You Could Soon Pay For Your Favorite Subscriptions In Stablecoins Via Stripe

Stripe’s quiet move to enable stablecoin subscription payments could revolutionize crypto usability, making Web3 and stablecoins a seamless part of everyday transactions.

Stripe surreptitiously revealed that it will allow stablecoin payments for subscriptions and other recurring transactions, not just one-offs. This signals its increasing commitment to crypto.

Such a feature could provide a major onramp for crypto functionality, making all of Web3 that much more mainstream.

Stripe’s Stablecoin Subscriptions

Stripe, a global leader in payments processing, has been incorporating stablecoins for the past few months now. This took place after major acquisitions as part of a broader strategy to re-enter the crypto space.

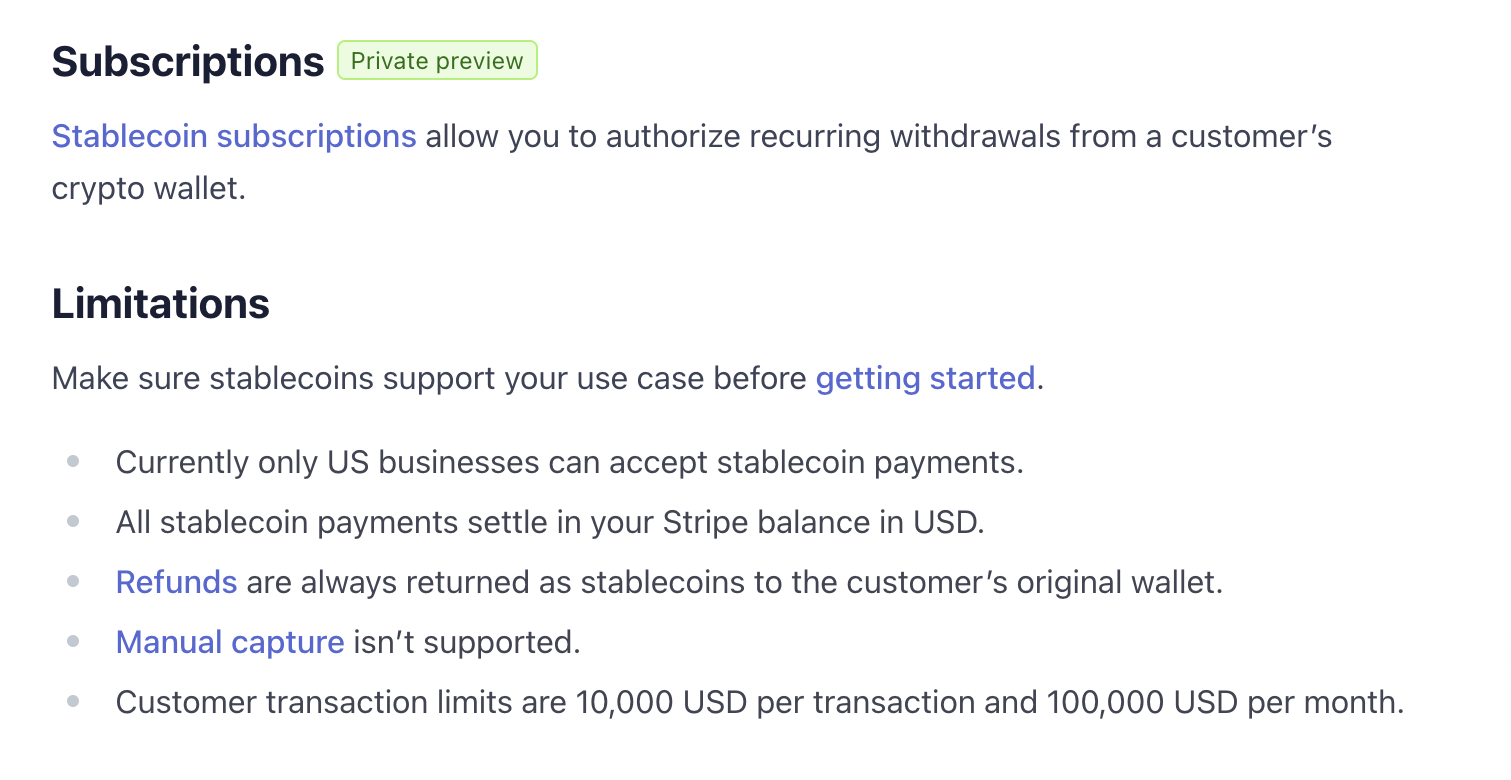

Today, unverified rumors have been circulating that Stripe would begin allowing stablecoins for subscription payments. Although the company hasn’t evidently announced it outright, a key clue corroborates these claims: a section labeled “private preview” on an FAQ page.

Stablecoin Subscription Payments. Source:

Stripe

Stablecoin Subscription Payments. Source:

Stripe

The line about subscription payments is very small, but still confirms that Stripe is adding or has already added this stablecoin functionality.

Such a move could have huge implications for crypto, enabling a major new onramp and functionality for stablecoins.

So far, it seems likely that USDC will continue being Stripe’s main stablecoin for this feature, but a lot is unclear. Either way, recurring payment functionality would fully cement this corporate giant’s interest in Web3.

Slack, Squarespace, Notion, and Shopify are just some of the big names that use Stripe’s payment module for subscriptions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bitcoin Matches Equities in Investment Portfolios as $30B Inflows Indicate Institutional Transition

- Crypto market consolidates amid cautious trading ahead of macroeconomic events, with Matrixport noting "mostly sideways" conditions despite sustained institutional inflows. - Bitcoin rebounds to $126,000 after $3.55B ETF inflows in October 2025, driven by BlackRock's iShares Bitcoin Trust and growing corporate BTC holdings. - Market volatility spikes from Trump's China tariff threat ($19.35B liquidations) but stabilizes near $111,000 support, with Fed's October 29 rate cut (96.7% expected) seen as potent

ISR Technology Fuels America's Uranium Comeback to Strengthen Energy Security

- enCore Energy discovers shallow uranium deposits in Texas using ISR, cutting drilling costs by 40% and leveraging existing infrastructure for rapid production scaling. - Urano Energy acquires enCore assets to expand its uranium portfolio, aligning with U.S. energy security goals amid reduced reliance on Russian and Central Asian imports. - Federal policies and DOE initiatives prioritize domestic uranium production, with enCore's dual ISR operations (Alta Mesa/Rosita) positioned to benefit from regulatory

Trump’s Innovation Strategy Fueled by Unified Crypto Oversight and Advancements in AI

- Trump nominated SEC crypto task force chief Michael Selig to lead CFTC, aiming to unify cryptocurrency regulation and clarify agency authority over digital assets. - Port3 Network expanded Web3 AI infrastructure through five strategic partnerships, enhancing agent development and security while participating in industry growth discussions. - Defense AI firm BigBear.ai saw 300% stock growth from military contracts and airport tech, despite $228.6M losses, with $390M cash reserves supporting future expansi

Mystery Wallet Aligns $5M Fartcoin Wager With Expectations of Fed Rate Reduction

- A 0x71a0 wallet holds $5M in Fartcoin (FARTCOIN) with strategic $0.6–$1 take-profit orders, reflecting speculative positioning ahead of the Fed's rate decision. - Fartcoin surged 20% from October lows, showing bullish divergence and potential retest of $0.40 support, a key level for trend validation. - The Fed's expected 25-basis-point cut and end of quantitative tightening could boost risk assets, with Bitcoin's open interest spiking to $37.63B. - Institutional-like positioning contrasts with retail cau