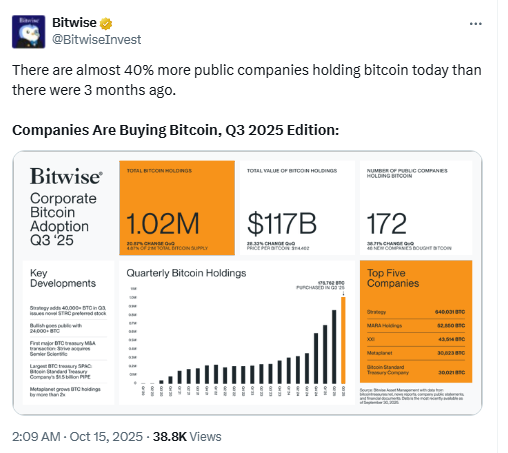

Bitcoin treasuries expanded fast in the third quarter, according to the Bitwise report. Public companies holding Bitcoin increased by 38% between July and September.

The total number reached 172 corporate holders, based on BitcoinTreasuries.NET data.

The Bitwise report shows that companies now hold over one million BTC, equal to 4.87% of the total supply.

The total value of these Bitcoin treasuries reached $117 billion, reflecting a 28% increase quarter over quarter.

Companies Buying Bitcoin Q3 2025. Source: Bitwise

Companies Buying Bitcoin Q3 2025. Source: Bitwise

Hunter Horsley, CEO of Bitwise, said o n X that the figures are “absolutely remarkable.” He added,

“People want to own Bitcoin. Companies do too.”

His remarks reflected the ongoing growth of corporate adoption.

Corporate adoption details: Strategy and MARA lead in Bitcoin treasuries

Strategy, led by Michael Saylor, remains the largest Bitcoin treasury holder. On October 6, the company added more Bitcoin, bringing its total to 640,250 BTC.

MARA Holdings ranks second with 53,250 BTC, following an increase earlier this week. Both companies are highlighted in the Bitwise report as key corporate holders.

The data in the Bitwise report is based on public disclosures compiled by BitcoinTreasuries.NET. This allows quarter-to-quarter tracking of corporate adoption and treasury growth.

Analyst commentary on corporate adoption and Bitcoin demand

Rachael Lucas, analyst at BTC Markets, said the growing accumulation indicates that “larger players are doubling down, not backing away.” Her remarks describe how corporate adoption of Bitcoin treasuries continues to build.

Lucas explained that these decisions reflect long-term treasury strategy rather than short-term trades. Companies are positioning Bitcoin within their balance sheets as part of broader financial planning.

She also said that this activity supports the development of financial instruments such as Bitcoin-backed loans and new derivatives, reflecting deeper integration into corporate finance structures.

OTC execution shapes Bitcoin price impact

Corporations often buy Bitcoin through over-the-counter (OTC) desks. OTC transactions reduce slippage and avoid visible impacts on exchange order books.

As a result, large purchases do not always move the Bitcoin price immediately.

Other market factors can drive sharp price swings. Lucas pointed to long-term holders taking profits and increasing derivatives activity as key forces.

She also mentioned U.S.–China trade tensions as a macro factor affecting volatility. These external shocks overlap with corporate adoption and OTC flows in shaping price behavior.

Bitcoin issuance vs corporate demand

According to Bitbo , Bitcoin miners produce about 900 BTC per day. A River report published in September 2025 estimated that businesses purchase around 1,755 BTC per day. This shows corporate demand outpacing daily issuance.

This data compares new supply and corporate buying but does not predict prices. It illustrates how corporate adoption affects overall market flows.

The Bitwise report shows that companies now hold more than one million BTC, equal to 4.87% of the total supply. Regular updates provide visibility into this growing segment of the market.

Bitcoin ETFs add to corporate adoption momentum

U.S. spot Bitcoin ETFs recorded $2.71 billion in weekly inflows last week, continuing their strong “Uptober” trend.

These Bitcoin ETFs operate alongside Bitcoin treasuries, providing another channel for institutional exposure.

Lucas said that Bitcoin ETFs offer traditional investors a regulated and familiar structure to access the asset. This broadens corporate adoption and participation without requiring direct custody.

ETF inflows and Bitcoin treasuries both reduce circulating supply and rely on custodians, liquidity providers, and regulated infrastructure.

Price context and institutional participation

During the reporting period, Bitcoin price stood at $111,197. Market conditions were volatile, influenced by funding rates and liquidations in derivatives markets.

Edward Carroll, head of markets at MHC Digital Group, commented on institutional demand trends.

He noted that institutional participation is expected to continue expanding over time, affecting market dynamics.

Editor at Kriptoworld

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 4, 2025 • 🔄 Last updated: August 4, 2025