminal activity.

The FSA’s new initiative, if successful, will reclassify crypto under Japanese law. Instead of being a “means of settlement,” digital tokens will become financial products, and they’ll presumably be classified differently than securities.

This move will allow the FSA to impose new restrictions and punish insider trading incidents. Such a solution is elegant, but it isn’t necessarily guaranteed to happen.

The FSA is going to submit a bill to Japan’s Parliament in 2026, requesting to amend crypto’s position in the Financial Instruments and Exchange Act. It is also reorganizing during that same year, creating a new Bureau for crypto and Web3.

In other words, legislative obstacles could hamper this reclassification effort, and an optimistic timeline still puts this far away. Nonetheless, Japan’s financial regulators are quite serious about crypto’s use in insider trading.

Hopefully, this effort can provide a model for tamping down on rampant Web3 crime.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana (SOL) To Rise Higher? Key Bullish Reversal Pattern Signaling Potential Upside Move

Ethena (ENA) To Rebound? Key Bullish Reversal Pattern Formation Suggests So!

Shiba Inu price forecast: bulls eye breakout after deep accumulation

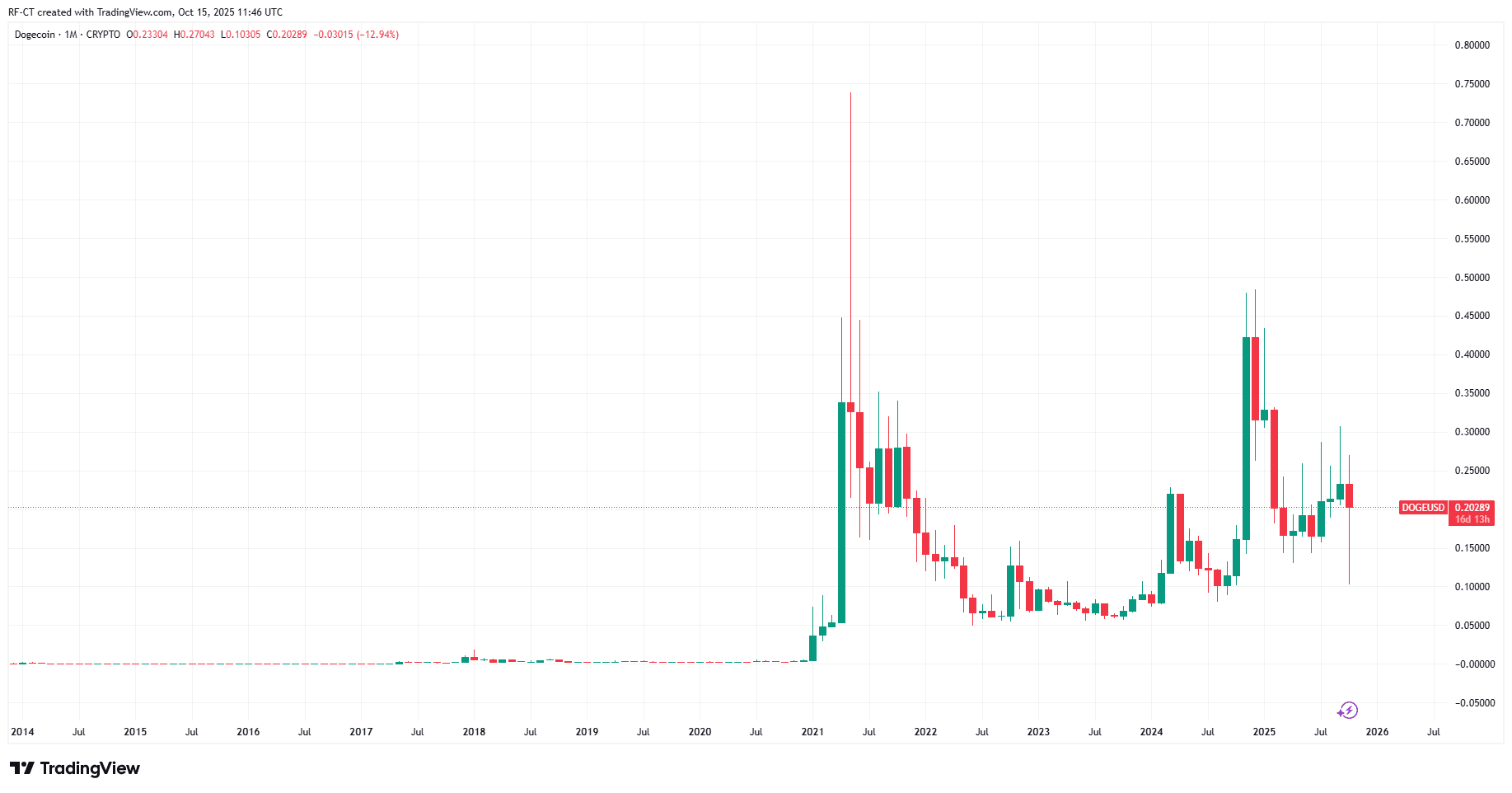

DOGE Price Prediction 2025: Can DOGE Rebound Strongly After Recent Dip?